It appears, dear reader, that Mister Jerome Powell, the esteemed Chairman of the Federal Reserve, has let slip a hint—cryptocurrency banking rules shall be somewhat loosened, though do not hold your breath for any kindness in the form of interest rate reductions this May.

During his discourse at the Economic Club of Chicago, Mister Powell confronted the swirling mists of uncertainty wrought by trade policies, steadfastly maintaining the central bank’s ever-watchful, if somewhat stern, demeanour.

The Hawkish Gaze of Mister Powell

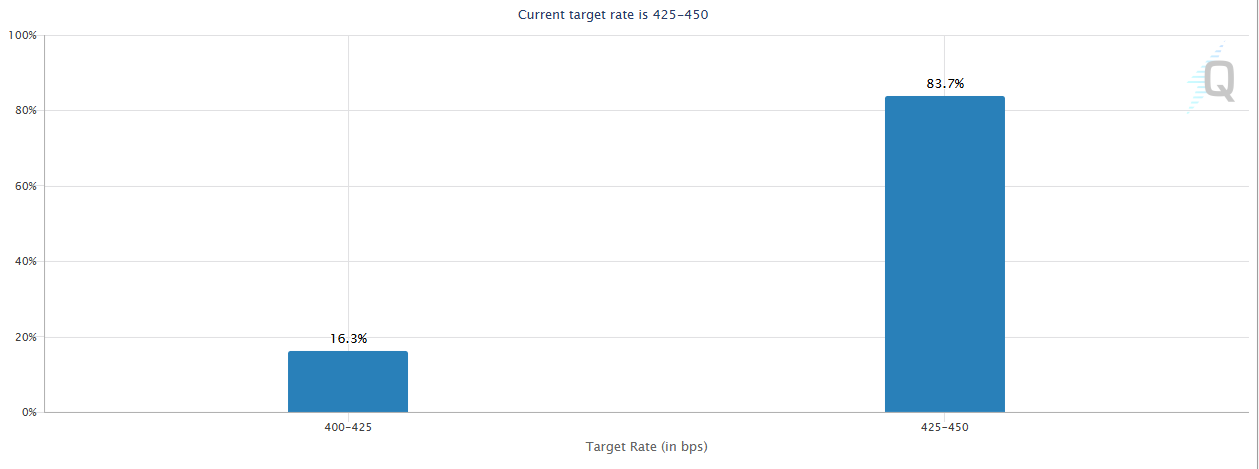

Alas, the hopeful murmurs for a May reprieve in interest rates have all but vanished, with the mercurial CME FedWatch placing their odds at a paltry 16%. Our dear US equities, that fickle company, took a slight dip after his remarks—as if sulking over the absence of any gentle whispers from the Fed.

“We should not rush to lower interest rates,” quoth Mister Powell in all his deliberate wisdom. “Patience, dear friends, for clarity must first lay her cards upon the table before we meddle with policy.”

Yet, in the bustling bazaars of cryptocurrency, the markets lingered with a steady eye. Optimism for rate cuts had been thoroughly drained by last week’s stern FOMC minutes and a surprisingly meek CPI report.

In a rare moment of enthusiasm, Mister Powell turned to the topic of digital assets.

“Cryptocurrency is finding favour among the masses. A proper legal framework for stablecoins, I dare say, is a splendid notion.”

He further declared the Federal Reserve’s approval for the ease of certain banking strictures upon the crypto realm, acknowledging its maturation and craving for clear, rather than restrictive, oversight.

This curious combination—no haste in policy relief but a welcoming nod to crypto regulations—elicited little excitement among digital asset enthusiasts, who perhaps long for drama in these temperamentally stoic times.

Bitcoin, that ever-stubborn stallion, lingered near $84,500, showing the stoutheartedness of a novice at a dance, ignoring the bears prowling the equities.

Mister Powell admitted that economic vigor likely took a sluggish turn at the dawn of 2025 and mentioned, almost with a wink, that Trump’s tariffs present “a key source of uncertainty,” as if speaking of a meddlesome relative at a family gathering.

Moreover, the Fed’s tightening of its purse strings has no end in sight, and should inflation dare to rise anew, more austere measures may well be required—much to the dismay of those with a tender constitution.

Lastly, while pledging to aid global partners with dollar liquidity if crisis demands it, Powell stoutly denied the existence of any Fed “put,” reminding us all that the central bank’s independence is no mere trifling suggestion, but a law carved in stone.

For the crypto markets, this cautious approval was as a shining glimmer within a somewhat bracing and unforgiving macroeconomic climate—quiet hope amid financial tempest. 🤔💸

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom Town Square Vault password

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-04-16 23:36