Ethereum (ETH) took a nosedive, shedding over 7% in a day, proving that even Trump’s 90-day tariff pause couldn’t save it. Key indicators are flashing red, and a full recovery seems as likely as a unicorn sighting in Wall Street.

The BBTrend is still sulking in the negative zone, and the whales? They’re just sitting on their digital thrones, doing nothing. With a bearish EMA structure, Ethereum might need a miracle—or at least a massive wave of buyers—to escape this downward spiral.

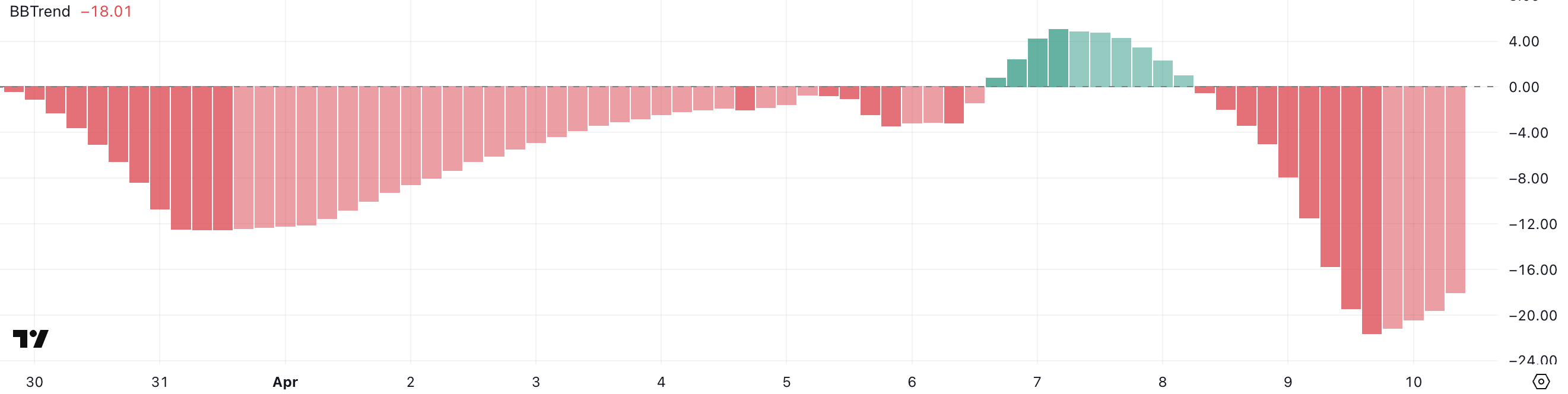

ETH BBTrend: Less Negative, Still Gloomy

Ethereum’s BBTrend indicator has inched up to -18 from -21.59, which is like saying a storm is now just a heavy drizzle. Sure, it’s better, but you’re still getting soaked.

This indicator, which uses Bollinger Bands to measure trend strength, is still in the red, meaning the bears are still in charge. Positive values? Bullish. Negative values? Bearish. And -18? That’s bearish with a capital B.

Ethereum.

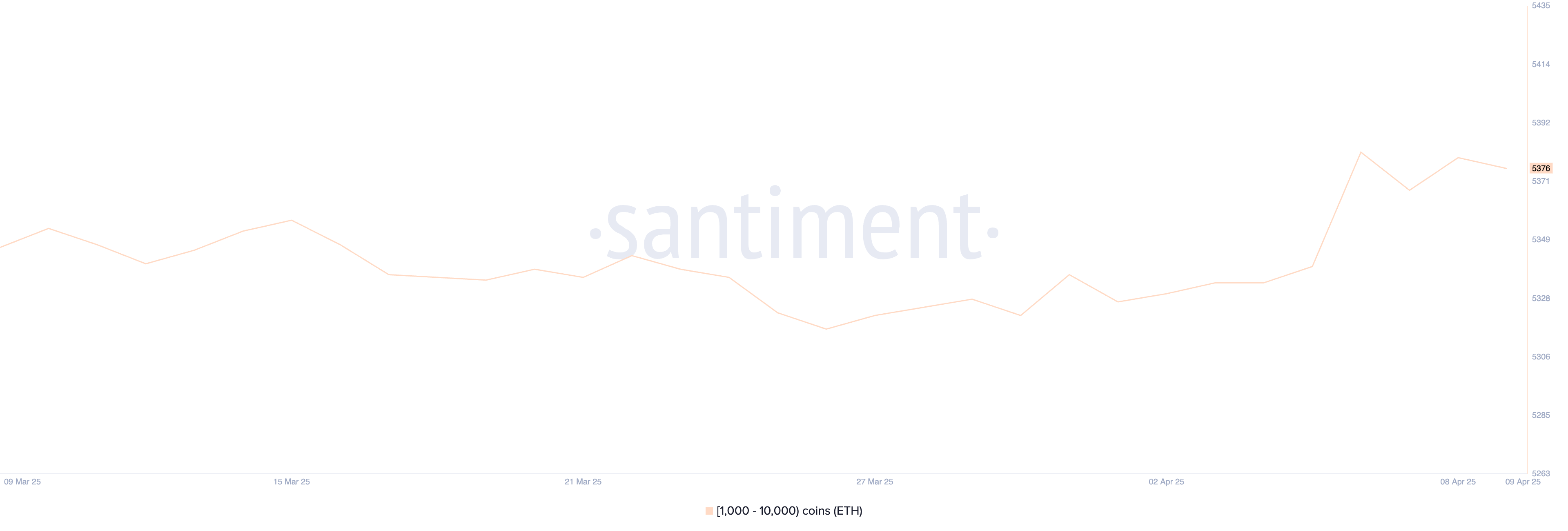

Whales: The Silent Spectators

The number of Ethereum whales—those holding between 1,000 and 10,000 ETH—briefly rose from 5,340 to 5,382, but then they just stopped. Now, it’s at 5,376, which is about as exciting as watching paint dry.

Whales are crucial because they can move markets with their massive buys or sells. Right now, they’re just chilling, which suggests they’re not convinced enough to dive back in. Confidence might be creeping back, but it’s not strong enough to fuel a major breakout.

For Ethereum to really surge, we’d need to see these whales start accumulating again. Until then, it’s a waiting game, and patience is not exactly a virtue in crypto.

Is Ethereum’s Bounce Just a Tease?

Despite the recent bounce after Trump’s tariff pause, Ethereum’s EMA structure is still bearish. Short-term moving averages are below the long-term ones, which is like saying the car’s moving, but it’s still in reverse.

Combine that with the negative BBTrend and the stagnant whale activity, and it’s clear Ethereum needs a lot more buying pressure to turn things around. If that happens, ETH could aim for resistance at $1,749, with potential targets at $1,954 and $2,104. But if momentum fades, it’s back to the drawing board, with key support at $1,412. If that fails, ETH could tumble below $1,400 and maybe even revisit the sub-$1,300 zone.

So, is Ethereum’s surge just a temporary blip? Only time will tell, but for now, the bears are still in the driver’s seat. 🐻

Read More

- Ludus promo codes (April 2025)

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Cookie Run: Kingdom Topping Tart guide – delicious details

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Grand Outlaws brings chaos, crime, and car chases as it soft launches on Android

- Seven Deadly Sins Idle tier list and a reroll guide

- Val Kilmer Almost Passed on Iconic Role in Top Gun

- Grimguard Tactics tier list – Ranking the main classes

- Maiden Academy tier list

- Tap Force tier list of all characters that you can pick

2025-04-11 00:26