In the land of cryptocurrencies, where the digital coins dance to the tunes of global markets, Ethereum, the noble knight of blockchain, found itself in the midst of a tempest. On a fateful Monday morning in Asia, as the sun rose with a sigh, our hero’s price plunged to a five-month low, akin to a knight falling from his high tower, landing with a thud around $2,300. The cause? A whisper of a global trade war, setting the stage for a grand opera of risk aversion, leaving investors shaken and stirred.

Alas, on Feb. 3rd, as dawn broke, Ethereum (ETH) took a nosedive, plummeting 23.6% to an intraday low of $2,368. The villain of the tale, none other than President Donald Trump, announced trade tariffs on China, Canada, and Mexico over the weekend, setting off a chain reaction of events that would test the mettle of our digital knight.

Higher import tariffs, akin to a dragon breathing fire upon the economy, could lead to inflation rising, akin to a flood of gold coins overwhelming the kingdom. This, in turn, sparked a risk-off sentiment, a dark cloud looming over the land, pressing down on cryptocurrency prices, turning sunny skies into stormy weather.

As the day wore on, the altcoin market fell 28%, a sea of red washing over the charts, with major altcoins like XRP (XRP), Solana (SOL), Dogecoin (DOGE), and Cardano (ADA) recording losses between 15-30% over the past day. The crypto realm was in chaos, akin to a battlefield strewn with fallen soldiers.

And so, Ethereum experienced its largest liquidation event in two years, with $475.72 million liquidated from long positions and $127.78 million from short positions. Open interest in its futures market fell 27% to $23.36 billion, while its funding rate dropped to levels last seen during the March 2020 COVID crash. The knight was bruised, battered, and perhaps, broken.

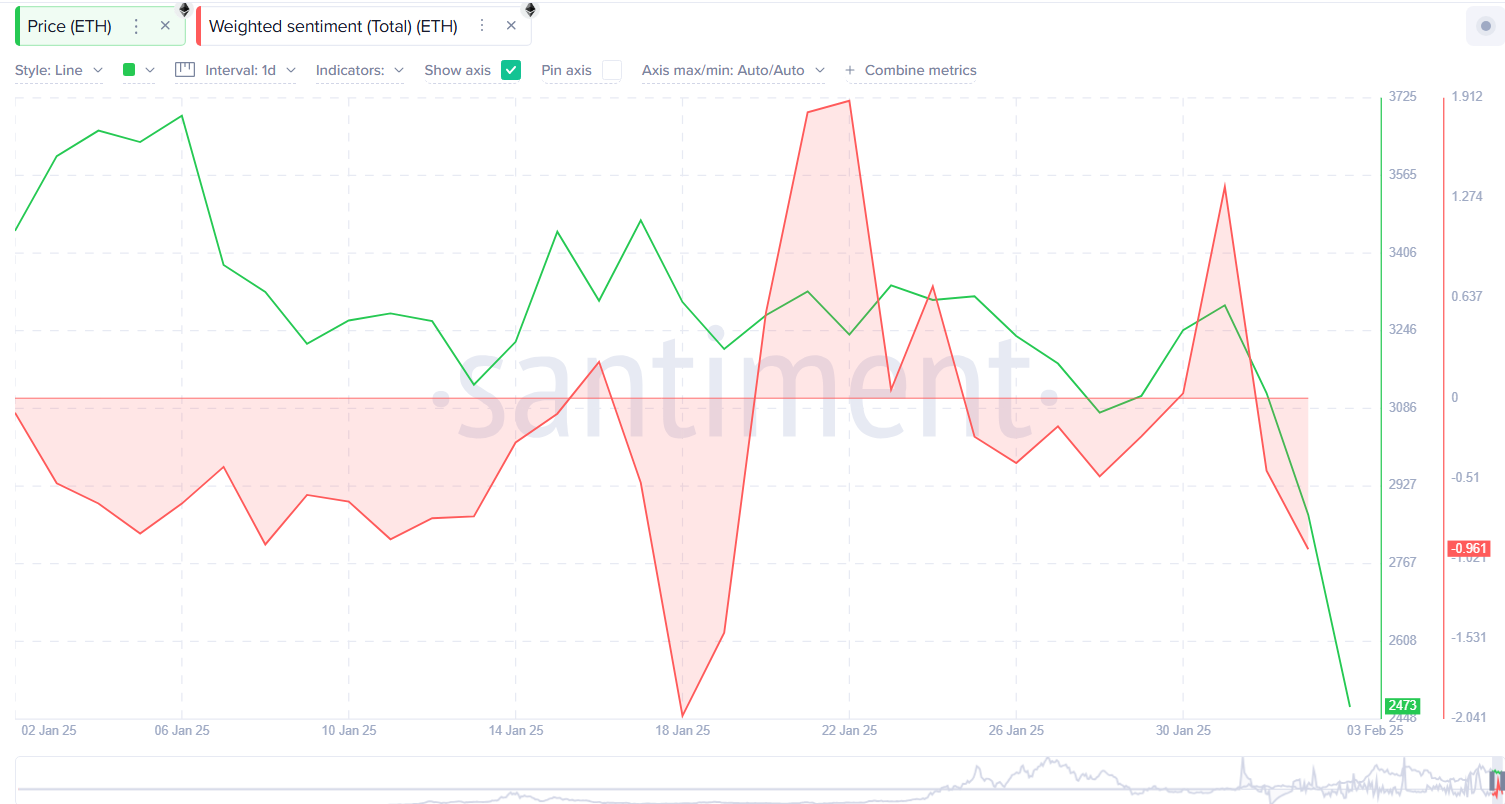

Yet, amidst the gloom, a glimmer of hope. The weighted social sentiment for ETH has turned negative, but could this be the calm before the storm, or the sign of a turnaround?

A Technical Analysis of the Knight’s Journey

On the daily USDT chart, ETH has moved below the 50-day and 200-day moving averages, a sign of a strong short-term bearish trend. The Aroon indicator shows the Aroon down at 100% while Aroon Up showed a reading of 0%, suggesting further losses may loom on the horizon. Yet, the Relative Strength Index, with an oversold reading, hints that selling pressure on ETH may be easing, a beacon of light in the darkness.

Could this be the bottom, the lowest point of the knight’s descent? A recovery above the 200-day moving average could confirm a trend reversal, a sign of strength returning to our hero.

A Rebound on the Horizon?

Despite the turmoil, signs of dip buying emerge, a glint of gold in the mire. Investors have withdrawn $326.7 million worth of ETH from exchanges, a sign that some see the pullback as a buying opportunity, a chance to acquire wealth in the midst of despair.

Whales, those mighty creatures of the deep, have begun to stir, purchasing large amounts of ETH following the price plunge. One whale, in particular, purchased 35,494 ETH, worth nearly $88 million, a sign that even the giants of the sea see value in the depths.

Insane hold of $DAI.

A whale has used $1M $DAI to buy 398 $ETH at a price of $2,515, after holding $DAI for almost 2.5 years.

The whale received these $DAI from FixedFloat 2.5 years ago.

Addresses:

– 0xf094e2d70385f4f3af3cc4ba7e6da0dcfac522dc-…

— Onchain Lens (@OnchainLens) February 3, 2025

Georgii Verbitskii, Founder of TYMIO, speculates that ETH could see a short-term bounce toward $2,700, driven by technical factors and a temporary reprieve in market sentiment. Yet, without strong catalysts or fresh narratives, Ethereum’s strength against Bitcoin remains uncertain.

“If global tariff concerns escalate or another wave of negative news hits the market, we could see one more leg down before ETH finds more stable ground,” he adds, a note of caution in his voice.

Analyst Ali Martinez identifies an ascending parallel channel in Ethereum’s price action on the 3-day chart. He notes that ETH must hold the $2,750 support level to sustain its trajectory within the channel. Should this level hold, Martinez projects a potential rebound to $6,760, a ray of hope in the midst of the storm.

At press time, Ether was still down 18.4%, trading hands at $2,541 per coin. Will Ethereum rise again, or will it fall deeper into the abyss? Only time will tell, dear reader, as we await the next chapter in this epic tale of digital valor and volatility.

Read More

2025-02-03 11:00