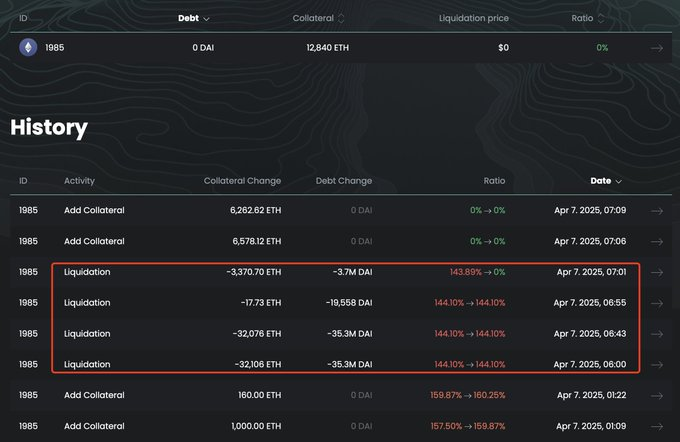

Picture this: you’re an Ethereum whale, swimming majestically through the vast ocean of decentralized finance, feeling invincible with your 67,570 ETH worth $106 million. Then, out of nowhere, the market decides to play a cruel joke on you. Ethereum’s price drops 14% in a single day, and suddenly, your collateralized debt position on Sky—yes, the platform with the audacity to call itself “Sky”—falls below the required ratio. Cue the liquidation. 🚨

Poof! Your ETH is sold off faster than a clearance sale at a crypto-themed thrift store. And just like that, $106 million vanishes into the ether (pun absolutely intended).

Sky, the platform that sounds like it was named by someone who’s never actually seen the sky, is a DCA collateral-based loaning platform. Users can borrow crypto assets like Ethereum and DAI, and lend them out as stablecoins. But here’s the catch: if the value of your collateral drops too much, Sky will liquidate your position faster than you can say “HODL.”

And it’s not just this one whale. The entire crypto market was having a collective meltdown. Bitcoin dropped below $78,000, and other big names like XRP, BNB, and Solana saw their prices fall by 10% or more. The total market cap dropped to $2.5 trillion, which is still a lot of money, but not as much as it was before everyone started panicking. 📉

Meanwhile, the ETH/BTC trading pair hit its lowest level since March 2020, which is basically the crypto equivalent of a bad hair day. And who’s to blame for all this chaos? According to some, it’s President Donald Trump’s tariff war. Because of course it is. 🙄

But wait, there’s more! Another investor was teetering on the edge of liquidation after borrowing DAI with 56,995 wrapped Ethereum worth $91 million. And in the last 24 hours, over 320,000 traders have been liquidated, losing nearly $1 billion. It’s like a crypto apocalypse, but with more memes.

On the bright side, there’s always that one person who sees a market crash as a shopping opportunity. Enter “7 Siblings,” who just bought 24,817 ETH for $42 million, bringing their total holdings to over 1.2 million ETH worth $1.9 billion. Because when life gives you a market crash, you buy more Ethereum, apparently. 🛒

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Cookie Run Kingdom Town Square Vault password

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

2025-04-07 20:27