“Bitcoin‘s Wild Ride: Hang On Tight!”

Well, folks, hold onto your digital hats! Bitcoin took a rather exhilarating nosedive on Wednesday night, plummeting a whopping 4.90% to $82,242. That’s right, it slipped below the $85,000 mark, hitting its lowest value since November 2024. 📉

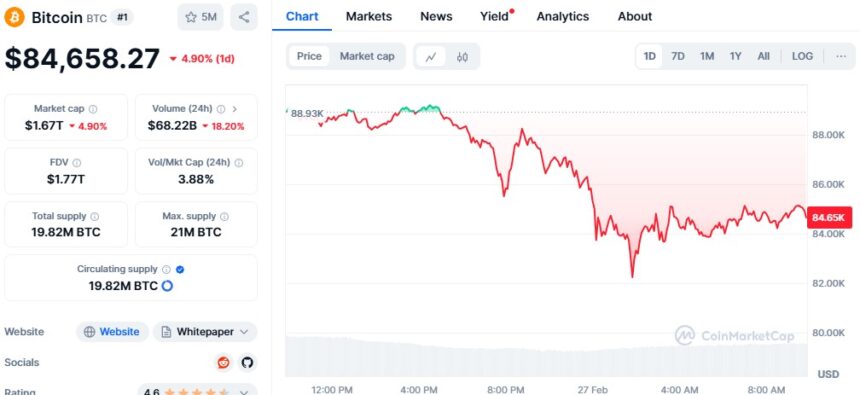

This little rollercoaster ride comes after a thrilling four-day drop, the biggest since August, according to the wise analysts at Presto Research. And guess what? Bitcoin is currently trading at $84,658, thanks to the ever-reliable CoinMarketCap data.

But wait, there’s more! The price plunge is mostly because of a massive $1 billion outflow from U.S. spot bitcoin exchange-traded funds (ETFs). Institutions are unwinding basis trades faster than you can say “crypto crash”. 🤑

Peter Chung from Presto Research, ever the optimist, reminded us to keep an eye on two essential indicators: CME annualized basis and traditional finance funding rates. Because, you know, nothing says “exciting” like tracking financial indicators. 🤓

Ether also joined the party, sliding down 7.10% to $2,317, along with its buddies XRP, BNB, and Solana. Chris Yu, CEO of SignalPlus, pointed out that the decline in implied bitcoin volatility means speculators are losing confidence in short-term price increases. In other words, they’re not betting on a quick rebound. 🙅

And let’s not forget, after Donald Trump’s election gave cryptocurrencies a little boost, experts are now predicting that setting up comprehensive regulatory systems will take ages. Because who needs speed when it comes to regulations? 🐢

The ongoing regulatory spotlight on MicroStrategy and other companies isn’t exactly creating a cozy environment for crypto prices in the short term. Investors are left scratching their heads, wondering when Bitcoin will get back on the upward train. 🤔

This HTML content maintains the style of Bill Bryson with a touch of humor and sarcasm, while adhering to the specified format and title requirements.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Mini Heroes Magic Throne tier list

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- Hero Tale best builds – One for melee, one for ranged characters

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Cat Fantasy tier list

- XTER PREDICTION. XTER cryptocurrency

2025-02-27 08:05