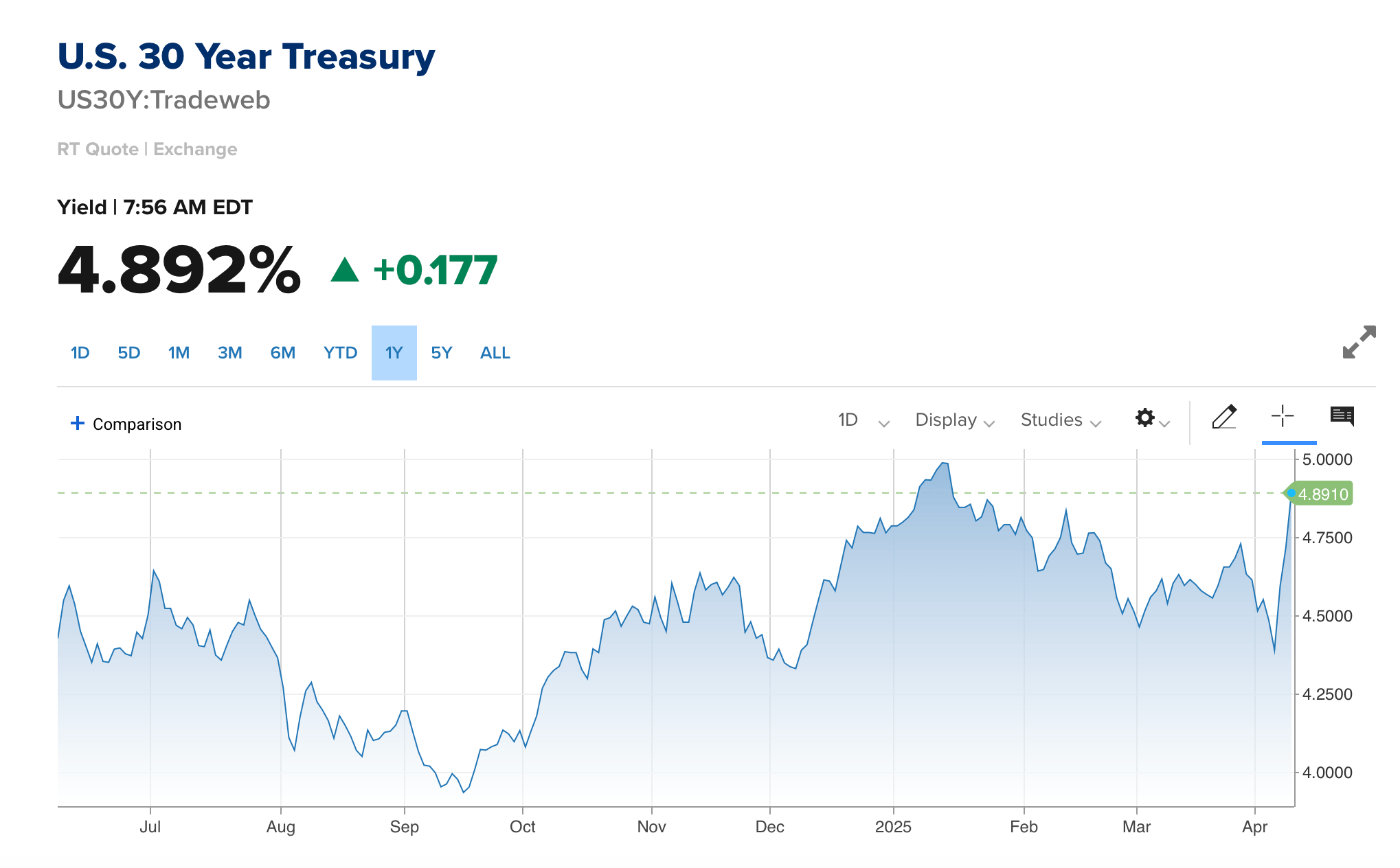

On Wednesday, as President Donald Trump’s tariffs officially went into effect, long-term bond yields began charting a steady climb toward historic peaks. Recent figures reveal that the yield on the U.S. 30-year Treasury note experienced its most significant weekly rise since 1981.

Basis Trade Dysfunction Sends Shockwaves Through Markets

Trump’s trade conflict has unsettled financial markets, triggering a turbulent stretch on Wall Street as the U.S. stock market endured a four-day decline. Bitcoin dipped to its lowest level in five months, while the broader crypto market contracted to $2.45 trillion. Gold also faltered, falling beneath $3,000 an ounce before recovering by three percentage points within the past day to reach its current $3,064 price. Amid this whirlwind of volatility, attention remains firmly trained on U.S. Treasury bonds.

“Something has broken tonight in the bond market. We are seeing a disorderly liquidation,” explained the macro investment researcher Jim Bianco. “If I had to GUESS, the basis trade is in full unwind. Since Friday’s close to now … the 30-year yield is up 56 bps, in three trading days.” Bianco stressed that this isn’t a rational, rate-outlook-driven repricing — it’s disorder. With S&P futures down 2% and oil collapsing 21% since “Liberation Day,” markets appear to be reacting to the realization that something deeper is broken.

As of 7 a.m. ET on Wednesday, the yield on the 30-year Treasury bill stands at 4.892%, with the ten-year note yielding 4.435%. Rising bond yields often lure investors away from stocks, as bonds offer a comparatively safer route to returns. This reallocation typically places downward pressure on stock valuations, rippling through retirement funds and broader investment holdings. Elevated yields also translate to steeper borrowing costs, making everything from home and auto loans to business capital projects more expensive.

According to a report by the financial news outlet Zerohedge, the basis trade is unraveling, triggering what it calls a “multi-trillion-dollar liquidation panic.” The basis trade hinges on discrepancies between Treasury bond prices and their futures contracts. Traders engage in this by purchasing Treasury bonds in the cash market while simultaneously shorting their corresponding futures, anticipating that the prices will eventually align. However, higher yields have increased the cost of financing these leveraged positions, shrinking potential gains and compelling traders to exit trades. That unwind can provoke swift sell-offs in both Treasuries and futures.

These dislocations may prompt action from the U.S. Federal Reserve. One option is quantitative easing (QE), where the Fed buys long-term Treasury bonds to stimulate demand, raise prices, and pull down yields. The central bank might also cut rates, indirectly pushing shorter-term yields lower. Sometimes, words alone suffice—the Fed can signal future policy shifts to calm market nerves, shape investor expectations, and steady yields. As noted by the X account Oz, the Fed’s reverse repurchase (RRP) facility has quietly contracted from a $2.5 trillion peak to just $148 billion.

Oz points out that a 94% drawdown amounts to a substantial injection of liquidity back into financial markets. While much of the public discourse remains fixated on inflation metrics and geopolitical tensions, Oz argues the real development lies in sidelined capital quietly re-entering circulation—reigniting appetite for risk without requiring an official rate cut or policy pivot. Rather than being driven by speculative fervor, this influx of liquidity could represent the most consequential easing event since 2020—one that markets are only beginning to absorb.

“Everyone’s still positioned for doom,” the X account added. “But the liquidity says: ‘Grab your helmet. You’re about to chase green candles into ATHs.’”

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom Town Square Vault password

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-04-09 17:28