Right. Ethereum. It’s at it again. The price is shimmying its way up, which apparently has something to do with all the positive vibes following the market actually behaving itself for once—plus, the US and China haven’t thrown handbags at dawn in, what, a week? Confidence is up, the “numbers” people are getting giddy over “on-chain metrics,” and even those DeFi lot are partying like it’s pre-FTX. The result? ETH eyeing up $2K like it fancies a night out but isn’t quite sure what shoes to wear. 👠💸

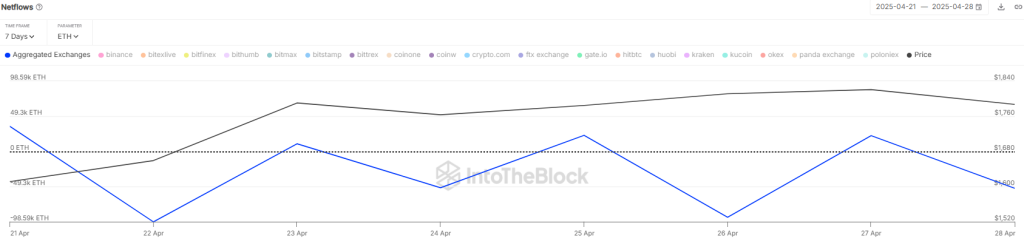

Ethereum’s Netflow Is Leaving Like It’s Avoiding an Ex at a Party

So ETH has been dealing with more mood swings than me after a bad date. Buyers and sellers have been throwing money around, with $26.7 million in liquidations over the last day. And get this: $10.6 million from buyers and $16.1 million from sellers. Basically, no one knows what’s going on, so everyone’s just slamming the big red “SELL” and “BUY” buttons and hoping for the best.

Now, IntoTheBlock said netflow turned negative by 51,590 ETH. Translation: so much ETH is running for the exits, you’d think someone announced free wine elsewhere. People are stashing their coins away in cold wallets, plotting to hold onto them like they’re precious childhood toys (or regrettable tattoos). Exchange reserves are shrinking, sellers are disappearing, and everyone pretends it means something good. 🤷♀️

Meanwhile, ETFs—because the world’s not confusing enough—inhaled $64 million in net inflows on April 28. And before that, they gorged on $151.7 million in a week. That’s their best performance since February 2025. Not that we’re keeping track.

Oh, and DeFi? ETH is still the Queen Bee. The Total Value Locked is ~ $51.7 billion. That’s up 15.5% in just a week. Must be nice. Also: trading on DEXs has shot up a whopping 30%, now hitting $1.65 billion daily. Honestly, who’s doing all this trading? Do you people not sleep?

The moral of the story: the drumroll gets louder for the $2,000 barrier. Will ETH crash the party, or be left standing outside in the rain (again)?

Ethereum’s Next Move: The Thriller No One Can Predict

ETH actually closed above its 50-day moving average, which is the financial equivalent of putting the bins out on time—a rare and impressive feat. But now it’s struggling to break $1,900. The current price? $1,826. Up 1.4% in 24 hours, which either feels like a fortune or an insult, depending on when you bought in.

Watch the 20-day moving average. No idea what that means? Don’t worry, neither does anyone else, but pretend you do at parties. If ETH bounces from $1,802, things get spicy: it might sprint to $1,950 (the scene of the previous disaster). If it breaks that? We’re talking $2,100—or maybe even $2,500 if everyone loses their minds simultaneously.

But if ETH slips under that 20-day line and closes there, sellers snatch the wheel. And we might see prices plummet to $1,560, at which point, yes, everyone will tweet “I told you so.”

Ethereum: unpredictable, slightly addictive, possibly self-destructive. In other words, classic.

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- 9 Most Underrated Jeff Goldblum Movies

- Castle Duels tier list – Best Legendary and Epic cards

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- Can the Switch 2 Use a Switch 1 Charger?

2025-04-29 22:34