It appears that the largest liquid staking initiative on Solana, known as Jito, is thriving. The value locked in its platform and the fees it’s charging have both reached new peaks.

As per information on its website, Jito (JTO) boasts a TVL (Total Value Locked) of approximately 14.6 million Solana (SOL), which translates to around $2.7 billion. This substantial volume positions it as the 14th largest player in the decentralized finance sector and the third-largest liquid staking protocol, trailing behind only Lido and Binance Staked ETH.

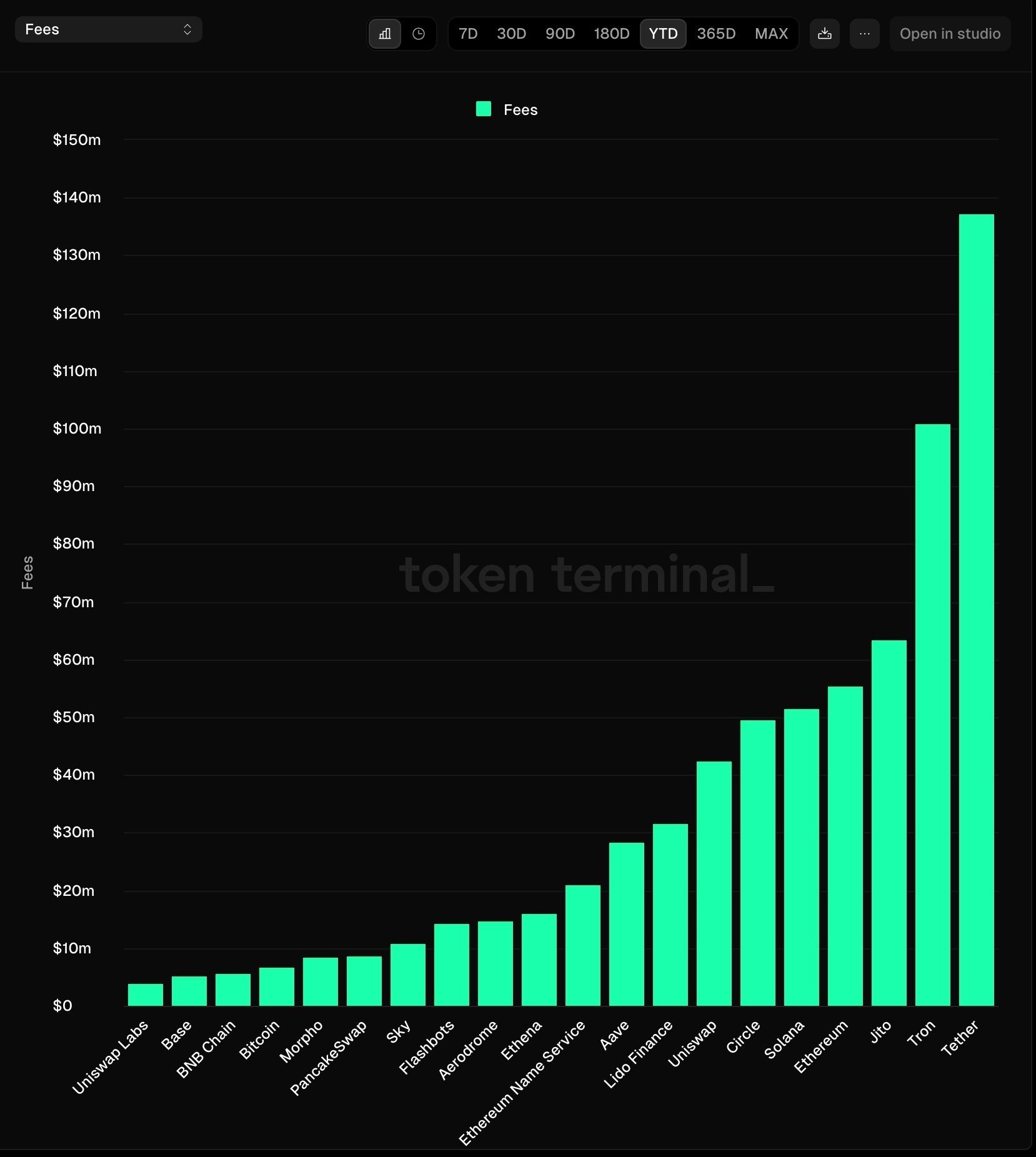

Jito is beating Solana, Ethereum, and Uniswap this year

Jito boasts nearly 150,000 active users and has managed to swap tokens on networks like Solana (SOL), Ethereum (ETH), and Uniswap this year, with the latter seeing increased transaction fees.

As per TokenTerminal’s report, Jito has raked in a staggering $63 million in fees this year, edging out Ethereum with its $55.1 million earnings. Solana and Uniswap (UNI) follow closely behind with approximately $51 million and $42.1 million respectively.

Among all crypto projects this year, Jito’s earnings from fees ranks third following Tether and Tron, with respective totals of $137 million and $100 million. Additionally, Jito is now leading the DeFi sector in profitability. Furthermore, its fee income surpasses Lido Finance, the largest liquid staking platform that has earned $31 million this year.

In the past year, it has earned approximately $729 million in fees, while over the past six months, it has brought in around $559 million.

Jito’s daily charges have rebounded, climbing back up to $14.1 million per day in November from a low of $2.25 million per day in December, which was its previous record high.

Jito offers two main solutions

Jito provides its clients with the options of liquid staking and re-staking. With liquid staking, users can move their locked tokens into the network and exchange them for JitoSOL, which is a type of liquid staking token, often abbreviated as LST.

As an analyst, I’d like to highlight a unique aspect: Instead of the conventional staking method, we have the Liquid Staking Token (LST). What sets it apart is its liquid nature, enabling holders not only to retain ownership but also to trade and use it within DeFi protocols. Notably, Jito reports that the current yield for staked LSTs stands at 9.81%, which surpasses the average Solana staking yield of 7.4%.

Jito now offers Restaking, a feature that converts staked assets into Vault Receipt Tokens (VRT). Essentially, this service enables those holding staked assets to potentially increase their earnings in the long run. Currently, the total value locked within Jito’s restaked tokens is approximately $42.6 million.

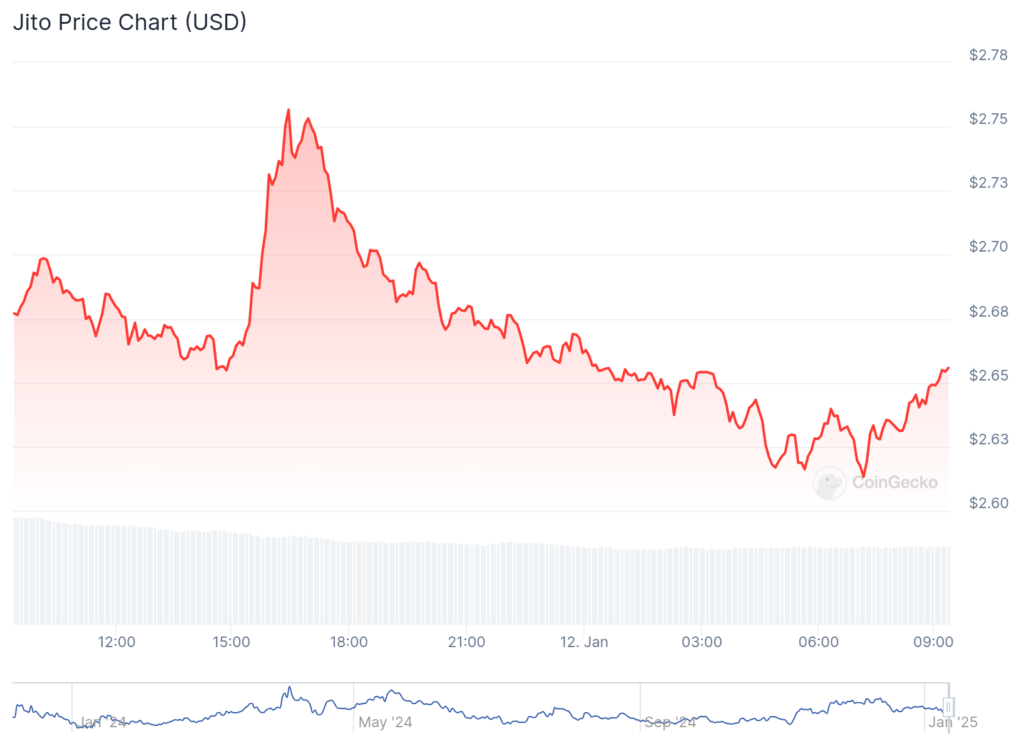

Despite the airdrop in 2023, Jito’s token has not fared well. On January 12, it was trading at $2.64, marking a 40% decrease from its December peak and a 50% drop from its record high of $5.3.

The consistent release of 11.31 million JTO tokens every month, up until December 2026, is the reason for this performance. Currently, there are 281 million JTO tokens in circulation, with a total supply capped at the same number.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Grimguard Tactics tier list – Ranking the main classes

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Cookie Run Kingdom Town Square Vault password

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-01-12 17:24