2024 saw a historic influx of funds into digital asset investment products to the tune of $44.2 billion, with U.S. spot-based ETFs spearheading this trend, even amidst some market turbulence, according to the data.

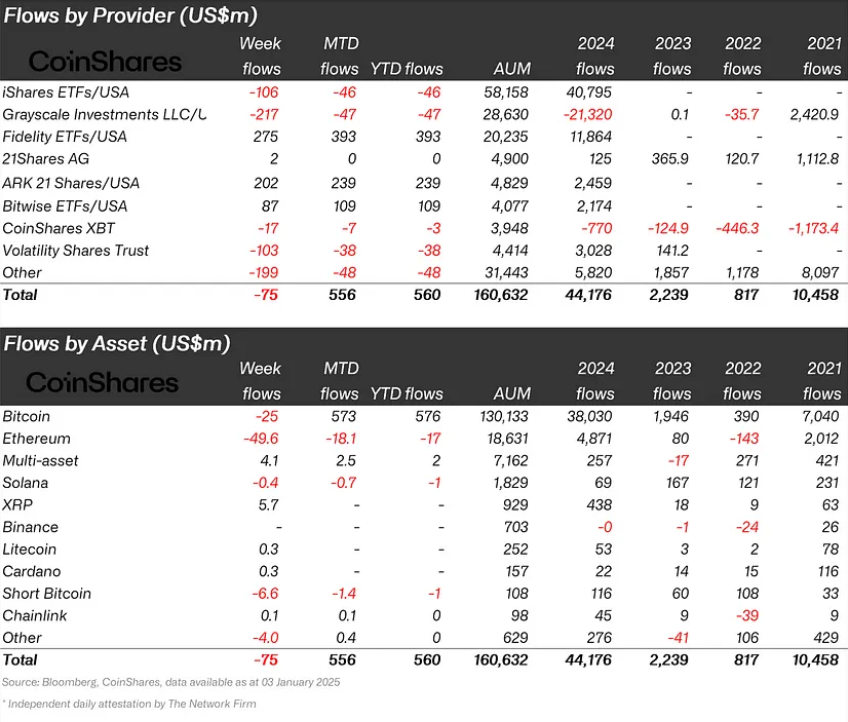

2025 started off robustly for digital assets, with an inflow of approximately $585 million into these products during the opening three days of the year. However, when considering the entire week, which encompassed the last two trading days of 2024, there were net withdrawals amounting to $75 million, as indicated by data from CoinShares, a European asset manager.

According to James Butterfill, CoinShares’ head of research, the year 2024 witnessed an unprecedented $44.2 billion invested into digital asset products. This figure is nearly four times greater than the previous record set in 2021, where only $10.5 billion was poured into these investments.

A significant portion of this increase was driven by U.S. spot-based exchange-traded products, accounting for all inflows amounting to $44.4 billion. While Switzerland had smaller influxes of $630 million, there were substantial outflows from Canada and Sweden – $707 million and $682 million respectively. These outflows were offset by the increased interest in U.S. products or profit-taking, thereby maintaining a stable overall balance.

Bitcoin (BTC) remained at the forefront, amassing approximately $38 billion, representing about 29% of the total assets under management. Despite rising prices, there were smaller investments in short-Bitcoin products to the tune of $108 million, a decrease from $116 million as seen in the data for the year 2024.

In the tail end of 2024, Ethereum (ETH) saw a significant resurgence, attracting a whopping $4.8 billion in investments – that’s almost double its inflows from 2021 and an astounding 60 times more than what it received in 2023. Interestingly, Ethereum’s growth overshadowed Solana (SOL), which managed just $69 million in investments during the same period. Meanwhile, other altcoins (excluding Ethereum) garnered $813 million, making up about 18% of the total assets under management in 2024.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Cat Fantasy tier list

- EUR CNY PREDICTION

2025-01-06 14:09