Last week, the crypto world experienced a meltdown worthy of a Dostoevsky novel, with $240 million fleeing exchange-traded products (ETPs) like rats from a sinking ship.

The catalyst? None other than President Donald Trump’s latest trade tariffs, which have investors clutching their digital wallets tighter than a miser clutching his last ruble.

//beincrypto.com/wp-content/uploads/2025/04/BMTUSDT_E7334A_2025-03-11_11-54-20-28.png”/>

The shift in sentiment reflects a deepening sense of uncertainty across all asset classes. The US led the outflows with $210 million, a clear sign that Trump’s tariffs are rattling more than just trade partners. BeInCrypto reported that the president’s “America First” agenda includes a baseline 10% tariff on all imports starting April 5, with higher “reciprocal” tariffs targeting specific countries. China, for instance, faces a whopping 54% tariff, while the EU, Japan, and Vietnam aren’t far behind.

China, never one to take such slights lying down, accused the US of “unilateralism, protectionism, and economic bullying.” Analyst Jackson Hinkle summed it up with a sardonic quip: “China accuses the US of unilateralism, protectionism, and economic bullying with tariffs.”

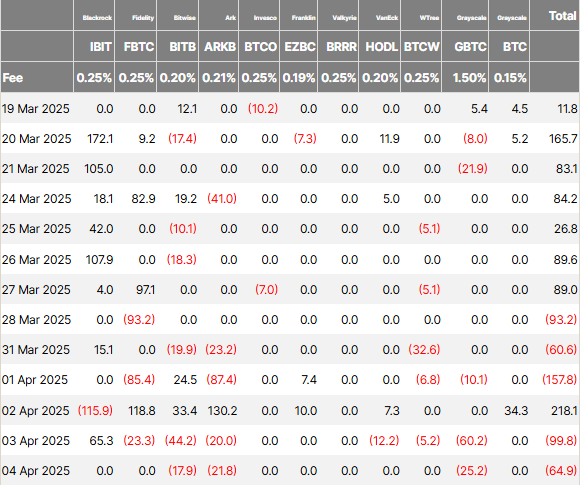

Meanwhile, the US spot Bitcoin ETF market saw $172.89 million in net outflows, ending a two-week inflow streak that had added nearly $941 million. Grayscale’s GBTC led the pack with $95.5 million in outflows, followed by WisdomTree’s BTCW at $44.6 million. Other ETFs, including BlackRock’s IBIT and ARK 21Shares’ ARKB, also reported significant redemptions.

Ethereum ETFs fared no better, marking six consecutive weeks of outflows totaling nearly $800 million since February. Last week alone, Ethereum funds saw $49.93 million in redemptions, reinforcing the narrative of widespread risk aversion.

Still, not all was doom and gloom. Franklin Templeton’s EZBC, Fidelity’s FBTC, and Grayscale’s newer spot Bitcoin Trust collectively saw $61.8 million in inflows, suggesting that some institutions are still willing to dip their toes into the crypto waters.

CryptoQuant CEO Ki Young Ju offered a glimmer of hope, reminding everyone that on-chain data remains crucial for understanding market dynamics. “Dismissing on-chain data due to paper Bitcoin is misguided; it’s essential for understanding market supply and demand dynamics,” he said on X (Twitter).

As the second week of Q2 begins, investors are left wondering whether this pullback is a temporary correction or the start of a deeper structural shift in crypto’s institutional narrative. Standard Chartered Bank predicts Bitcoin could rebound as early as Friday, but for now, the market remains as unpredictable as a Moscow winter.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Mini Heroes Magic Throne tier list

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- XTER PREDICTION. XTER cryptocurrency

- Cat Fantasy tier list

2025-04-07 17:39