Now, Raredex has officially gone live on the Avalanche (Arbitrium) blockchain, making it easier than ever before for individuals to invest in this previously exclusive asset class that was primarily accessible to institutional investors up until now.

On the Arbitrum network, Raredex serves as a unique blockchain platform, offering retail investors an opportunity to invest in precious rare earth metals. These metals are essential for various industries, including tech development and renewable energy, but have historically been challenging for individual investors due to high initial costs typically exceeding $10,000. Raredex simplifies this by providing fractional ownership through blockchain-powered tokenization, where each token corresponds to one kilogram of the physical metal.

As Louis O’Connor, CEO of Raredex, I’m excited to underscore the democratic possibilities we’re unveiling. What this means is that investment opportunities that were once exclusively available to governments and well-connected, affluent individuals are now within reach for everyday investors. This shift empowers a broader range of people to participate in an asset class they might not have had access to before, all while reducing the substantial capital requirements that previously acted as barriers to entry.

How does Raredex work?

With Raredex, your physical metals are securely stored in a high-security vault managed by Tradium in Germany. This ensures easy access to custody and availability for investors. Each token comes with comprehensive data detailing its origin, allowing for thorough verification. Through the use of blockchain technology, an immutable record of ownership is created, minimizing potential fraud and enhancing transparency.

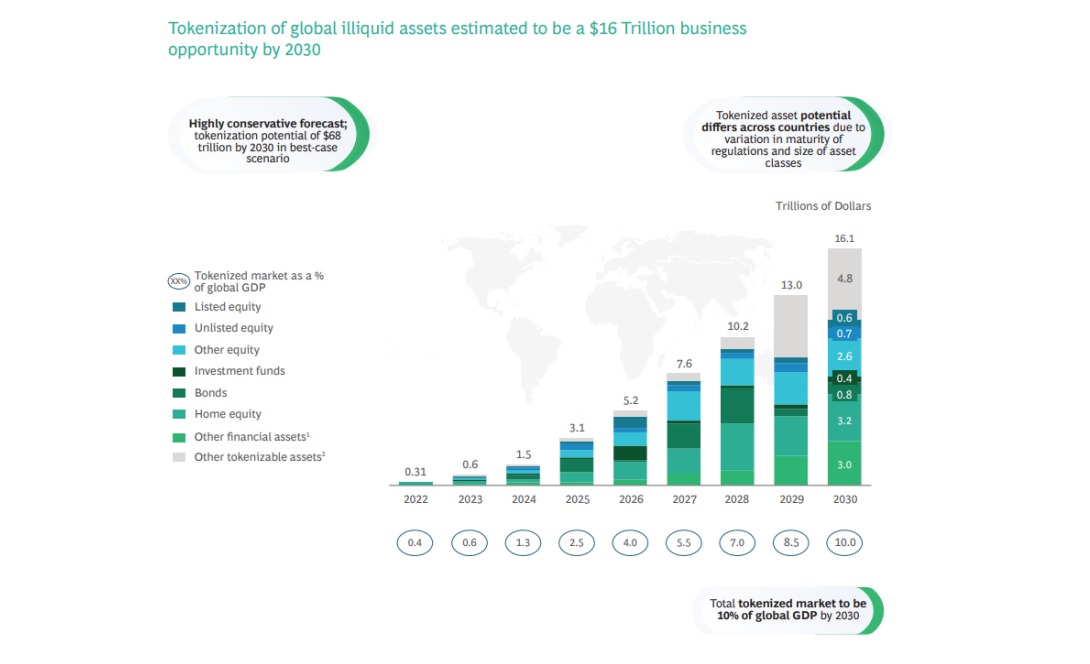

The introduction of our platform coincides with heightened curiosity surrounding RWA tokenization, which is part of a broader movement towards digitizing real-world assets. This development follows the significant expansion of the RWAs sector, where revenue surged by 700% to reach $860 million in 2023. Analysts from Boston Consulting Group and ADDX predict that this market could grow to an astounding $16 trillion by 2030. The inherent security and transparency offered by blockchain technology will boost confidence, while the fragmentation of assets presents novel avenues for investment in valuable resources.

Additionally, there are other comparable ventures such as UBS Asset Management’s Ethereum-based tokenized investment fund and Archax’s $4.8 billion money market fund running on the Ripple (XRP) platform.

Due to increasing interest in advanced technologies and renewable energy that rely heavily on rare earth metals, Raredex’s blockchain-based platform might serve as an example for a broader expansion of commodity trading using blockchain technology. This transformation could revolutionize how investors engage with tangible assets.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-01-09 07:58