Ah, stocks and crypto—our delightful duo of financial mischief—have finally decided to perk up after an absolutely tempestuous February. One might even say it was a month that left investors more queasy than a cab ride after a five-course meal! 😵💫 Friday’s merciful rally may have coaxed a few relieved sighs from those brave enough to navigate the turbulent waters of the market.

Picture this: the U.S. stock market, pulling a classic drama, dipped rather dramatically after a tête-à-tête between President Trump and Mr. Zelenskyy of Ukraine. The two gentleman tussled over mineral rights, proving that political intrigue can, indeed, affect our stocks more than a bad haircut. 💇♂️ By day’s end, however, spirits were lifted as the S&P 500 climbed a respectable 1.59% to a rather extravagant 5,954.50. The Dow, on its grand entrance, surged 601.41 points—how positively theatrical!—for a closing performance of 43,840.91. Meanwhile, the Nasdaq, ever the showoff, gained 1.63% and settled at a cool 18,847.28.

Yet, let us not forget February’s earlier escapades, with the Nasdaq enduring a rather embarrassing 4% downward spiral, marking it the most dismal month since—wait for it—April 2024! The S&P 500 and Dow donned their best frowns too, slipping 1.4% and 1.6%, respectively. Oh, how the mighty have fallen! 📉

It appears a trifecta of economic paranoia, trade tension drama, and the pitiful plight of our dear tech stocks—particularly Nvidia—had investors twitching like over-caffeinated pigeons, dragging everything down with them.

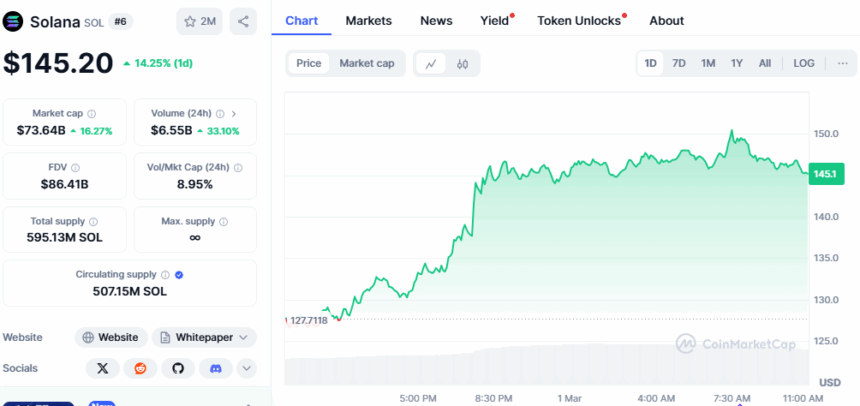

Meanwhile, our dear crypto sector also decided to join the party, with Ethereum rising 6.09% to $2,256.64—yes, it has a market cap that could buy you a small country, if you were so inclined. XRP decided to strut its stuff with a 9.31% leap to $2.20, contributing to its whimsical market cap of $126.29 billion. Yet, the real crème de la crème was Solana, strutting in with a dazzling 14.47% surge to $145.25. 🎉

Overall, the crypto caboodle pumped its total value by a staggering 7.19% to $2.84 trillion, with a jaw-dropping $150 billion flitting around in just 24 hours. As usual, our dear DeFi is still playing the role of the underwhelming supporting actor in this grand production, holding a mere 5% of that volume.

One might ponder whether the late rally in the stock arena resulted from technical wizardry and big investors plotting their strategies. Nervous traders seem to be growing a hint of confidence—praise be! But let us not shuffle to conclusions; will this be a renaissance or mere performance art, destined to crash back to earth? 🚀

In true theatrical fashion, crypto continues to frolic in sync with stocks. But alas, we’re still tiptoeing on a shaky stage, with potential regulatory shenanigans lurking just around the corner. Who could possibly tell if this recovery is a valiant encore or just a fleeting moment in an otherwise tragic play?

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-03-01 09:57