Once again, dear reader, Bitcoin floundered between $94,089 and $94,305 in an hour fit only for gamblers and melancholic philosophers. Its market cap, a figure so large it may as well be the GDP of a small, stubbornly corrupt European kingdom, stands at $1.86 trillion. As for the daily trading volume, it scraped together $19.74 billion—enough, perhaps, to purchase the hopes and dreams of every late-night crypto YouTuber. The day’s price, confined like a tragic hero, ranged mournfully from $93,806 to $95,741.

Bitcoin

On the 1-hour chart—oh, that cruel hour—Bitcoin displays a downtrend, stubborn and unrelenting, as if even the bulls themselves are occupied elsewhere, perhaps composing mournful balalaika music. Lower highs, lower lows; each candle a quiet confession. One cannot ignore the red volume spike at $93,550, a warning flare, a glass shattered in the quiet of a Petersburg evening: sellers have seized the stage, and buyers retreat, possibly to await better weather or a new government. Channel? Bear flag? Call it what you will. Should we descend beneath $93,550, pack up your optimism and send it home to its mother. But if, by some miracle, $95,000 is reclaimed on robust volume, perhaps the curtain will rise on a new act. Unlikely, but hope, much like a persistent mother-in-law, rarely takes hints.

Roll back the clock to the four-hour chart, and the situation appears even more dire—if your idea of fun is watching a slow-motion train wreck in financial form. Each microstructure another weary sigh, lower highs and lows like the mood of the Russian countryside after a particularly unkind winter. The $92,846 support mocks us—should it fall, bids might drop to $90,000, a number round enough to comfort only numerologists. As for resistance, the region between $96,500 and $97,000 is an unyielding bureaucrat—every attempt at persuasion rejected with the coldest form letter. The volume surge from May 4 to May 5? Possibly institutions, possibly panic, but certainly not hope.

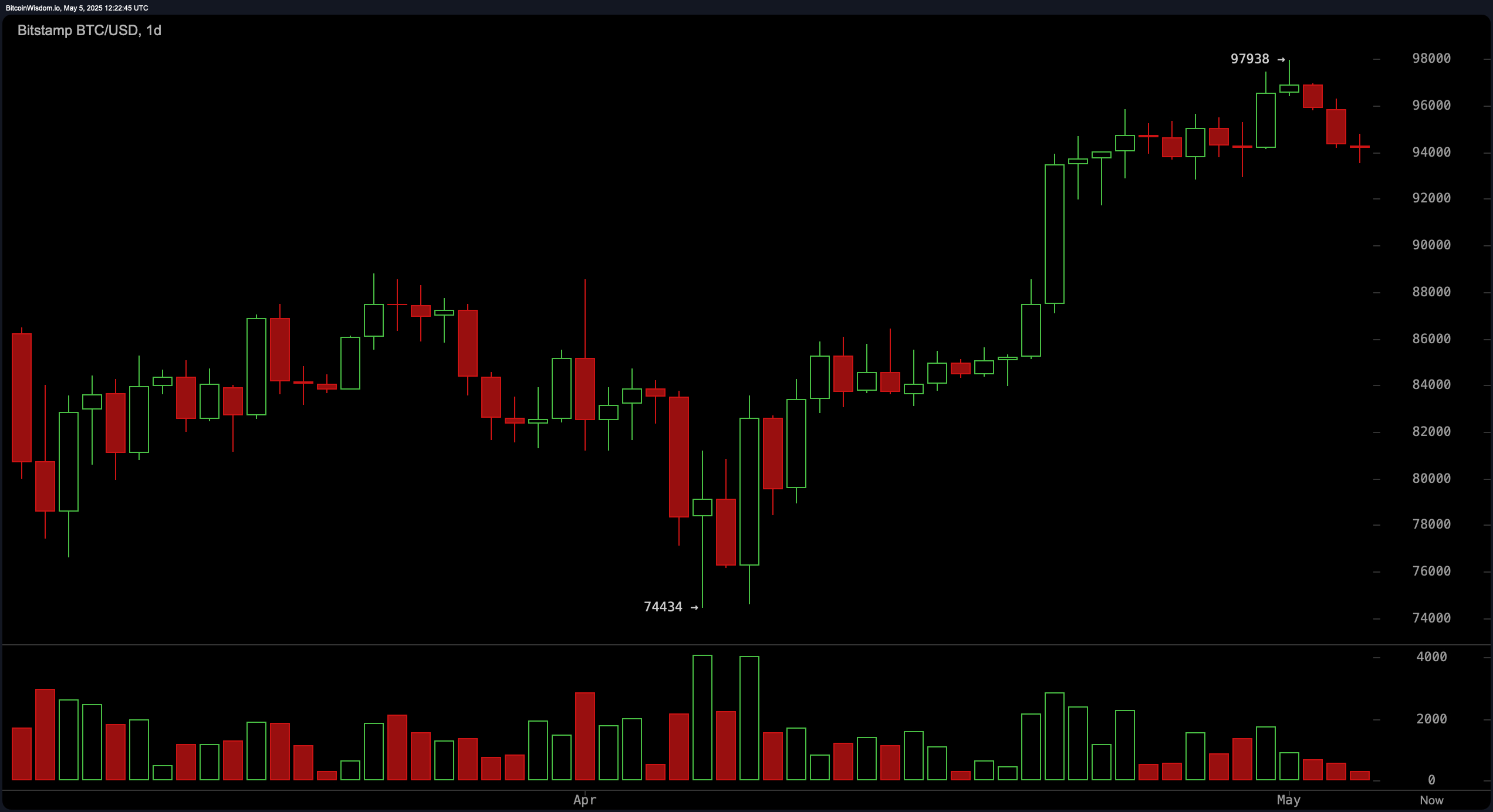

On the daily ledger, Bitcoin seems to have left its resolve at some forgotten train station. After a brief foray near $97,938, it faces a wall of rejection—like a poet denied publication, but with more charts and fewer romantic missives. Red candles multiply; green candles, when they emerge, are so thin they might be mistaken for hope itself. Volume tells a melodramatic story—buyers whisper, sellers shout. Support clings around $93,000 to $94,000, but if these trenches fail, a deeper retreat is all but assured. Such is the life of a digital currency on a bender.

Momentum indicators yawn in indifference, neither bullish nor bearish, simply tired—like the countryside after a spring thaw that didn’t deliver. RSI at 60, Stochastic at 74, CCI at 42: these, my friend, are the numbers of a market that has taken to staring out the window and sighing. The ADX at 30, as decisive as an indecisive lover. The Awesome oscillator does little except look confused (8,029), and momentum has thrown in the towel (−525). Only the MACD at 2,748 whispers promises of bullish afterglow, as sincere as a city official at a ribbon-cutting.

Moving averages (MAs)? A study in contradiction. The 10-period EMA and SMA (94,352 and 94,984 respectively) have surrendered their optimism—but lo!—the 20-period and above rally to the bull’s cause, with the 200-period EMAs and SMAs (rounding out their numbers like old men gathered around a chessboard) standing firm at 86,298 and 90,411. Here the eternal struggle between short-term despair and long-term hope plays out, one tragicomic candle at a time.

Bull Verdict:

Should Bitcoin, through sheer grit or accidental grace, maintain the $93,000–$94,000 trenches, and stage a grand return to $95,000 with volume worthy of a Dostoyevsky narrative, then perhaps, just perhaps, the $96,500–$97,000 ceiling will finally bear weight. With allies in the form of long-term moving averages and a solitary hopeful MACD, we may yet toast to $98,000. Or not. Most likely not. But let’s dream together, shall we? 🥂

Bear Verdict:

Failing all that, with a breach beneath $92,846 and the kind of volume that would terrify even the most emboldened tea-leaf reader, Bitcoin may plummet to $91,000 or $90,000. In this scenario, every chart and oscillator sings the same melancholy tune, and hope itself is given the day off. Break out the vodka and black bread, comrades: the downtrend marches on. 🐻

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Mini Heroes Magic Throne tier list

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- Hero Tale best builds – One for melee, one for ranged characters

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Cat Fantasy tier list

- XTER PREDICTION. XTER cryptocurrency

2025-05-05 16:33