Well, well, well… look who’s back on the rise! The U.S.-based Bitcoin exchange-traded funds (ETFs) just had their biggest single-day net inflow in, like, forever—okay, two months—but that’s practically a century in crypto-time. April 21st saw a whooping $381.3 million come pouring in, all thanks to some big players in the market. Take a bow, Farside Investor, you nailed it!

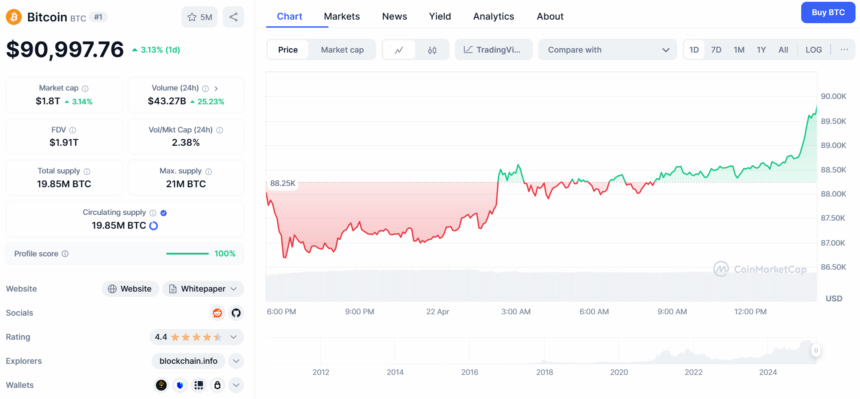

That was the most significant cash splash since January 30, when Bitcoin ETFs raked in $588.1 million, following Bitcoin’s all-time high. But hold onto your digital wallets, because Bitcoin is now strutting around at a jaw-dropping $90,997. Just a little casual flex, no big deal.

The real MVP? ARK 21Shares Bitcoin ETF (ARKB), which bagged $116.1 million of the glory, followed by Fidelity’s Wise Origin Bitcoin Fund (FBTC), with a respectable $87.6 million. Not bad, but let’s not forget the little guys—Grayscale’s Bitcoin Trust (GBTC) and Bitcoin Mini Trust ETF (BTC) also pulled in a cool $69.1 million. They’re all having a party and Bitcoin’s the guest of honor.

And just when you thought it couldn’t get any more exciting, along comes BlackRock’s iShares Bitcoin Trust ETF (IBIT), the big cheese, with $41.6 million. Oh, and smaller funds like HODL and EZBC? They too threw in their chips—$11.7 million and $10.1 million, respectively. Every little bit counts, right?

Now, here’s where it gets interesting—expectations are soaring for the debut of the first-ever XRP ETF. People are biting their nails, waiting to see if this newcomer will shake up the crypto scene. Who knows, maybe it’ll make the rest of these ETFs look like amateurs. 😏

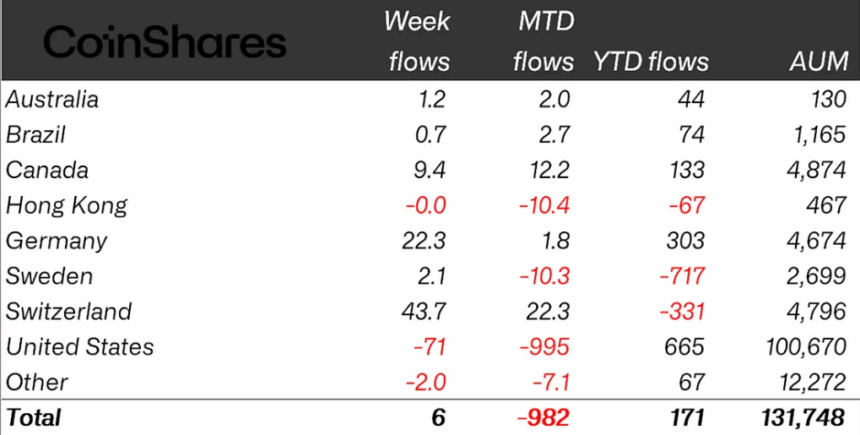

But not so fast! While Bitcoin ETFs are getting all the love, the rest of the digital asset market isn’t exactly throwing a parade. U.S. investors are still in “let’s be cautious” mode, with net outflows of $71 million for the week. So, yeah, April 21st might’ve been a wild exception, but the U.S. is keeping its cards close to the chest. 💸

Across the pond, though, Europe is all sunshine and rainbows. Switzerland is leading the charge with $43.7 million, followed by Germany at $22.3 million, and even Canada is joining the fun with $9.4 million in inflows. It’s like the digital asset party moved to Europe and they’re not asking for an invite. 😎

But wait, there’s more! Mid-week, stronger-than-expected U.S. retail sales led to a minor setback—$146 million in outflows. Oops. That caused some wild fluctuations, proving once again that crypto’s mood swings are harder to predict than the weather. ☔️

In the grand scheme of things, Bitcoin products had a teeny tiny outflow of $6 million, and the short Bitcoin investment products are still crying in the corner. They’ve seen outflows for seven weeks straight, losing a mind-boggling 40% of their total assets under management. Maybe time for a new hobby?

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-04-22 19:18