Ah, the joy of watching Bitcoin ETFs begin the week in a lovely shade of red. Zero inflows recorded across the board, which makes you wonder if the whole cryptocurrency circus has lost its charm… or if investors just decided to take a coffee break from their excitement. Either way, the mood is grim!

Meanwhile, in the derivatives market, Bitcoin continues its slow-motion dance of despair, with a surge in put contracts. But don’t worry, maybe there’s still hope for optimism? Or is that just wishful thinking? 🤔

BTC ETFs See No Inflows as Outflows Soar – Surprise, Surprise!

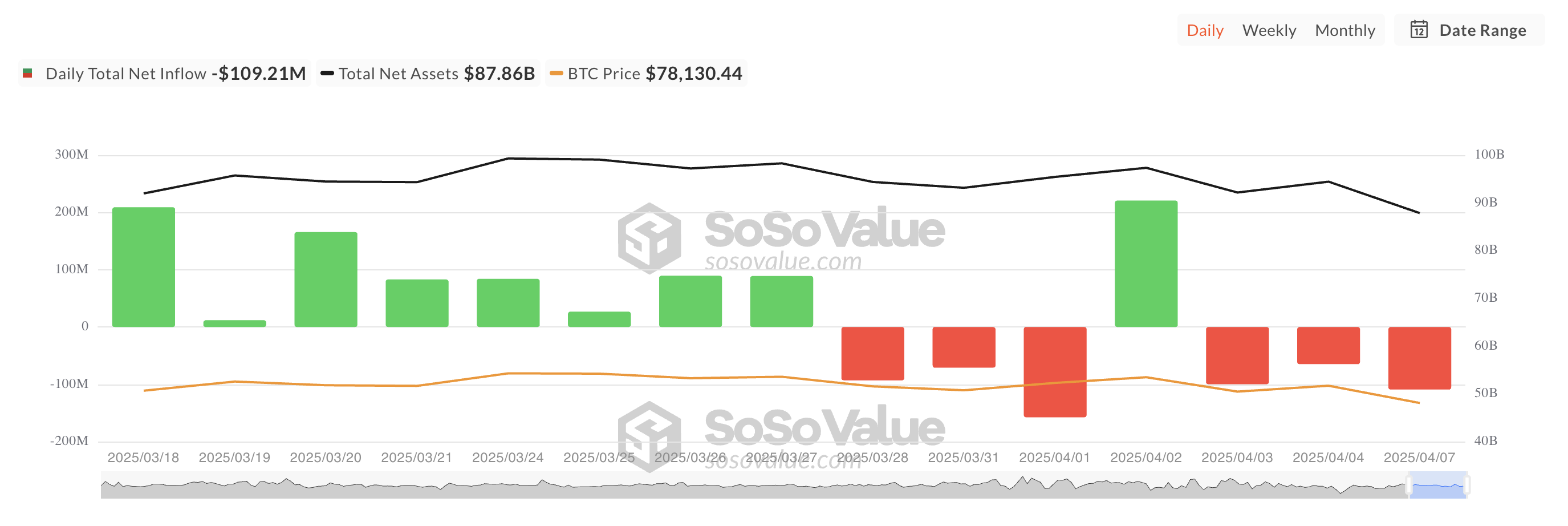

On Monday, the floodgates opened as capital rushed out of spot BTC ETFs, hitting a seven-day high of $109.21 million in outflows. And what triggered this mass exodus, you ask? Oh, just a little thing called the weekend bloodbath in the crypto market, resulting in over $1 billion in liquidations. You know, the usual day at the office for crypto. 🙄

Grayscale’s ETF GBTC took the lead in this sad march of outflows, losing $74.01 million, bringing its total assets down to a modest $22.70 billion. Poor thing, it just can’t catch a break.

Meanwhile, Invesco and Galaxy Digital’s BTCO also joined the party, with $12.86 million leaving their coffers. At least they can boast about a total historical net inflow of $85.32 million – but who’s counting when it’s all just numbers on a screen, right? 😅

And here’s the kicker – none of the twelve spot Bitcoin ETFs had a single net inflow yesterday. None. Zilch. Nada. Looks like institutional investors have decided to stay on the sidelines for now. Let’s all pretend we’re shocked.

BTC’s Short-Covering Rally Faces Bearish Bets in the Derivatives Market – Uh Oh!

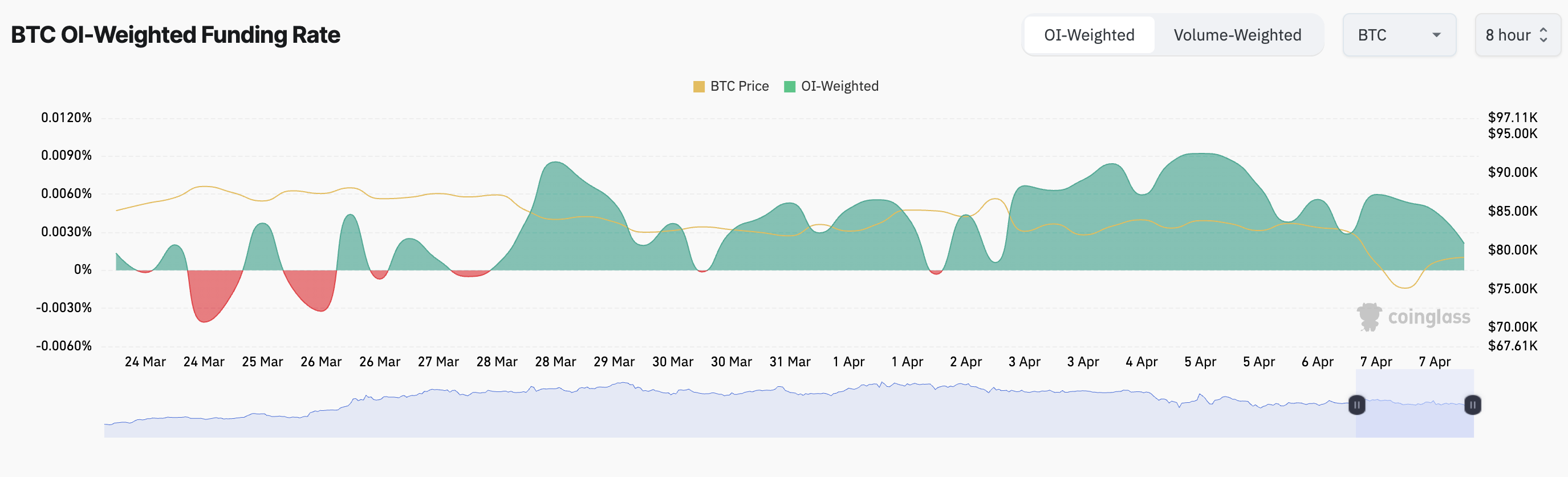

As Bitcoin struggles to stay above $80,000 (and let’s be honest, barely hanging on), its trading activity continues to nosedive. This is reflected in its futures open interest, which has dropped by 2%, sitting at a lovely $50.95 billion. Can we even call it a “drop” anymore? More like a slow-motion tumble down a steep hill.

But here’s the twist – while the price of BTC has gained 3% during this same period, suggesting some kind of rally, we’re left wondering: is this a true recovery or just a temporary blip from short-covering? You know, that moment when traders close their bearish positions and watch the price rise for a second, but then immediately regret it. 🙄

This tells us one thing: BTC futures traders are probably closing those bearish positions just to temporarily push the price up. Maybe for a quick high-five with their friends? Who knows at this point.

But, don’t despair completely! Despite the drop in BTC’s price and futures open interest, the funding rate is still positive. So, there’s still some faint hope left for optimism, as traders are willing to pay a premium to hold long positions. Guess the dream isn’t over yet? 😜

On the flip side, the derivatives market isn’t exactly throwing a party. Investors are opening more put contracts, which could mean one thing: people are preparing for a bigger crash. The future of BTC might be in the hands of those who are betting on doom and gloom. Good times, huh? 😅

So, buckle up. BTC traders seem to be getting ready for some downside risk, as if they’re looking forward to a bumpy ride. Let’s just hope they packed their seatbelts.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Cat Fantasy tier list

- Overwatch Stadium Tier List: All Heroes Ranked

- EUR CNY PREDICTION

2025-04-08 10:21