- The SEC has waved its magic wand over BlackRock, Fidelity, and Bitwise Ethereum ETFs – options trading is now live. 🎉

- Bloomberg’s crystal ball says staking approval could land as early as May or August. Stay tuned! 🔮

The U.S. Securities and Exchange Commission (SEC), with all the gravitas of a bureaucratic deity, has granted approval for options trading on spot Ethereum (ETH) ETFs. This monumental occasion sees the launch of options for BlackRock’s ETHA, Bitwise’s BITW, and Fidelity’s FETH. 🏛️

As Nate Geraci from ETF Store humorously points out, this update may just be the magic sauce that attracts more ETH investments. His words are a delightful mix of optimism and strategy:

“SEC has approved options trading on spot ETH ETFs… Much like with BTC ETFs, brace yourself for a flurry of new product launches. We’re talking covered call strategies, buffer ETH ETFs, and more!”

The ETH Price: A Symphony of Expectations and Realities

Now, hold your horses! While the news is certainly sparkling with promise, Bloomberg analyst James Seyffart politely reminds us that this approval was “100% expected” – mostly because it was just the SEC’s deadline for a decision. ETH had already priced in this outcome, like an impatient theater-goer waiting for the curtain to rise. 🎭

That said, Seyffart hasn’t given up all hope: the possibility of staking approval is still hanging in the air. Maybe it’ll arrive by early May or perhaps in August, who knows? But the final deadline isn’t until October, so let’s not get too carried away. 🕰️

“It’s possible they could approve staking early, but remember, the final deadline is at the end of October.”

Most experts are now eagerly eyeing staking’s potential to boost ETH demand, particularly among institutional investors who wouldn’t mind a 3% annual yield as a side dish. 💸

In fact, some analysts argue that the lack of staking is partly why spot ETH ETFs have been limping along compared to their much more sprightly BTC ETF cousins. Since launch, ETH ETFs have garnered $2.3B in inflows. Meanwhile, BTC ETFs have had a truly jaw-dropping $35B, a 17x outperformance. Ouch. 😬

That said, ETH had a bit of a moment on April 9th, jumping a solid 10% from $1400 to $1600. No, this wasn’t entirely thanks to the options approval – President Donald Trump’s tariff pause probably had more to do with it. Yet, the options approval did stir some market interest. 🤑

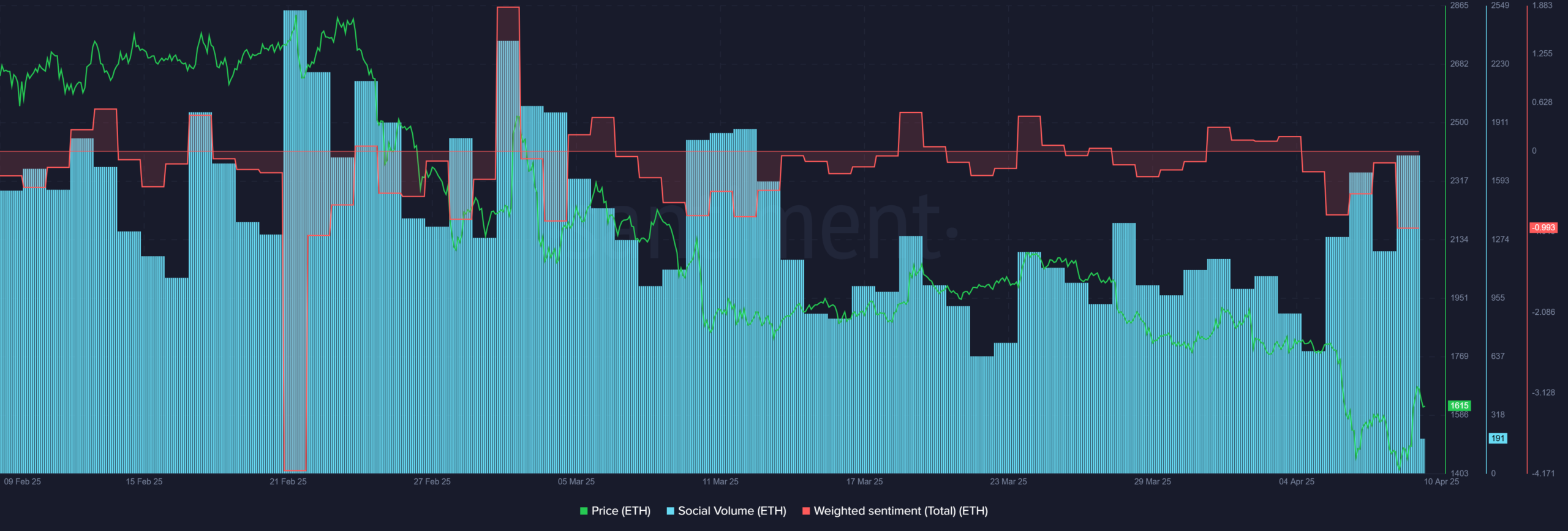

Indeed, ETH’s Social Volume reached a new high in April. The people are talking! 📱

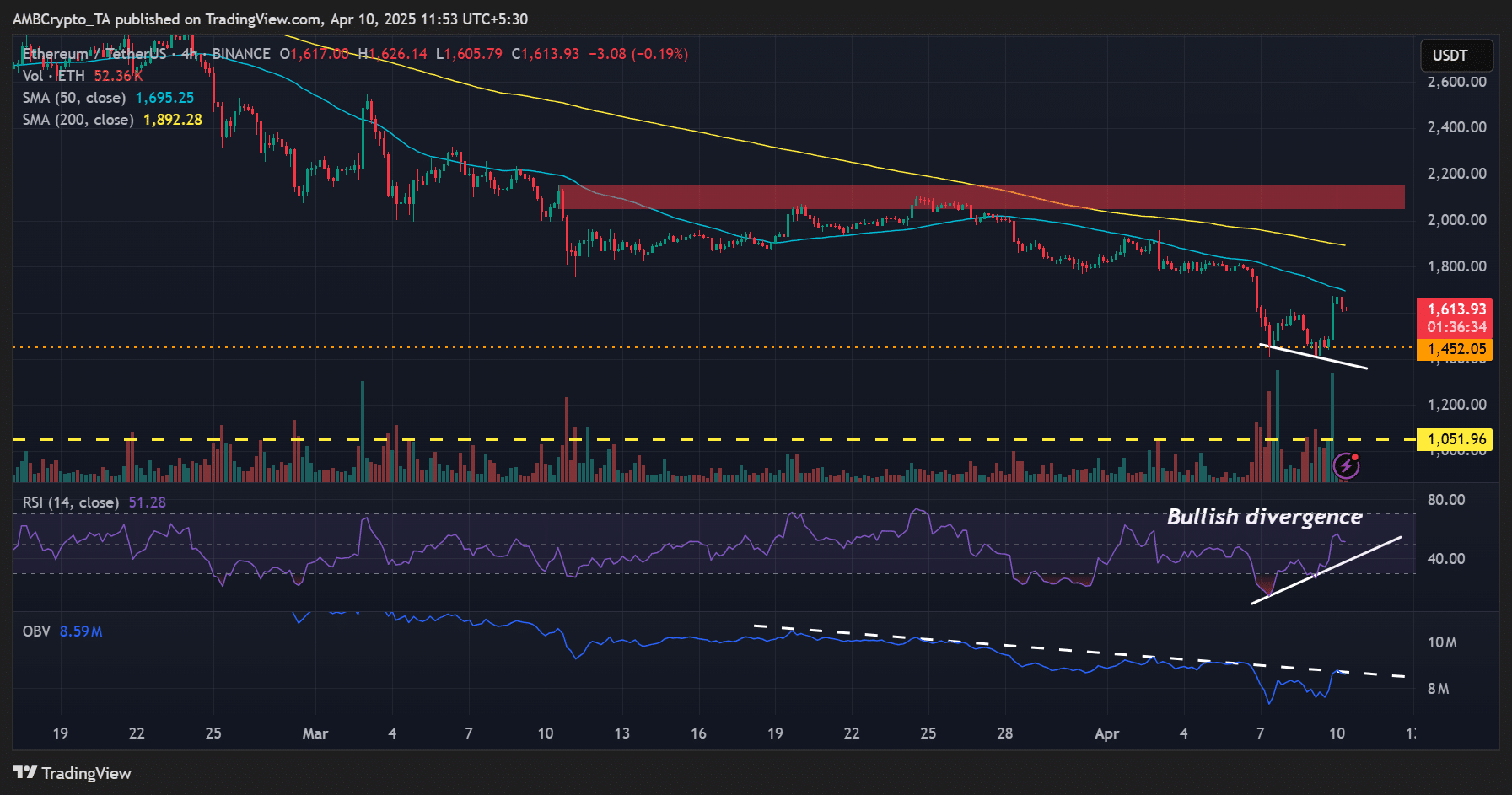

But let’s not get ahead of ourselves. While there’s a glimmer of hope, the sentiment is still on the pessimistic side, making it tough for ETH to sustain any significant recovery. Yet, a bullish RSI divergence on the 4-hour chart suggests that a glimmer of recovery might be just around the corner, if the stars align. ✨

For that recovery to gain some momentum, ETH will need to break through its overhead resistance (aka the trendline hurdle). The On Balance Volume (OBV) will be the key indicator to watch. ⏳

So, where does that leave ETH in the short-term? The $1600 mark (50EMA) could prove to be a solid stopping point, much like it did recently. But, if ETH manages to push past that barrier with some solid volume, we might just see it rally higher. The real test, however, will come in the long-term, where a favorable macro shift and staking approval could be the catalysts for a true recovery. 📈

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Cookie Run Kingdom Town Square Vault password

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-04-10 13:18