As May unfolds, Hedera (HBAR) sits precariously on the edge of potential chaos, much like an overfilled kettle ready to burst. Futures activity has cooled significantly, and HBAR’s price movements now seem to follow Bitcoin‘s every move—except, of course, when it doesn’t.

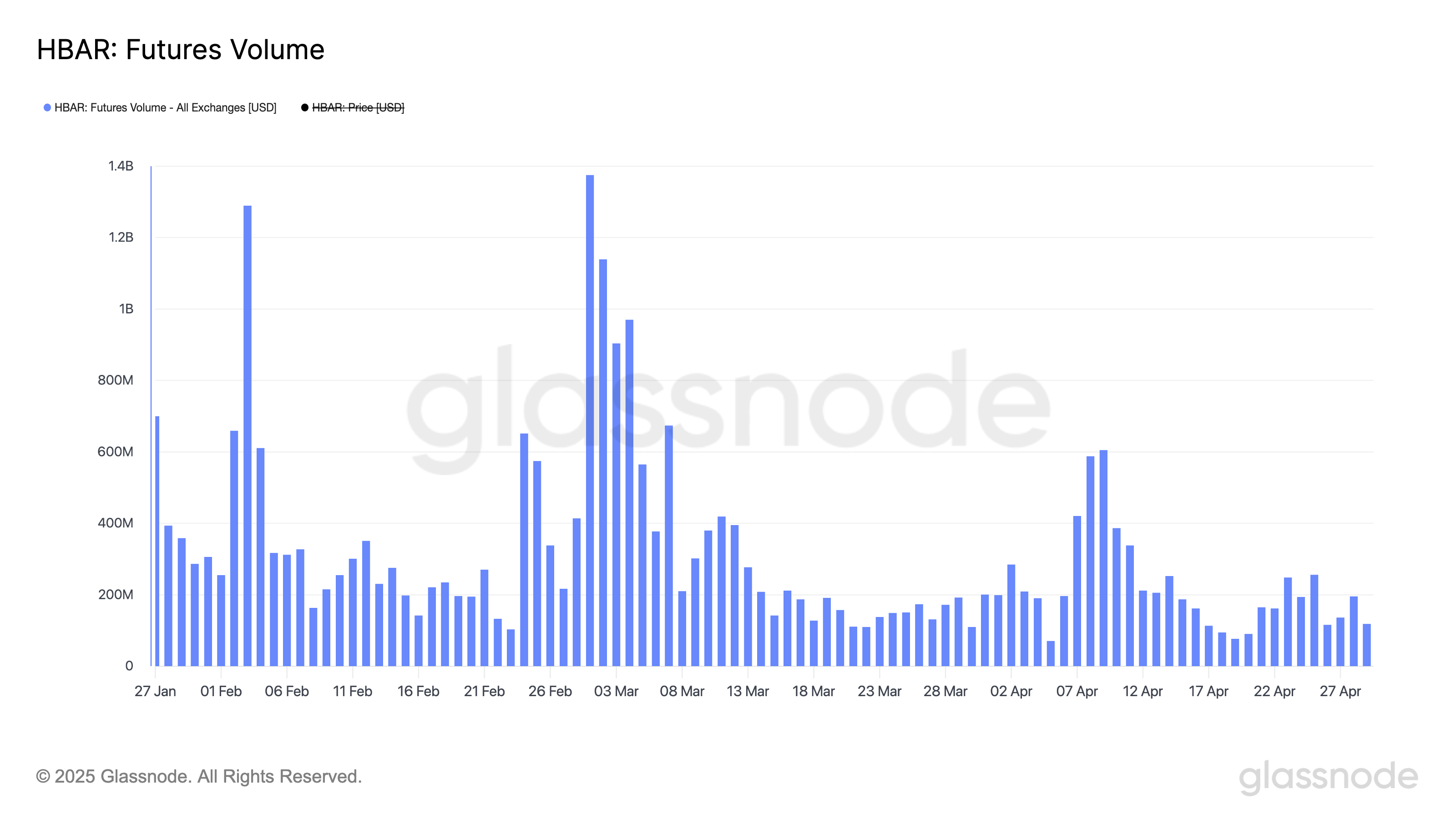

The once-thriving world of HBAR Futures has shrunk, leaving a quiet, empty space where speculation used to live. The volume is slumping, which is a nice way of saying that traders have mostly lost interest. A far cry from the good ol’ days of fevered trading.

The Once Thriving Futures Market Has Slowed to a Crawl

Currently, HBAR Futures volume has limped to a humble $118 million, a far cry from the recent pitiful low of $76 million on April 19. That was the day optimism took its last breath.

Earlier in the year, these numbers were marching to much higher beats, but that’s all in the past. March 1st saw a glorious $1.3 billion peak, but by mid-April, that had withered down to just under $300 million. It’s safe to say that traders have moved on to more exciting endeavors.

Futures, in case you’re wondering, are those fancy derivative contracts where traders bet on HBAR’s future price. It’s the high-stakes world where hedge funds and retail investors alike love to dabble. Now, it’s a quiet waiting room where only the brave—or the bored—linger.

With volumes dwindling, we’re left to wonder if HBAR’s price is now driven more by actual demand than leveraged bets. How quaint.

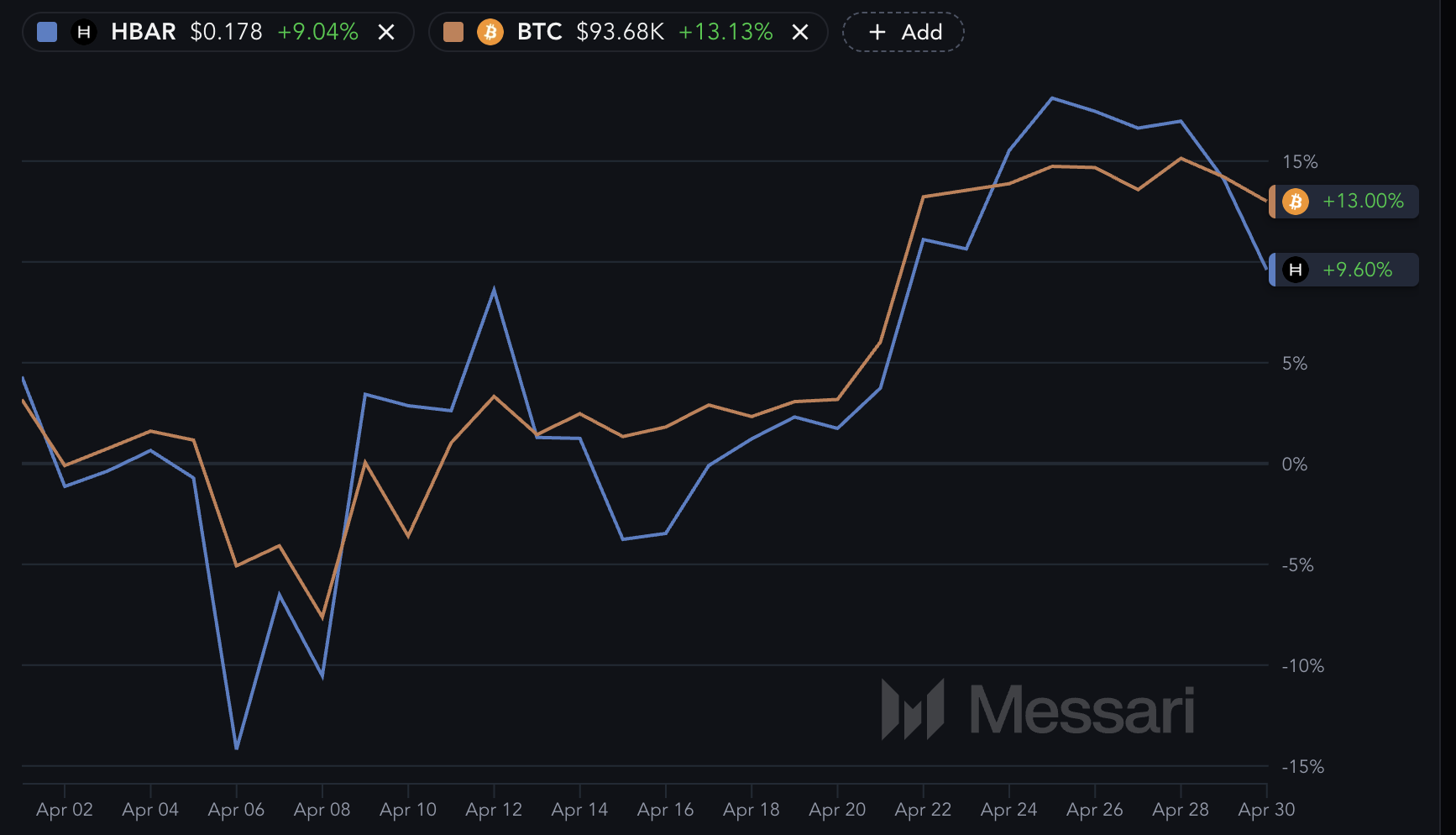

Bitcoin’s Party Could Drag HBAR Along – Or Not

HBAR has recently taken to mimicking Bitcoin’s every move like an overeager shadow. When Bitcoin rallies, HBAR surges with an almost unseemly enthusiasm; when Bitcoin takes a dive, HBAR plunges even harder. It’s like a rollercoaster where the only thrill is how fast it crashes.

Currently, Bitcoin is basking in the glow of a 13% rise over the last month, with the $100,000 mark looming ever closer. Should BTC punch through that barrier, HBAR could, theoretically, catch the wave and surge toward $0.40. Or, you know, it could just as easily implode if the technical support falls through the cracks.

The market sentiment around Bitcoin seems to be improving, with institutions inching back in, thanks to those enticing ETF inflows. Should Bitcoin break the $100,000 ceiling, expect a flurry of capital to spill into HBAR too. But let’s be real—HBAR’s fortunes are at the mercy of Bitcoin’s whims.

HBAR is basically the crypto equivalent of that one friend who insists on tagging along to every event, hoping to bask in the glory of the cool crowd—Bitcoin in this case.

Brace for May: Bullish Breakout or a Catastrophic Plunge?

As we edge into May, HBAR faces a brutal crossroad. On one hand, it could break through the resistance levels and soar—imagine a 123% gain to $0.40. But on the other hand, the market could flip the bird to HBAR and send it spiraling downwards like a falling piano.

To soar, HBAR needs to smash through key resistance points at $0.20, $0.258, $0.32, and $0.37—each of which has previously slammed the door in its face. Should it succeed, you might just see a fresh wave of excitement. Who knows?

But let’s not kid ourselves—there’s still a strong possibility of the dreaded ‘death cross’ hanging over HBAR’s head. If this bearish pattern takes hold, brace for a potential fall to $0.16, or if the mood turns really grim, $0.124. And don’t even ask about the worst-case scenario—it’s enough to make anyone’s stomach churn.

Read More

2025-05-01 02:04