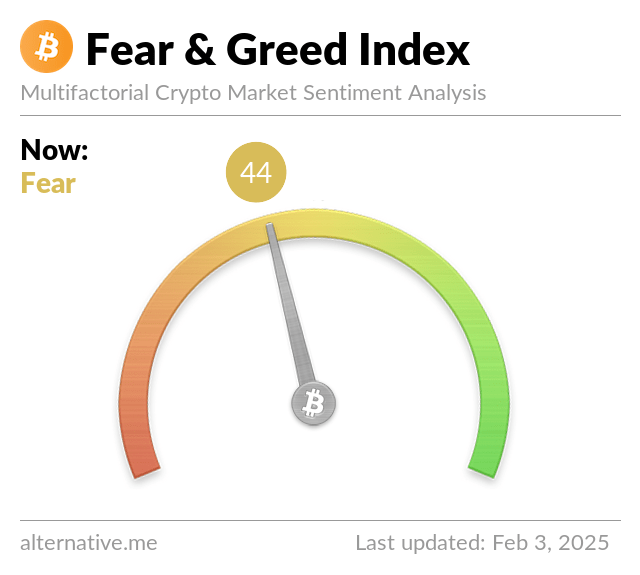

Well, ain’t this a sight to see! The Crypto Fear & Greed Index, that little fella that tries to measure the heartbeat of the crypto world, has taken a nosedive down to a four-month low of 44. Seems like the market just had itself a little hissy fit, wiping out $2.2 billion in what felt like the blink of an eye.

Now, this ain’t no ordinary dip, folks. We’re talking about a plummet that sent the total crypto market cap tumbling down nearly 12% in the wee hours of Feb. 3. Poor ol’ Bitcoin (BTC) took a hit too, losing over 5% of its value. And just like that, the index went from a “moderate greed” score of 60 to a “fear” score of 44, quicker than you can say “sell, sell, sell!”

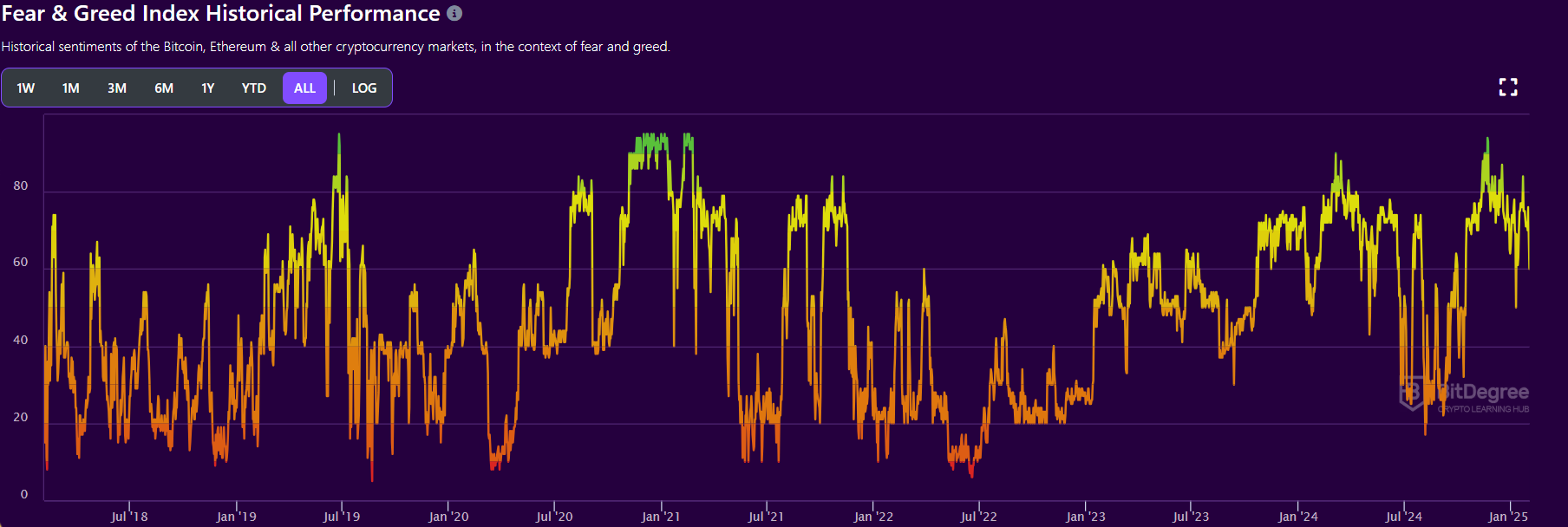

It’s a record-breaking liquidation event, alright, but the index score isn’t screaming “sustained market selloff” just yet. Remember those bear markets in 2018, 2019, and 2022? This ain’t quite in their league…yet.

Seems like the general consensus is that this is just a hiccup in the grand scheme of things. The bulls are still charging ahead, and this isn’t the start of a downward spiral. On-chain analyst Willy Woo summed it up pretty nicely in his X post, saying Bitcoin has become so ingrained in our collective psyche that it’s practically untouchable. He reckons there are only two paths: you either buy it and strike gold, or you keep hating and lose your marbles.

Is #Bitcoin digital gold?

That misses the point, the key is how is it created?

Bitcoin is a meme so strong that it’s a squatter living rent free in people’s minds.

After a while there’s only 2 paths: you buy it and become rich or you keep hating and turn crazy.

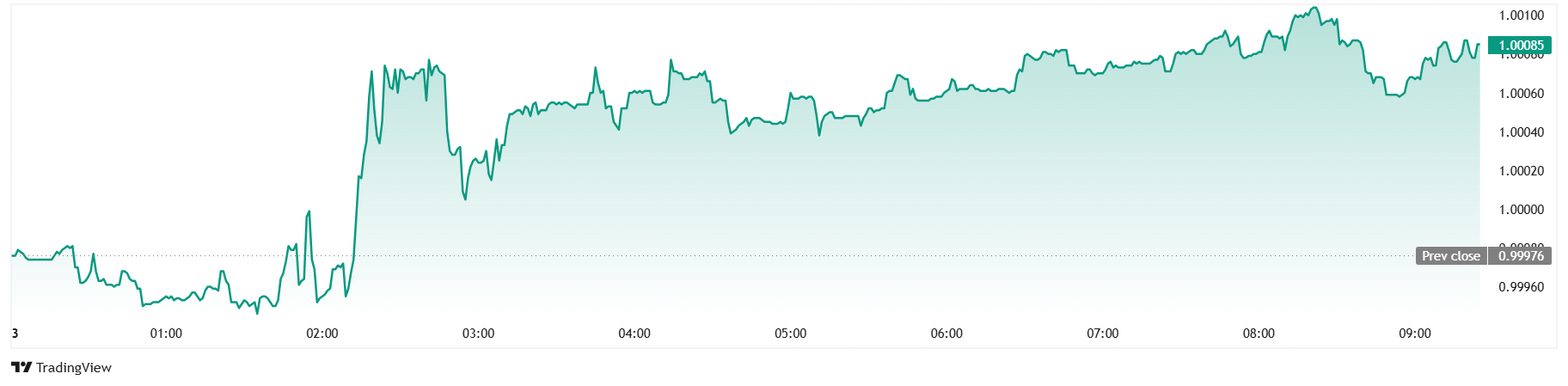

As we speak, “Buy the dip” is trending like wildfire on X. Bitcoin’s clawing its way back up from a 24-hour low of $91,200 to around $95,000, and Ethereum‘s doing its best to follow suit, moving up from $2,368 to about $2,600. Even Tether’s feeling the bounce, recovering from a 24-hour low of $0.99946 to about $1.00085 on Monday morning.

The Fear & Greed Index’s stubborn refusal to budge too much might just be a sign of the times. Big players like MicroStrategy have been pouring money into Bitcoin, creating a sort of calming effect in these wild, wild crypto waters.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Grimguard Tactics tier list – Ranking the main classes

- Mini Heroes Magic Throne tier list

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

2025-02-03 12:47