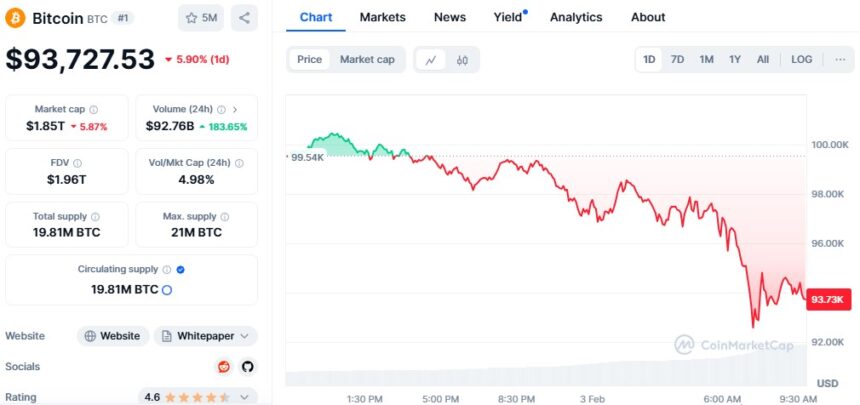

On a rather dreary Monday, as the sun rose over the bustling streets of Asia, Bitcoin and Ether found themselves in a most unfortunate predicament. The price of Bitcoin, that once glittering beacon of hope, plummeted to a disheartening $92,580, a figure that would make even the most stoic investor weep. It was a drop so steep, one might think it had taken a tumble down a flight of stairs. 😱

Ether, not to be outdone, decided to join the pity party, suffering its most significant decline since September, a staggering 24% drop to a mere $2,300. It seems both cryptocurrencies were in a race to see who could fall the fastest, and oh, what a spectacle it was! 🎢

The cause of this market malaise? None other than President Donald Trump, who, in a fit of tariff-induced enthusiasm, announced new duties on imports from our dear neighbors, Canada and Mexico, as well as a delightful 10% on Chinese products. One can only imagine the collective gasp from traders as they clutched their pearls. 😅

With annual trades exceeding $1.6 trillion at stake, the response from Canada, Mexico, and China was swift and filled with promises of retaliation. It was as if a game of economic chess had begun, with each nation poised to make its next move, leaving investors in a state of delightful uncertainty. 🧐

Chris Weston from Pepperstone, ever the voice of reason, remarked that during such tumultuous times, crypto markets act as a “risk proxy.” Indeed, the current trade conflict has left many pondering the fate of inflation and corporate profits, as if they were characters in a tragic play. 🎭

In the wake of Trump’s announcement, the crypto market saw a staggering $1.79 billion in liquidations within just 24 hours. Over 450,000 traders were swept away in this financial tempest, with long positions taking the brunt of the fall. It was a veritable bloodbath! 💔

Once, Bitcoin basked in the glory of $107,071.86, a high reached shortly after Trump’s election victory, when investors naively believed that favorable regulations were just around the corner. Alas, the slow pace of change has left many feeling like they’ve been waiting for a bus that never arrives. 🚌

Yet, despite this short-term calamity, some investors cling to the belief that Bitcoin remains a hedge against inflation and instability. Financial experts now watch with bated breath as Bitcoin hovers around the $90,000 mark, like a tightrope walker teetering on the edge. 🎪

Ultimately, the fate of Bitcoin lies in the hands of global economic conditions and trade conflicts, a precarious situation that could lead to further market losses. One can only hope that the next act in this financial drama brings a happier ending. 🍿

Read More

- Cookie Run Kingdom Town Square Vault password

- Fortress Saga tier list – Ranking every hero

- Cat Fantasy tier list

- Castle Duels tier list – Best Legendary and Epic cards

- 9 Most Underrated Jeff Goldblum Movies

- Mini Heroes Magic Throne tier list

- Maiden Academy tier list

- Hero Tale best builds – One for melee, one for ranged characters

- Gold Rate Forecast

- XTER PREDICTION. XTER cryptocurrency

2025-02-03 10:30