In a week awash with folly and fleeting optimism, the cryptoverse offered us its usual cocktail of bluster, bafflement, and slightly suspect hope. Bitcoin and XRP, those titans of digital fancy, took center stage, smug and exasperating as ever.

Were you more gainfully employed—or simply too sensible—to tune in? Fear not: here is the week’s crypto gossip, distilled for maximum amusement.

Bitcoin’s Run at $97,000: The Gatsby of Crypto

To begin our tale, consider Bitcoin’s valiant (if melodramatic) dash to the $97,000 summit. Our hero last graced these heights in February of 2025, only to swoon back to $96,731—rather like a debutante with weak ankles at her first ball.

Bitcoin, never one to shy from theatrical fluctuations, endured President Trump’s tariffs with the stoicism of a British boarding school boy forced to eat cold porridge. Markets wobbled, rumors wafted, and—significantly—Bitcoin positioned itself as a hedge against TradFi foibles and jittery US Treasuries. Wall Street’s luminaries poured into Bitcoin ETFs, leaving Gold ETPs to gather dust (and perhaps a Sigmund Freud-themed coin, at this point).

Sui and Pokémon: NFTs, Privacy Policies, and Childlike Wonder

The Sui blockchain sought its place in the sun, abetted by Pokémon rumors so fevered the SUI token ballooned 60%. The internet, equipped with an industry-standard tinfoil hat, noticed that Parasol Technologies—a recent Mysten Labs acquisition—surfaced in a Pokémon HOME privacy policy. Cue: wild speculation and more tinfoil.

Alas, a sheepish clarifying edit followed. The SUI party lost a little steam, but—like any good ghost story—suspicions and SUI price volatility lingered long after the facts had toddled off to bed.

“The Sui Foundation hastily deleted all traces of Pokémon NFTs. Cue gasps, whispers, fainting in the corridors. Blockchain to patch bugs and dupe exploits, but not—alas—not to resurrect your old Pokémon Red save,” quipped a particularly sprightly observer.

Whisper it, but rumor-mongering persists; perhaps Parasol will yet teach Pikachu how to hodl.

SUI retreated a modest 3%, trading with the melancholic dignity of a moon-landing conspiracy theorist fresh from a debunking. Current price: $3.47 (Poké Balls not included).

ProShares XRP ETF: Hope, Derision, and Another Letdown

Amid echoes of confetti cannons, rumors insisted that the august SEC had green-lit a ProShares XRP ETF. Said rumors, stamped out by BeInCrypto and an earnest ETF analyst, proved about as reliable as a weather forecast in the Sahara: the actual approval was for leveraged and short futures ETFs. XRP spot ETF? Keep dreaming, folks.

“Reports of ProShares launching XRP ETFs on April 30th are premature. Launch date? Still anyone’s guess. Like the Loch Ness Monster, we see only occasional ripples,” confirmed ETF analyst James Seyffart, presumably shaking his head in weary bemusement.

Still, ProShares gamely introduced Ultra XRP ETF, Short XRP ETF, and Ultra Short XRP ETF. Because in crypto, the prefix “Ultra” works like a magic spell… or a dodgy supplement in a Victorian pharmacy.

From Futures to Fantasies: The XRP Optimism Machine

The not-quite-a-thing ProShares XRP futures ETF nonetheless sent the community into paroxysms of optimism, dreaming of a spot ETF and rivers of institutional cash. Armando Pantoja threw gas on the fire, opining that XRP would soon be awash with $100 billion—a figure no doubt calculated somewhere between tea leaves and tarot cards.

“A spot XRP ETF will change everything. Real demand! Price rockets! Champagne for all!” Armando probably said, while imagining Peter Schiff crying into a pillow.

Wall Street, never one to resist a shiny new bauble, flirted openly with XRP, even as more sober analysts pointed out that this was not, in fact, the messianic moment some had prophesied.

“Let us not confuse a futures ETF with actual world-changing innovation. It’s not the holy grail. That, my dear friends, awaits the spot ETF,” was the more withering assessment of John Squire, who has almost certainly seen it all and lived to deliver the punchline.

SEC Delays: Bureaucratic Pantomime at Its Finest

Not wanting to be left out, the SEC decided to move, well, even slower. It delayed a decision on the XRP ETF until June 17—leaving crypto enthusiasts to gossip about XRP, Dogecoin, and Ethereum staking ETFs over tea and mild expletives.

“All these deadlines are mere suggestions, really. Final decisions for most crypto ETPs are now a Q4 affair. If the SEC finds a sense of urgency lying around, perhaps mid-October will bring certainty—or, at the very least, a slightly different flavor of dithering,” Seyffart explained, perhaps while idly doodling clocks on a napkin.

As it stands, over 70 ETF proposals languish on the SEC’s to-do list. XRP ETF’s June deadline? Hardly written in stone; mid-October beckons for another round of bureaucratic hopscotch.

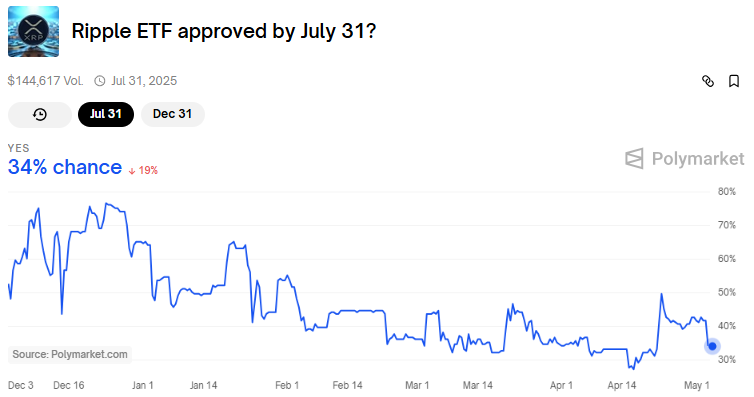

Bettors on Polymarket assign a 34% probability of approval by July 31—roughly the odds of a sensible haircut at an NFT conference. By December 31, confidence leaps to 79% (spurred, perhaps, by festive spirits).

And so, as always, we are left precisely where we began: bemused, expectant, and rather none the richer. 🥂🚀

Read More

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Hero Tale best builds – One for melee, one for ranged characters

- Gold Rate Forecast

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Castle Duels tier list – Best Legendary and Epic cards

- EUR CNY PREDICTION

- Mini Heroes Magic Throne tier list

- 9 Most Underrated Jeff Goldblum Movies

- USD CNY PREDICTION

- Jerry Trainor Details How He Went “Nuclear” to Land Crazy Steve Role on ‘Drake & Josh’

2025-05-02 14:18