Ah, the ever-elusive XRP, currently flirting with the number $2.17—a modest elevation against the grim face of the dollar over the past 24 hours. A staggering market capitalization of $126 billion rests upon its shoulders, alongside a dizzying $3.74 billion of trade wandering across the globe. Yesterday’s dance performed a waltz between $2.06 and $2.23, still 35.2% shy of its glorious peak—yes, the indomitable $3.40, a high that haunts its dreams. Meanwhile, in the land of Korea, it plays at a premium of $2.23, basking in local adoration, like a pop star on tour.

XRP

In the hour’s grand tapestry of trading, the tale of XRP unfolds like a melodrama, rising from $2.08 to $2.248, only to be met by ominous red candles— profit-takers or perhaps just wary knights retreating from the battlefield? As volume dwindles, reminiscent of an audience losing interest, what once surged with fervor now stands teetering near indecision, poised like a cat eyeing a cucumber. However, if XRP manages to clutch the $2.15 support zone, it may find a momentary reprieve rather than succumb to the caustic winds of trend reversal. Scalpers, all too eager, lurk around $2.15 and $2.18, targeting their quick flashes of glory towards the resistance—$2.24 to $2.26. But tread lightly, for the path may be sprinkled with volatile surprises down by $2.12.

The signs grow clearer on the 4-hour canvas, where XRP emerges, a phoenix rising from the ashes of $1.72 to exalt its recent $2.248 high. Swimming below the $2.25 mark, the momentum may be breathing slower, yet the chart still reflects a heartbeat of bullishness—a symphony of higher highs and higher lows. Pullbacks whisper sweet nothings in declining volume, almost reassuring in their approach. Potential entry points for the brave lie between $1.80 and $1.90, and should the dream of a breakout above $2.25 unfold, it might ignite imagined escapades up to $2.40 and $2.50, that glorious battleground of resistance.

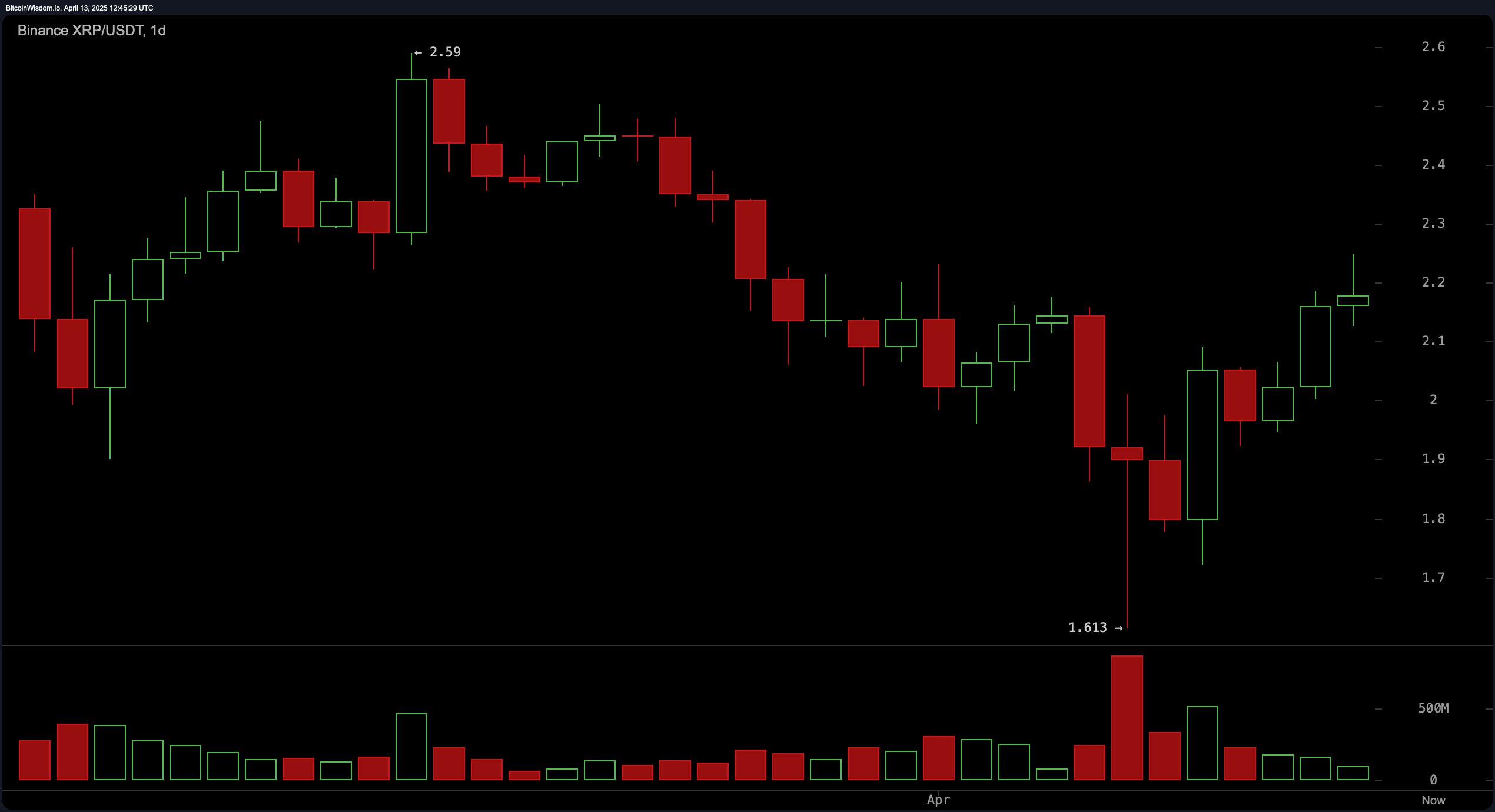

Diving deep into the daily waters reveals XRP clawing its way back up following a fall from grace—a $2.59 peak reduced to $1.613 abyss it seemed reluctant to embrace. The clouds of correction appear to part with growing volume and a hint of bullish ambition. Grasping the $2.00 psychological fortress, the terrain around $2.20 showcases stabilization or, perhaps, a riddle wrapped in an enigma—resistance, yes, still formidable around $2.30, waiting like a guard at the castle gates.

As we peer through the lens of oscillators, we find the relative strength index (RSI) resting at 51.47916, serenely indifferent—neither steeped in overbought elation nor suffocated in oversold despair. Meanwhile, the Stochastic oscillator, with its playful flirtation at 81.30227, teeters on the edge of overbought temptation. The commodity channel index (CCI) at 42.73520 and the average directional index (ADX) at 23.40758 reflect a noncommittal dance—ah, the agony and ecstasy of trading! The awesome oscillator humbly at −0.16920 lowers its head, suggesting a neutral stance, while the momentum indicator at 0.12093 hints at weariness. Curiously, the MACD level is at −0.06991, signaling a buy—an ironic divergence between momentum and strength amid the cacophony of numbers.

Now, concerning the moving averages (MAs), we see a mixed bag, like a plate of assorted pastries at a buffet—tempting but unpredictable. The exponential and simple moving averages for 10 and 20 periods sound the bright horn of positivity; a fleeting representation of the ambience. Yet, the 30-period simple moving average at $2.20407 and those of 50 and 100 periods echo the grumbling of bearish sentiments, throwing shade on any jubilant celebrations at higher altitudes. Notably, the bullish call of both the 200-period EMA and SMA at $1.95348 and $1.88929 respectively speaks of resilient support—ah, the oscillating heart of trading, lingering in the clouds of potential.

Bull Verdict:

The tapestry woven across multiple timeframes hints of bullish undertones—a charming V-shaped recovery, gallant volume on upward forays, and a steadfast price above the $2.00 psychological gate. The waving banner of the moving average convergence divergence (MACD) aligns with several short-term averages, promising upward momentum, while the unfolding of a double bottom pattern on the daily vanguard hints at a glorious breakout ahead. Should XRP surmount the $2.30 resistance with grandeur, the celestial path towards $2.50 brightens, predicting fortune’s favor.

Bear Verdict:

Yet, lurking in the shadows, even the light can cast a daunting shadow. Despite our leading star’s recent ascension, XRP wrestles with stark resistance around $2.30, while the waning winds of short-term momentum whisper caution. The oscillators, remaining tepid or diverging, echo a warning bell; a slip below the $2.15–$2.20 threshold may initiate a retreat to the enduring bastion of $2.00 or deeper. Without the herald of a confirmed breakout, this rally may simply be a fleeting embrace between the boundaries of consolidation.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom Town Square Vault password

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Seven Deadly Sins Idle tier list and a reroll guide

- Overwatch Stadium Tier List: All Heroes Ranked

2025-04-13 17:29