Oh, AAVE. How swiftly you tumble, just like a drunken philosopher falling off his chair after one too many glasses of vodka. Yes, my dear reader, for the second week in a row, AAVE has found itself in the clutches of a downturn, mimicking the sorrowful fate of most altcoins as the ever-present fear of tariff risks looms above like an oppressive cloud, threatening to rain down despair.

Alas, AAVE’s token, that poor creature, has plummeted to a low of $196.4. A price point not seen since November 25, and now languishing at a pathetic 50% below its once glorious high. Does it remind you of anything? Perhaps the human soul, lost and wandering, seeking meaning in the vast and tumultuous sea of financial markets.

But fear not, dear soul, for there may still be hope. Hope that could drive AAVE to the heavens. Yes, there are whispers—whispers of a potential surge, a 170% rise, lifting it to an all-time high of $666. Oh, what a beautiful number, the devil’s number, no less! We dare to dream such fantastical things, do we not?

Let us explore why, in this cruel and capricious world, AAVE might rise from the depths of despair:

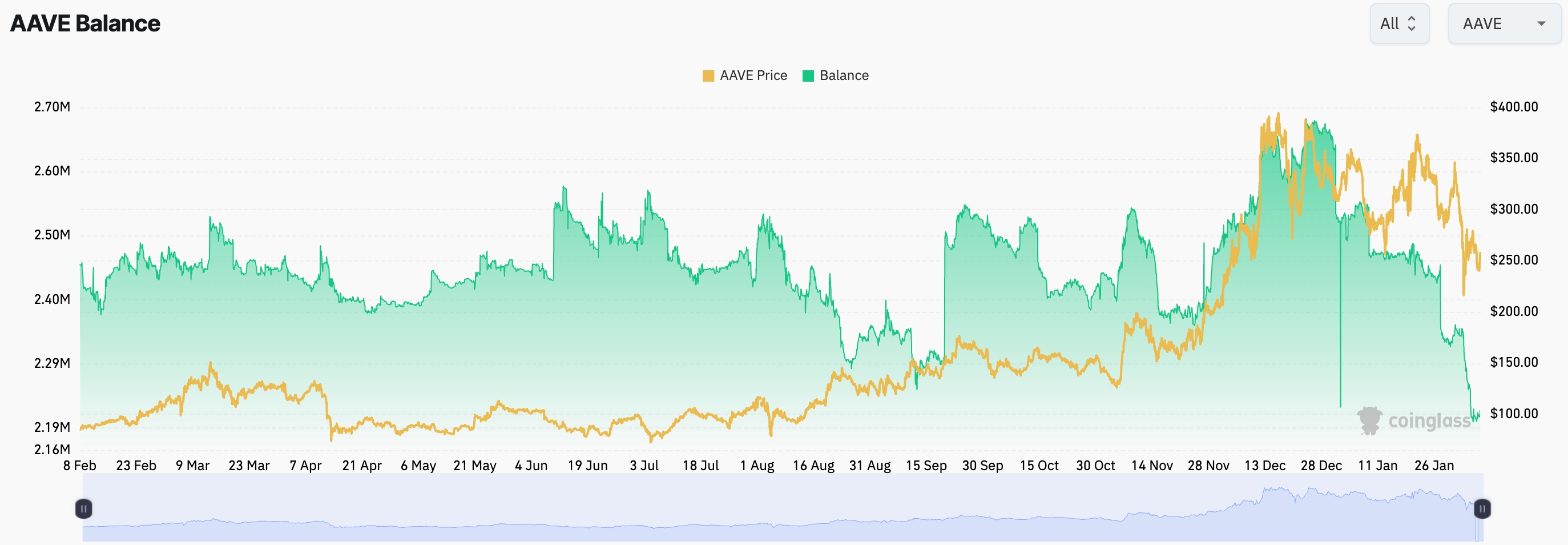

First, let us consider the accumulation. Ah, accumulation—like a miser hoarding his gold in the dark corners of his mind. According to Coinglass data, AAVE’s balances on exchanges have fallen to their lowest levels in years. On Friday, the balance stood at a mere 2.2 million, down from 2.67 million in December. A dramatic drop! The people are hoarding their tokens, clutching them to their chests, unwilling to part with them. Is it a sign of optimism? Or perhaps it is just a nervous tightening of the grip in a world gone mad?

When balances drop, it signals one thing: they are not selling. They are holding. And in the grand scheme of things, my dear reader, that is a good sign. For when balances rise, it signals the opposite—selling pressure, the great exodus of the weary from the realm of the unknown into the familiar arms of exchanges. AAVE’s holders are not so foolish. They cling to hope, like a man clutching at the last breath of air before drowning.

Secondly, AAVE remains the largest lending and borrowing protocol in the crypto universe, with assets totaling an impressive $20 billion. Oh, but the story doesn’t end there! AAVE is also raking in profits, with annualized fees surpassing a staggering $721 million. TokenTerminal data reveals that, as of this year, it has already earned over $103 million. Is it a sign of divine providence? Perhaps. Or simply the result of a well-oiled machine churning its gears for all they’re worth.

Let us not forget, dear reader, AAVE’s triumph in the face of adversity. On Monday, as the market quaked in fear, AAVE managed to handle over $201 million in liquidations without accumulating a single ounce of bad debt. Not a single drop! And the total bad debt itself has fallen by 2.7%. A miracle? Perhaps. A sign of resilience? Most certainly.

Amid significant market volatility, @aave successfully processed $210 million in liquidations while maintaining zero additional bad debt.

Here’s a breakdown of the key insights: 🧵👇

— Chaos Labs (@chaos_labs) February 3, 2025

But wait, there’s more! The AAVE network is expanding, growing like a vast and sprawling empire. Over 440 million USDS stablecoins have flowed into its coffers, a sign of growing trust, perhaps? And in a twist of fate, AAVE has moved to Base, the blockchain network owned by Coinbase. A vote is even underway to bring AAVE to Linea, further expanding its reach. Such is the power of ambition—of reaching ever outward, as the poet would say, toward the stars.

What does the future hold for AAVE?

Ah, the future. A mystery, a riddle wrapped in an enigma, forever just out of reach. But AAVE’s technical indicators suggest that a rally may be on the horizon. Like the proverbial phoenix rising from the ashes, AAVE has formed a “cup and handle” chart pattern. The upper boundary stands at $400. This is the “cup,” and the recent pullback is merely the “handle,” a formation that, according to the sages of the financial world, often precedes a mighty surge.

But there is more. A small hammer candlestick pattern has appeared, signaling that the “handle” phase is nearing its end, and the ascent, my friends, may soon begin. The depth of the cup is a daunting 90%, but fear not! If we measure the same distance from the upper boundary, AAVE could rise to a staggering $765. A 200% increase! A price explosion that defies the laws of nature, but in this world of madness, who can say what is impossible?

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-02-07 22:43