Oh, Uniswap, you dazzling darling of decentralized trading, what a spectacle you’ve become! One moment you’re the toast of the crypto town, the next you’re hobbling around with a “death cross” in tow—how terribly dramatic! A price retreat over the past months has left your splendid UNI token at a “humble” $10, a far cry (nay, an absolute wail) from that glorious $19.44 peak. And now? Down over 50% from last November, your chart looks like a tragic sonnet of despair. 🎭

‘Tis not just the Bitcoin (BTC) malaise that’s throwing wrenches into your polished gears. The altcoin bear market has been equally cruel, ensuring you’ve tumbled from the high table of decentralized exchange (DEX) dominance. Once a bon vivant of $100 billion in trading volume (so chic!), you’re now shamelessly trailing PancakeSwap’s $109 billion. And, oh, the ignominy—Raydium of Solana (SOL) fame is stealing your thunder! 😱

Ah, but wait—the Unichain mainnet, your latest glittering bauble, dares not impress! Twelve DeFi networks? $8.62 million in total value locked? Darling, that’s barely cocktail reception numbers. The likes of Stargate, Venus, and DyorSwap are hosting the party, but where is the pizzazz, the éclat—the chutzpah?!

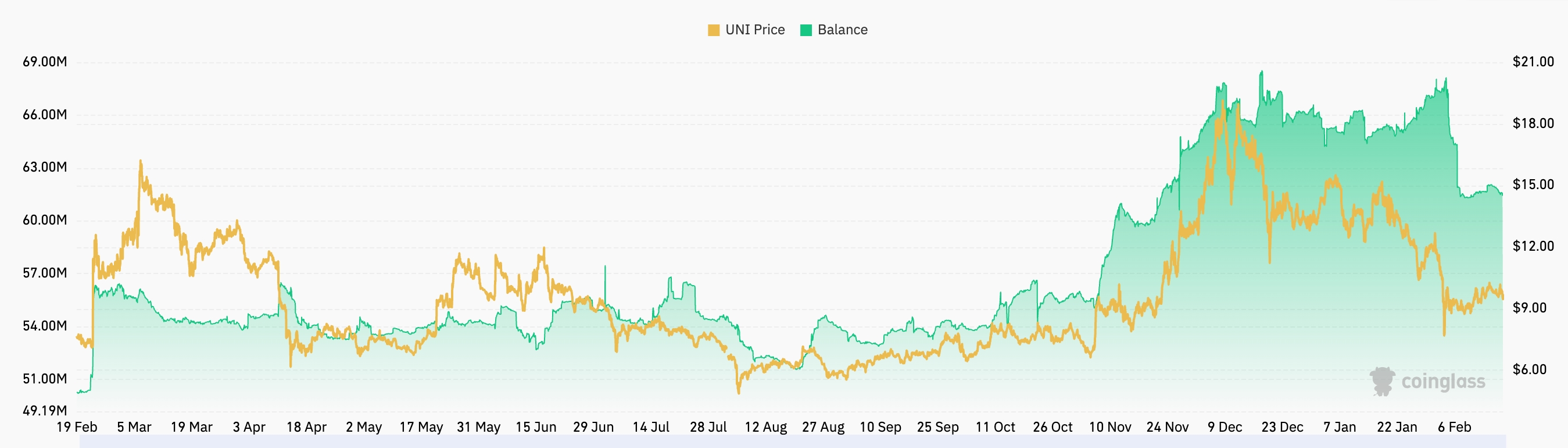

Still, Uniswap remains the diamond of the DEX—profitable, if glimmering a tad less brightly. This year’s $186 million in fees positively obliterates PancakeSwap’s paltry $71 million. One might almost forgive your chart woes. Almost. Investors are clutching their pearls at the drop in UNI token exchange balances—61 million, down from 67 million. “Reduced sell pressure,” they whisper, hope sparkling in their eyes. Truly, today’s optimist is tomorrow’s poet. 🎩

A Death Cross? A Bearish Flag? Truly, the Drama Unfolds! 💀📉

Behold your daily chart, Uniswap—a grim portrait of woe and bearish machinations. The death cross, where the 50-day and 200-day Weighted Moving Averages do the crypto equivalent of a Shakespearean handkerchief drop, has arrived. A bearish flag pattern completes this tragic tapestry, resplendent with a sharp decline, some dithering consolidation, and a spectacular fall below the 61.8% Fibonacci Retracement level. For fans of melodrama, this is a must-watch! 🎭

Should current trends continue, the $7 mark looks dreadfully likely—your lowest level this month, darling. But hope springs eternal; if you muster the courage (or sheer luck) to rise above $11.20, the 200-day moving average, we may yet pen a happier chapter in the Uniswap saga. Whatever happens, one thing’s for sure—crypto’s most theatrical DEX will never lack for an audience. Bravo, Uniswap, bravo! 🎬

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Cat Fantasy tier list

- Overwatch Stadium Tier List: All Heroes Ranked

- EUR CNY PREDICTION

2025-02-18 17:02