XRP, that enigmatic digital chimera, now dances at $1.90, flaunting a market cap of $110 billion and a trading volume of $13.96 billion in the last 24 hours. Its intraday journey, from $1.65 to $2.05, is a testament to the chaos and caprice of the crypto realm.

XRP

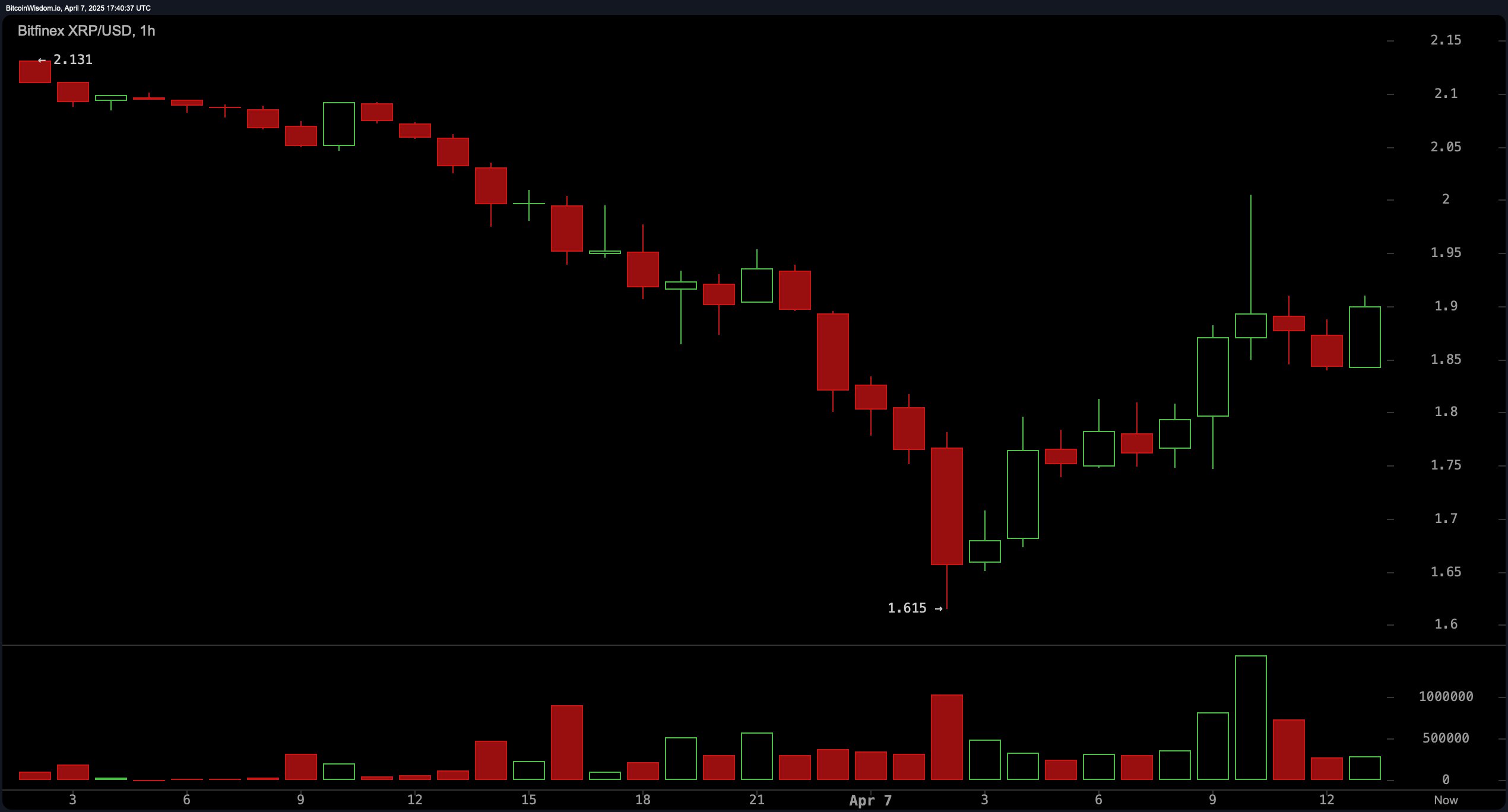

On the 1-hour chart, XRP has begun to claw its way out of the abyss, forming higher lows—a glimmer of hope for the downtrodden trader. A bullish candle at $1.75, backed by volume, whispers of a possible reversal. Now, it lingers between $1.85 and $1.90, teasing a bullish flag. Resistance looms at $1.93 to $1.95. If breached, $2.00 beckons. Traders, ever the opportunists, may find solace in the $1.80 to $1.85 zone, with stops below $1.75 to guard against the abyss.

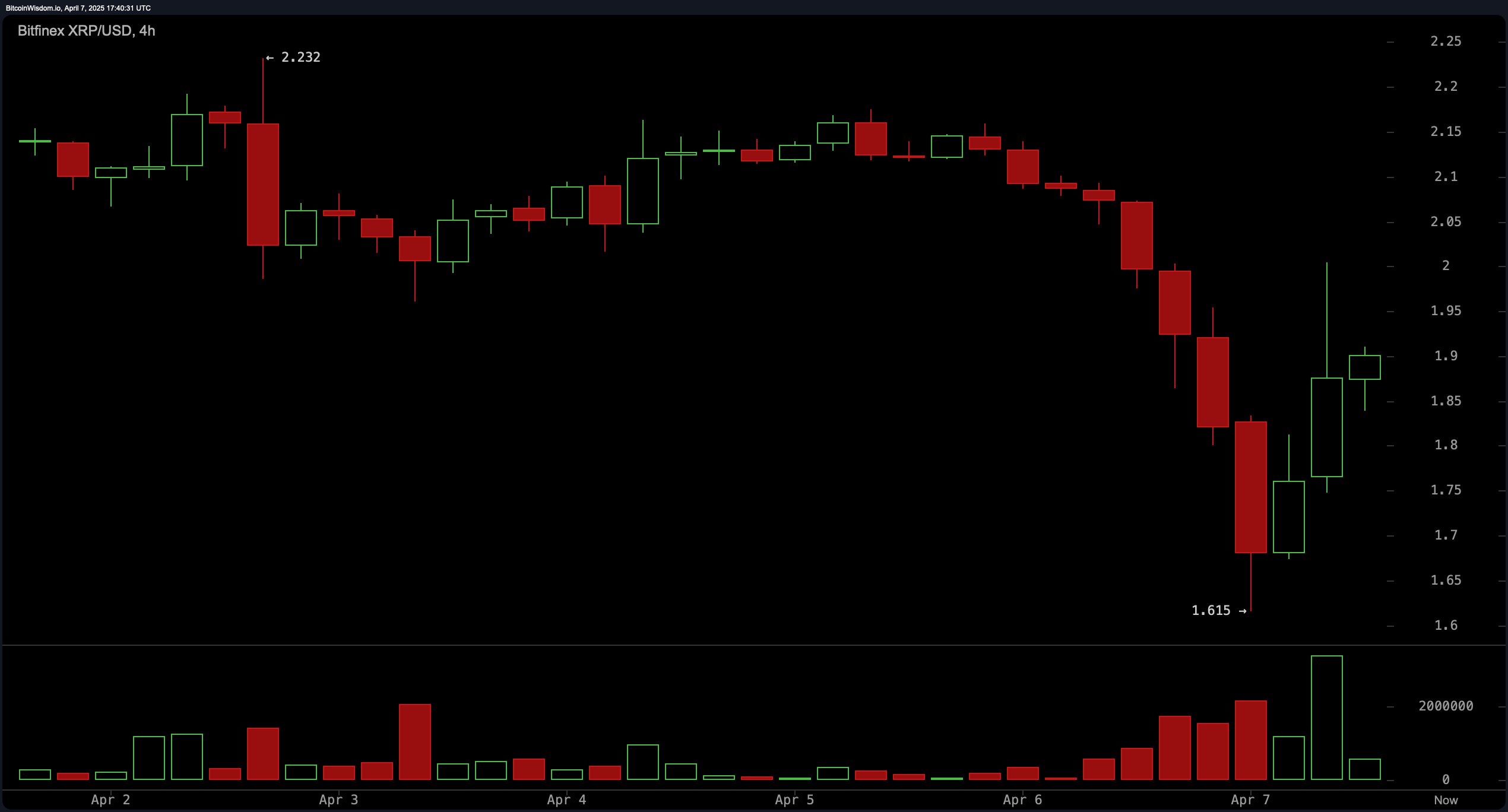

The 4-hour chart reveals a V-shaped recovery from the depths of $1.615, a phoenix rising from the ashes. Green candles, like soldiers, march in formation, signaling active buying. $1.90 stands as a formidable resistance. Should a retracement occur, the $1.75 to $1.80 range may offer a second chance. Profit targets? Aim for $2.00 to $2.10, where resistance once was support.

The daily chart, a chronicle of despair, shows a descent from $2.70 to $1.615. Yet, a red candle with a long wick and high volume hints at seller exhaustion—a glimmer of hope. The $1.60–$1.65 zone, a bastion of support, may yet spark a reversal. Resistance, however, looms large at $2.10–$2.30, a barrier that must be breached for sustained recovery.

Technical oscillators, those fickle arbiters of fate, remain neutral. The RSI at 34.935, the stochastic at 25.71025, and the CCI at −158.30216 all suggest indecision. The ADX at 20.50287 and the awesome oscillator at −0.25416 indicate a lack of trend strength. The momentum oscillator offers a buy signal, while the MACD delivers a sell signal—a cacophony of mixed sentiment.

Moving averages, those steadfast sentinels, reinforce the bearish tone. EMAs and SMAs from 10 to 100 periods all signal sell, except for the 200-period SMA at $1.84610, which offers a buy signal. This divergence between short-term bearishness and long-term optimism may set the stage for consolidation or a decisive breakout.

Bull Verdict:

If XRP holds above $1.75–$1.80 and breaks $1.93–$1.95 with volume, a bullish continuation toward $2.00 and $2.10 is likely. Higher lows, a V-shaped recovery, and a capitulation signal all suggest a reversal may be underway.

Bear Verdict:

Despite the recovery, XRP remains below key moving averages, and the MACD signals sell. If it fails to reclaim $2.00 and slips below $1.75, the downtrend may resume, dragging it back to $1.615 or lower.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Cookie Run Kingdom Town Square Vault password

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

2025-04-07 21:58