Ah, Bitcoin! The digital gold that dances like a drunken sailor on the high seas of finance. Recently, it has flashed some bullish indicators, but alas, the low volume whispers caution in the ears of the big traders. 🧐

On this fine Thursday, April 18, our dear Scott Melker, affectionately known as The Wolf Of All Streets (because why not?), pointed out that Bitcoin (BTC) has closed above the 50-day simple moving average with a candle so strong it could light up a dark alley. While the price took a little tumble to $84,349, it still clings to the 50-day SMA level of $84,202 like a cat to a warm lap.

$BTC DAILY

Bitcoin finally closed a strong daily candle well above the 50-day moving average – a notable technical development, especially since that moving average is beginning to curve upward again. It’s the first convincing close above the 50 MA in months, signaling a…

— The Wolf Of All Streets (@scottmelker) April 18, 2025

This joyous occasion hasn’t graced us since February 3, hinting at a potential positive shift in momentum. But wait! Other indicators are raising their skeptical eyebrows. While Bitcoin is frolicking above the 50-day SMA, it still lags behind the 50-day exponential moving average, which is lounging at $85,328. Talk about a party crasher!

Low volumes mean bad news for Bitcoin

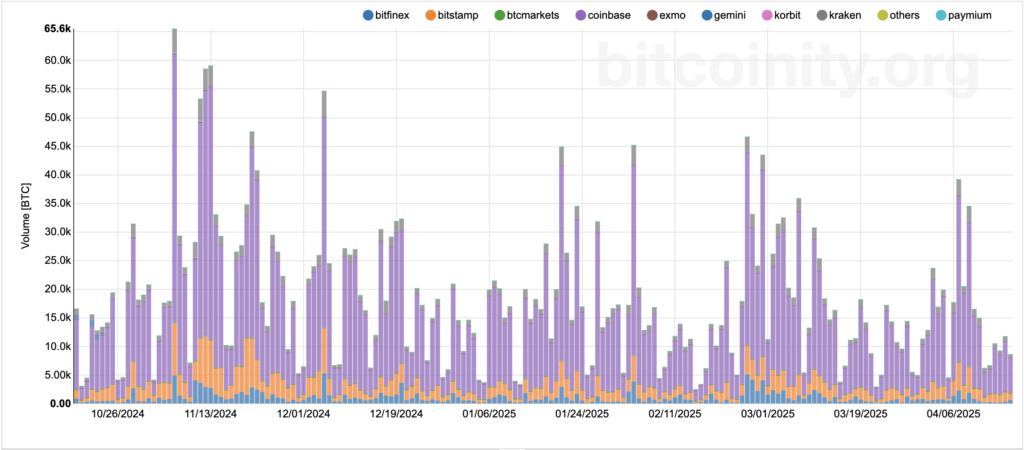

Our beloved token has broken through this level several times over the past week, only to stumble and fall flat on its face. Melker, ever the watchful hawk, points out that low trading volume suggests buyers are still playing hard to get. 😅

For instance, trading volume on major exchanges amounted to a mere 8,000 BTC on April 17, a significant drop from last week’s levels. Just a week prior, on April 9, trading volume was around 26,000 BTC. Where have all the buyers gone? Are they hiding under their beds? 🛏️

This suggests that investors are likely waiting for some positive macro news, which has been as elusive as a cat in a dog park. The ongoing trade war with major U.S. partners is causing fears of a potential economic recession, while the Federal Reserve is moving slower than a snail on a lazy Sunday, fearing that U.S. tariffs, especially on China, would spark domestic inflation. 🐌

In any case, Bitcoin will face resistance at the $85,000 level, which corresponds to a long-term descending channel forming from its January all-time high. And if volumes continue to decline, the asset risks falling to the channel’s midline at around $75,000. Buckle up, folks! 🚀

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-04-18 21:46