The year 2025 did something cruel to Ethereum, boys. Like the rivers after a long drought, it saw its fortunes dry up—value slashed nearly in half, 46% vanished into the haunted fog, leaving investors muttering about failed ETFs while counting the cobwebs in their portfolios. And as if that weren’t enough, the biggest brains in the Ethereum Foundation argued circles around themselves, chewing over Vitalik Buterin’s new wild-eyed scheme to make the network run as smooth as a Delta breeze. But now—just as folks were preparing the funeral pyre—Ethereum’s itching to crawl back from the grave. Maybe the biggest comeback since Lazarus, maybe just fresh fertilizer for the market. Who can say?

Table of Contents

Ethereum could rise from the dead with three catalysts

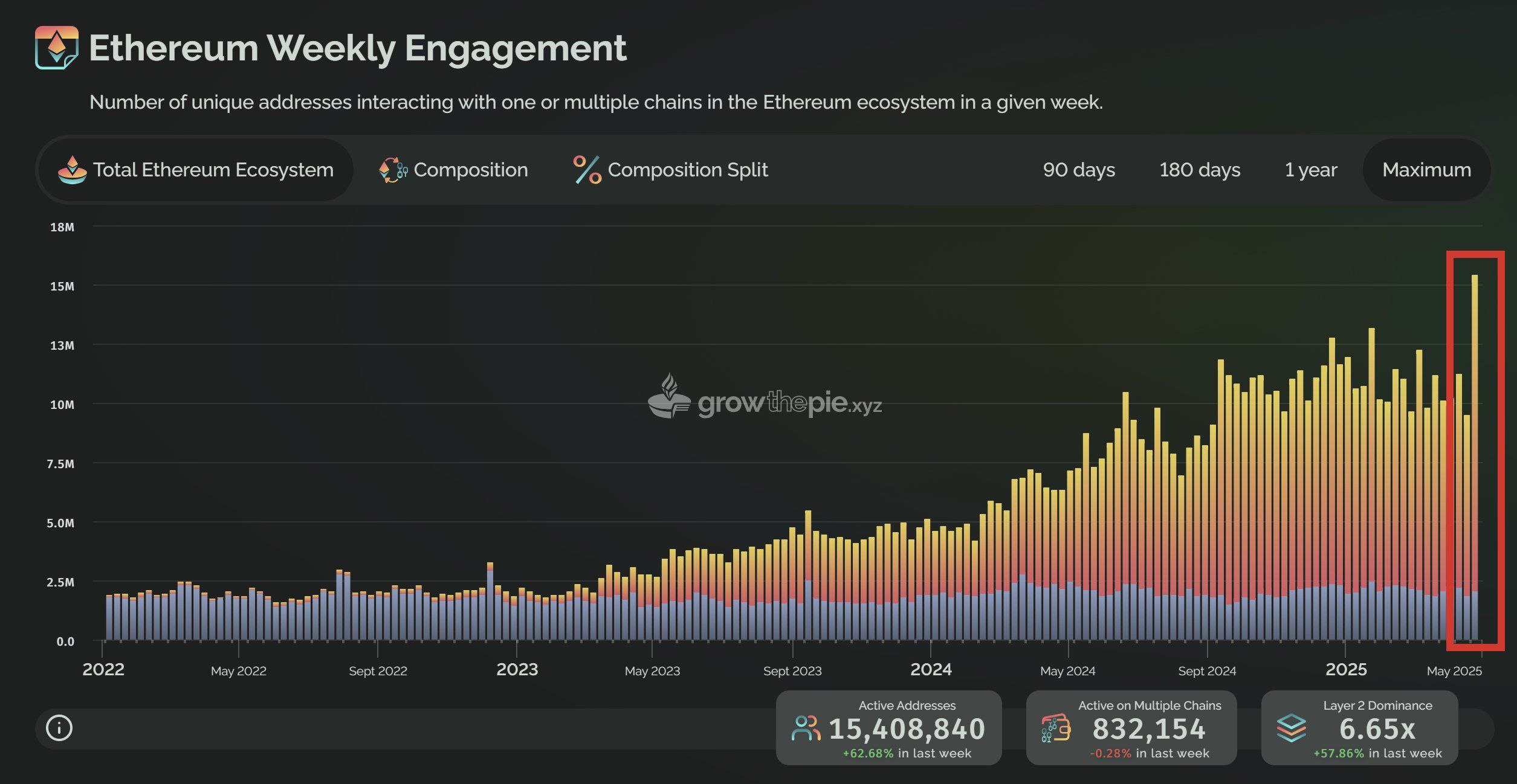

For four months, Ethereum (ETH) was like the old dog refused scraps at the back porch: relevance gone, revenue dried, new users passing by to try whatever shiny new thing Solana was serving up. But then, almost mysteriously, the number of unique addresses poking at the ETH ecosystem every week shot up—the analytics folks at Growthepie nearly fainted at an all-time high. 🧟

In one dizzy week, active addresses jumped 62%, Layer 2 dominance 57%, and the bean-counters whistled into their empty coffee mugs.

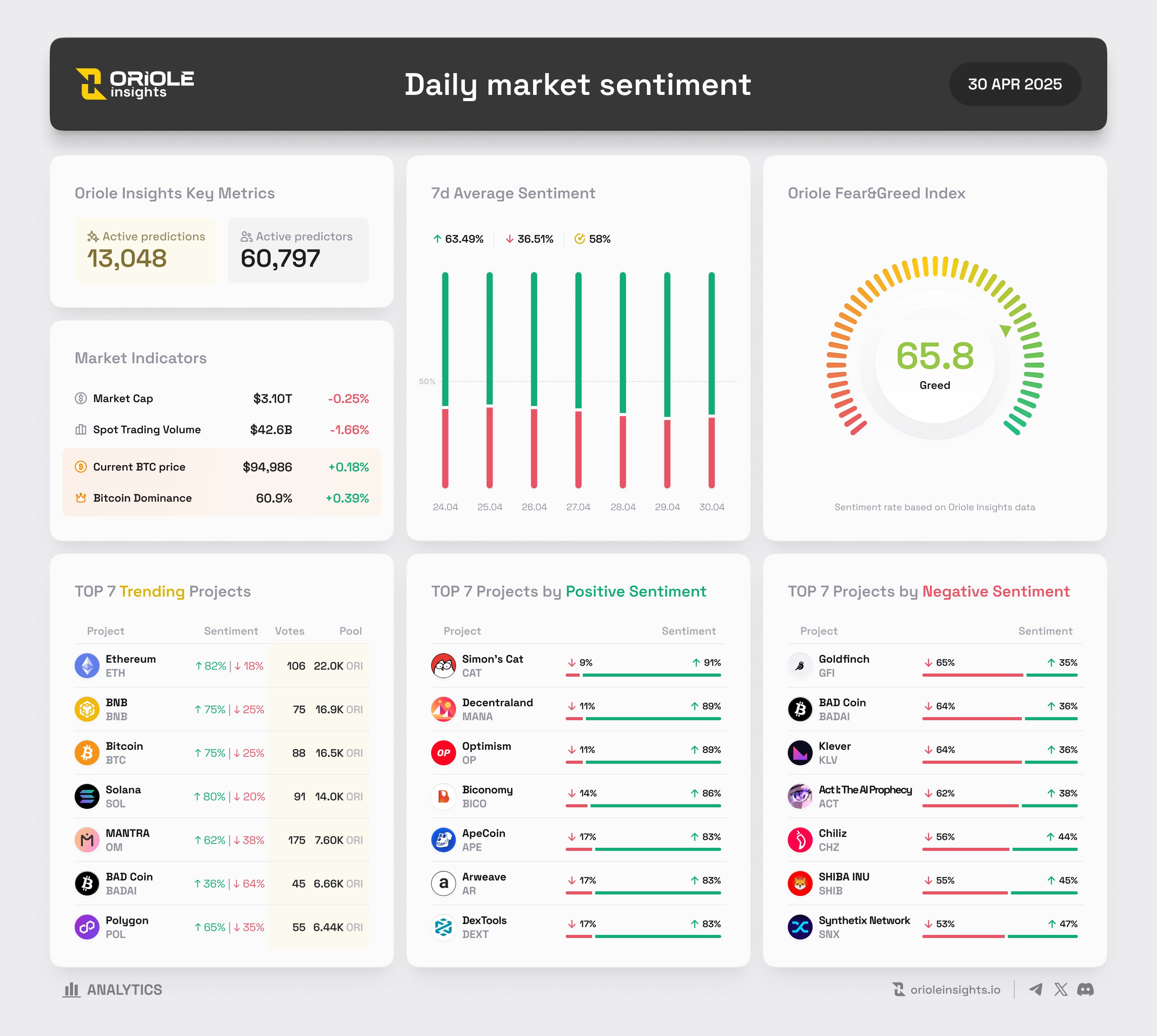

On a fine Wednesday—April 30, to be exact—Ethereum was finally the prom queen: 82% of traders lined up behind it, leaving Solana and Bitcoin scrambling for second place. The greedy bunch (with a “56” on the Oriole Insights greed-o-meter, which is apparently a real thing) charged in, bullish sentiment swelling like spring riverbanks.

After spending months underperforming just about anything with “coin” in its name, Ethereum’s getting back in the ring—thanks to some pep talks from Vitalik and a few Foundation shakeups. Maybe this is the resurrection, maybe just a twitch—meanwhile, Solana keeps luring away users and daily activity like some charismatic carnival barker. 🎪

The Foundation is doing something unthinkable: they’re betting it all on the token. Scaling L1, blobs (no comment), chasing user experience dreams. Maybe that’s what brings the crowds back, fills the coffers, and makes traders remember why they loved ETH in the first place. Or maybe it’s another round of hype and hope, served with a fresh side of memes.

Vitalik Buterin’s plan for Ethereum scalability

Somewhere in the spring, Vitalik Buterin—Ethereum’s answer to the absent-minded professor—wandered in with a new idea to boost scalability. The plan? Tweak the execution layer so it stops choking — like giving an old tractor a shot of whiskey and hoping it runs smoother. He swears the changes will barely ruffle the feathers of devs building on-chain, promising the transition will be as subtle as a breeze on the prairie (which is code for “we hope nobody notices if it explodes”).

Meanwhile, the ETH crowd—equal parts techno-optimist and chronic worrier—argues about whether this is the tonic that brings ETH back to relevance, or just one more rabbit out of an increasingly empty hat. 🐇

Ethereum v. Solana

This is the rivalry you didn’t know you needed: Ethereum versus Solana. Over on the Dune analytics boards, Solana is busy lapping Ethereum so fast it’s probably considering a pit stop out of pity. Four times the transactions, three times the active addresses—somebody pour Ethereum a Gatorade. 🚴♂️

SOL’s got a near $30 billion lead in DEX volume, active addresses multiplying like speculative rabbits, and somewhere, Ethereum is trying to remember where it left its mojo. The gap is now wide enough you could drive a truck full of failed stablecoins through it, monthly stats showing just how much catch-up ETH needs to play if it wants to top Solana and reclaim some dignity in the world of decentralized this-and-that.

The month-on-month comparisons are a cold reminder: Ethereum better get moving or risk being remembered as the friend who used to be cool (back before Solana showed up to the party).

Five burning questions and Ethereum’s future

What does BlackRock’s $150 billion deal mean for the future of Ethereum?

BlackRock—Wall Street’s closest thing to a money plant—has a $150 billion Treasury Trust Fund and a brand new share class that will use Ethereum’s magical pipes. The ETH crowd treats this as gospel, imagining fat years ahead and the kind of institutional love usually reserved for Bitcoin.

With BNY Mellon piping the cash and everyone muttering wise words about “tokenization,” ETH might just catch a windfall. Or as they say on Wall Street: “Don’t count those chickens before they tokenize themselves.” 🐣

Will Ethereum ETFs catch up with Bitcoin?

Farside Investors peek at the flows: for five whole days, U.S. spot ETH ETFs enjoyed a green parade—except April 30, when things got ugly and they lost $2.3 million. Still, $2.5 billion in the kitty over fifteen days is nothing to sneeze at (unless you’re Bitcoin, which did that before breakfast).

ETH still has its nose pressed against the Bitcoin bakery window, but at least it’s back in line. Second quarter’s heating up; maybe it’s time for that underdog montage.

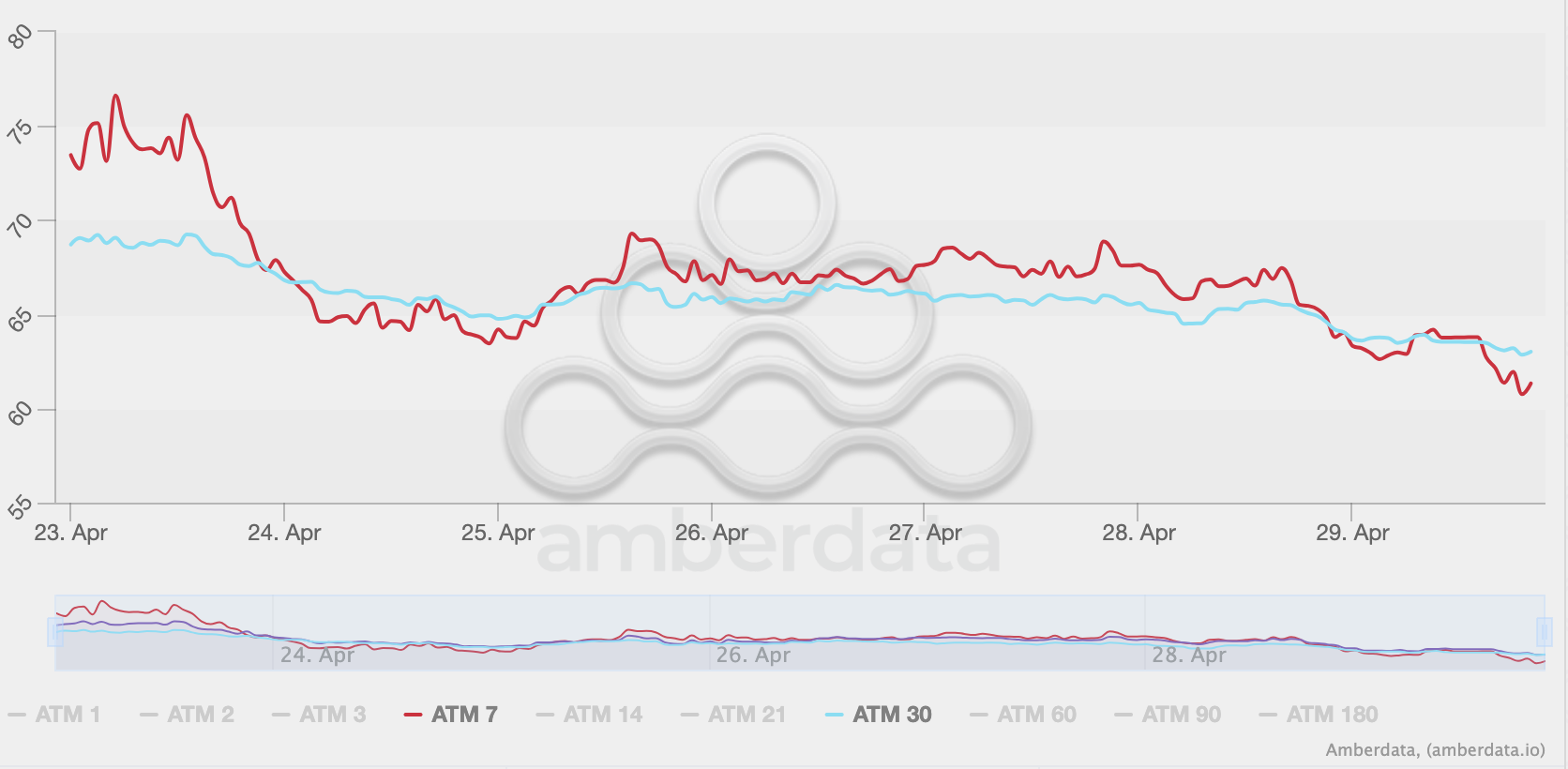

What does derivatives data show for the future of Ethereum?

Coinglass reports the options gamblers are busy—volumes rising, open interest climbing. Even if the longs and shorts can’t agree on brunch, open interest is up $3 billion since April 9. If the crowd is right, that’s bullish. If not, well—they’ll just write new derivatives and start over.

Will Ethereum price climb in the short-term?

On Derive.xyz, the optimism is thicker than grandma’s gravy. Four times more calls than puts—the sort of odds you’d see before the first fall harvest (and about as reliable). They put ETH odds at a rally above $2,300 by May 30 at 9%. That’s not a typo. Odds of falling under $1,600 at 21%. The rest is pure indecision dressed up with charts and jargon.

Options traders spend 81.8% of their premiums buying calls. If hope were a currency, they’d all be rich by now.

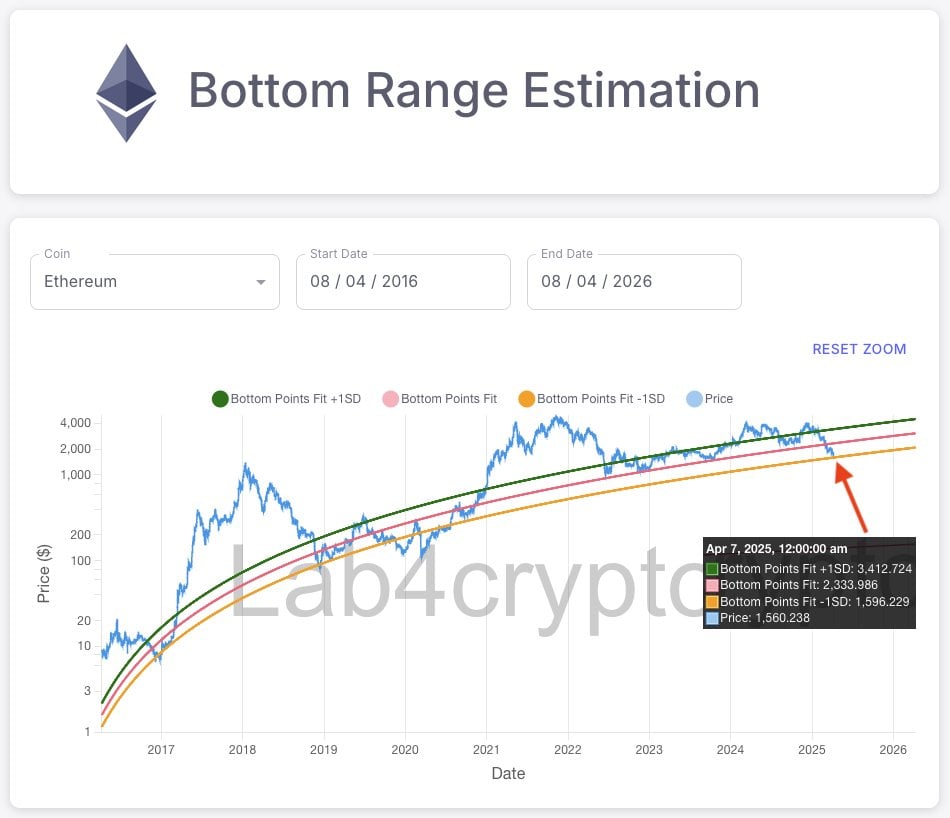

Has Ethereum price hit a cycle bottom?

Lab4Crypto declares a -1SD line has appeared—whatever that means to the common folk— and chart wizards everywhere hint at a bottom for ETH. Last time this number hit, buyers came crawling out from underneath their piles of rejected altcoins, ready to dollar-cost-average like heroes in a cheap Western. ETH touched this magical -1SD on April 8. Buy signal? Bug? Who knows. 🤷

Ethereum price prediction

Here’s the straight talk: ETH could jump 11%, test the upper edge of the “Fair Value Gap” at $2,000, and maybe—just maybe—run back to the $3,000 marker if the stars align and the coffee’s strong enough. Both the RSI and MACD technical gizmos are flashing green, so the crowd is whispering “bullish” in the saloon corners.

RSI reads 55, apparently good but not the kind of thing you’d engrave on a trophy. MACD’s showing green candles—bullish! Again! Still, if Bitcoin sneezes or the market gets spooked, ETH might have to revisit $1,658 and apologize for getting ahead of itself.

So, is Ethereum coming back for revenge, redemption, or just comic relief? Place your bets, keep your hands on your wallet, and maybe—just maybe—don’t let Vitalik drive the tractor this time. 🚜

Read More

- Ludus promo codes (April 2025)

- DEEP PREDICTION. DEEP cryptocurrency

- Mini Heroes Magic Throne tier list

- ZEREBRO PREDICTION. ZEREBRO cryptocurrency

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Fortress Saga tier list – Ranking every hero

- Grimguard Tactics tier list – Ranking the main classes

- Maiden Academy tier list

- CXT PREDICTION. CXT cryptocurrency

- The Mr Rabbit Magic Show is a new, completely free, and macabre creation from Rusty Lake

2025-05-01 21:56