So, Cboe BZX Exchange, in a move that’s either brilliant or completely bonkers, has decided to throw its hat in the ring and file for the first spot XRP ETFs in the U.S. I mean, who doesn’t love a little crypto chaos, right? 🎢

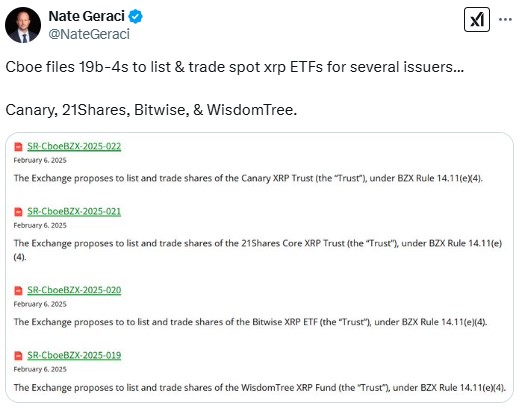

On February 6, they submitted these 19b-4 forms for four asset managers—Canary Capital, WisdomTree, 21Shares, and Bitwise. Sounds like a law firm, but no, they’re just trying to replicate the price of XRP, which is currently sitting pretty at $2.35. Fourth in the market? Wow, that’s like being the fourth-best pizza place in a town full of pizzerias. 🍕

Now, these 19b-4 filings are supposed to inform the SEC about proposed changes in market rules. If they get the green light, we’ll have the first XRP ETFs in the U.S. Just what we need, more ways to gamble on digital coins! This comes after the SEC, under the previous chair, Gary Gensler, decided Bitcoin and Ether ETFs were a good idea. I mean, who doesn’t want to ride that rollercoaster? 🎢

But wait! The SEC is now under the crypto-friendly acting chair Mark Uyeda. Analysts are practically drooling at the thought of more crypto ETFs popping up like weeds in a garden. They’re all wondering what a Trump-influenced SEC will allow. It’s like watching a reality show, but with more spreadsheets. 📈

This isn’t Cboe’s first rodeo with crypto ETFs. They recently resubmitted filings for Solana ETFs. So, it’s like they’re just throwing darts at a board and hoping something sticks. 🎯

Other firms like Bitwise and Canary Capital are also getting in on the action, and according to JPMorgan, XRP ETFs could rake in between $4 billion to $8 billion in their first year. That’s a lot of dough! But let’s be real, it’s just a sign that cryptocurrencies are slowly creeping into traditional markets like a cat burglar at midnight. 🐱👤

And hey, XRP is inching closer to its all-time high of $3.40 from 2018. So, buckle up, folks! This ride is just getting started! 🎢

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Cat Fantasy tier list

- Overwatch Stadium Tier List: All Heroes Ranked

- EUR CNY PREDICTION

2025-02-07 10:30