For those anxious about excessive prudence in asset management, Tether’s Q1 2025 Attestation Report offers some comfort. In a display of monetary zeal reminiscent of a nouveau riche peer, the firm procured a dazzling $65 billion in US Treasury bonds between the start of January and the last, weary gasp of March.

Throughout its semi-grandiloquent report, Tether congratulates itself on orchestrating global US dollar flows, confidently referring to its beloved USDT as “the leading digital representation” of the currency—because any less would be common. Incidentally, over 80% of its empire now consists of Treasury bonds, proving that perhaps the true stablecoin is ennui.

Why Is Tether Acquiring Enough T-Bills to Start Its Own Country?

Back when Tether unveiled its Q4 2024 Attestation Report, the haul of US Treasury bonds languished at a feeble $33 billion. (One shudders at the austerity.)

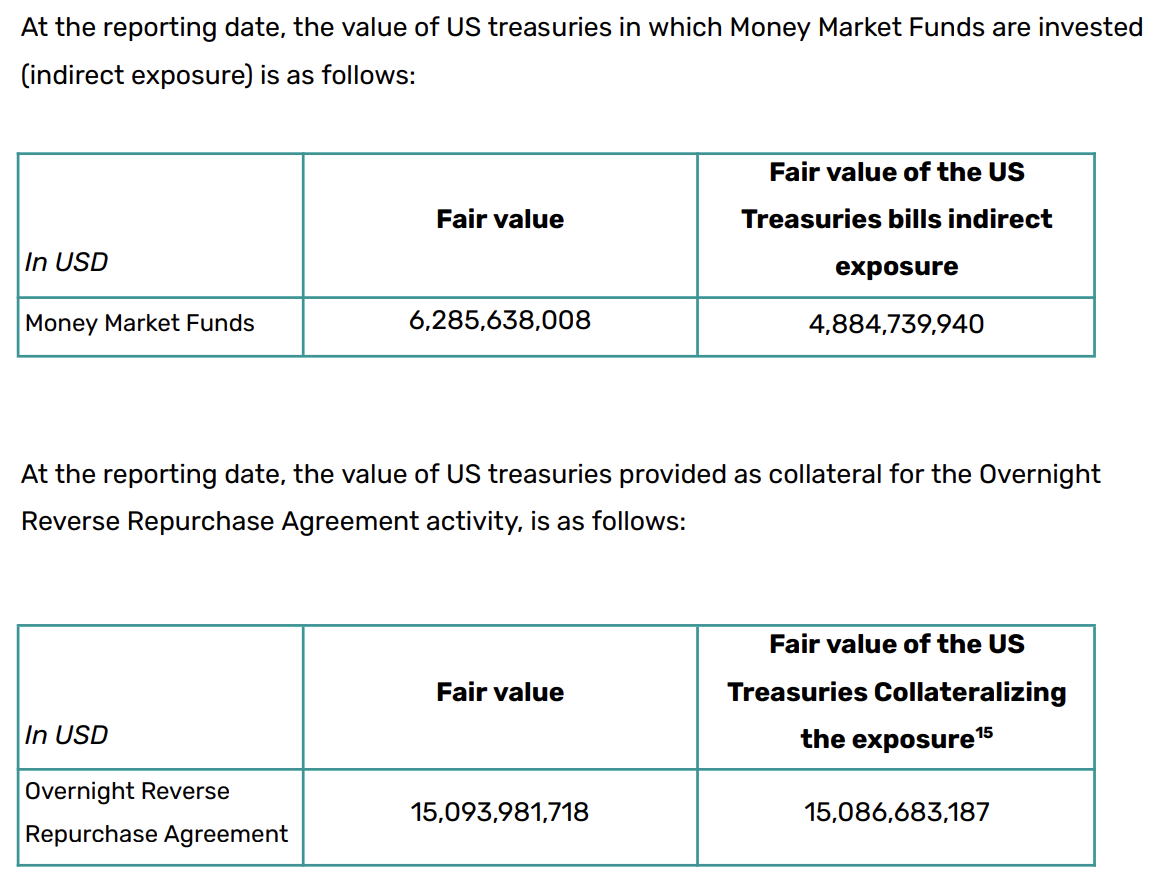

But a quarter is a long time in stablecoinland. As of March’s unremarkable conclusion, Tether had amassed $98.5 billion in Treasury bonds—enough to make several small Balkan states reconsider their life choices—with an additional $21.3 billion on the side, perhaps for dessert.

The company now claims $149.2 billion in total assets—undoubtedly a sum best appreciated with a monocle. A mere $7 billion rests in BTC, presumably for sentimental reasons or perhaps to avoid upsetting Bitcoiners at dinner parties.

For those keeping score, rumor mills were abuzz with whispers that Tether would unceremoniously abandon Bitcoin to mollify US regulatory cravings, and behold, reality obliged. If regulations pass, Tether will be required to cram even more reserves into Treasury bonds. Luckily for all, it’s been they-are-already-doing-that levels of compliant.

The firm has, as the Americans say, pivoted. President Trump, never one to miss a dramatic entrance, recently piped up about stablecoins championing US dollar dominance. Whether Tether is genuine or simply delighted to be noticed in such company is anyone’s guess.

The report, with all the delicacy of a bull in a tea shop, refers at least five times to “Tether’s growing role in distributing dollar-denominated liquidity” and its heroic crusade to “support the global relevance of the US dollar in a rapidly evolving economy.” If you hear faint sounds of a bugle, do not be alarmed.

USDT, the firm boasts, is “the leading digital representation of the US dollar”—much as one might be “the leading imitation crab meat.” CEO Paolo Ardoino, in a moment of feverish oratory, added:

“Our mission is clear: to responsibly and compliantly power the digital economy and strengthen the role of the US dollar on the global stage,” he declared, before presumably retiring to his study and a stiff drink.

If Tether aspires to become the cardinal force in international finance, its arsenal of US Treasury notes rather overshoots the mark. With holdings that dwarf most national budgets, the company could, by accident or design, make central bankers reach for their stress balls.

For now, expect Tether’s hungry, irrepressible ventures in the US market to expand further, provided officials can keep up, and Bitcoin maximalists can keep calm. 🕴️💸

Read More

- Castle Duels tier list – Best Legendary and Epic cards

- CRK Boss Rush guide – Best cookies for each stage of the event

- AOC 25G42E Gaming Monitor – Our Review

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Fortress Saga tier list – Ranking every hero

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

- Outerplane tier list and reroll guide

- Call of Antia tier list of best heroes

- Ludus promo codes (April 2025)

2025-05-01 22:52