In the land where tech stocks reign supreme, a chill wind blew through the valley, sending shivers down the spine of the crypto market. It was a time when whispers of trade wars and the specter of an economic downturn loomed large over the United States. And in this tempestuous climate, even the mighty Bitcoin (BTC) and Ethereum (ETH) felt the bite.

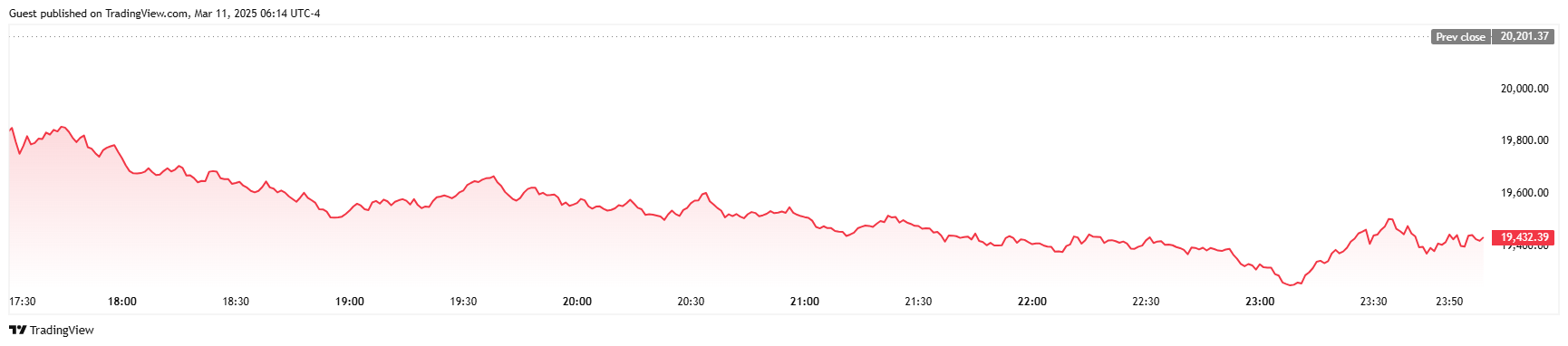

One fateful Monday, Bitcoin took a tumble, losing 4% of its value, slipping to a lowly $80,000. Ethereum, not to be outdone, plummeted by 6%, touching the ground at $1,756, a sight unseen since the distant October of 2023. But fear not, dear reader, for these valiant assets soon regained some of their lost luster. At the hour of writing, BTC rallied to $81,600, and ETH clawed its way back to $1,920. Yet, they still bore the scars of their recent battles, with BTC down by 1% and ETH by 8% from the previous day.

The crypto market’s woes were not born in isolation but were a symptom of a larger malaise affecting the tech sector. The Nasdaq 100 Index, a bastion of technological giants, suffered its darkest day since October 2022, plummeting by 3.8%. Economic seers, with their crystal balls and charts, foresaw a looming downturn in the land of the free. And who could forget the words of warning from the one and only Donald Trump, predicting “disturbances” in the trade winds with Canada, Mexico, and China?

“Now that the industry has its strategic Bitcoin reserve executive order, crypto has one fewer positive forward catalyst to price in, and we’re left at the mercy of macro risk appetites,”

sighed Joshua Lim, Global Co-Head of Markets at FalconX, his words echoing the collective sigh of the crypto community.

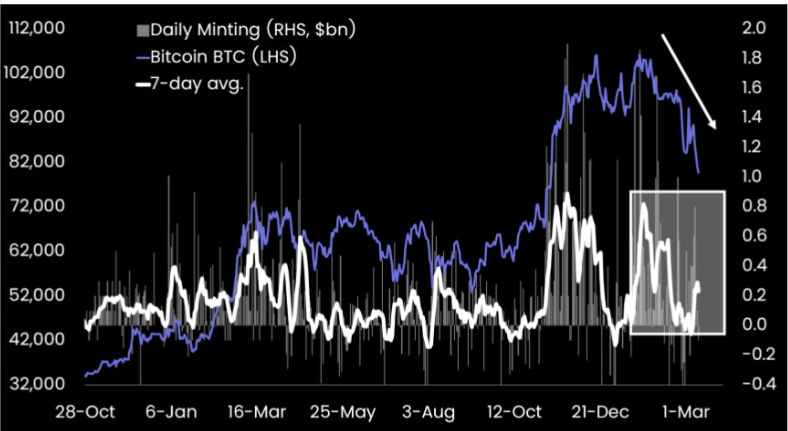

But the story does not end there, oh no! For the crypto world was also grappling with the slowing of stablecoin inflows. A chart shared by Matrixport on X revealed a grim truth: stablecoin inflows had dwindled by over 50%, mirroring Bitcoin’s descent from its lofty heights. In December 2024, stablecoin minting reached a zenith of nearly $1.8 billion. Fast forward to March 2025, and it vacillated between a mere $0.4-$0.8 billion, a staggering drop from its former glory.

Stablecoins, once the steadfast sentinels of market stability, now stood as harbingers of a liquidity crisis. Their decline spoke volumes about the waning demand for crypto, pushing the market into a state of consolidation. Matrixport analysts pondered the cause of this slowdown, suggesting either stablecoin issuers had amassed sufficient reserves or the market simply lacked the appetite for more. Whatever the reason, the crypto realm yearned for a flood of fresh capital to buoy its spirits and lift its prices.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

2025-03-11 13:31