In a twist that surprised absolutely no one who’s ever glanced at a crypto chart, the digital gold rush turned into a digital gold *slush* as Bitcoin took a nosedive below $100,000. The crypto market collectively lost over $900 million in 24 hours, which is roughly the GDP of a small island nation or the cost of Elon Musk’s next tweet. 🏝️💸

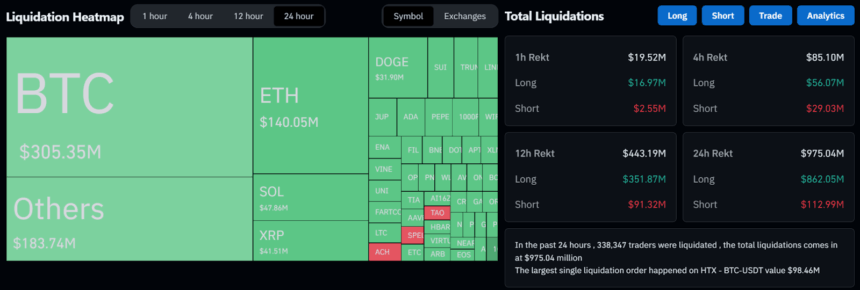

According to CoinGlass, 338,355 traders were left clutching their metaphorical hats as $862 million vanished from long liquidations and $112.86 million evaporated from short liquidations. It’s like a magic trick, but the only thing disappearing is your savings. 🎩✨

Bitcoin led the charge in the Great Crypto Fire Sale with $305 million in long liquidations, while Ethereum trailed behind with a mere $140 million. The market’s price swings were so wild, they could’ve been choreographed by a caffeinated squirrel. 🐿️☕

Bitcoin dropped 5% today, sliding from an intraday high of $105,000 to below $99,959. But hey, trading volume surged by 292% to $77.5 billion, proving that people love a good bargain—even if it’s a bargain on something that doesn’t physically exist. 🛒💎

The altcoin market wasn’t spared either, with Ethereum (ETH) losing over 5% to an intraday low of $3150. XRP, Dogecoin (DOGE), Cardano (ADA), and Avalanche (AVAX) also joined the pity party, painting the market in a lovely shade of “oh no, not again.” 🎨😬

BitMex co-founder Arthur Hayes, who apparently moonlights as a crypto fortune teller, predicts Bitcoin could tumble further to $70,000 or $75,000. But fear not! He also foresees a rebound to $250,000 by year’s end, thanks to the Federal Reserve’s magical money printer. 🖨️💵

“The Ugly will be published tomorrow morning. I am calling for a $70k to $75k correction in $BTC, a mini financial crisis, and a resumption of money printing that will send us to $250k by the end of the year,” he said, presumably while stroking a crystal ball. 🔮📉📈

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-01-27 21:25