- Some highly mysterious creatures known as “whales” have yanked 110,000 BTC off the exchanges—either because they’re stockpiling for an imminent moon landing or possibly they just lost their wallets. Either way, the market is twitching nervously.

- Traders have stacked up $496 million in longs near $102.8K and $319 million in shorts near $104.8K—suggesting more optimism than a Vogon at a poetry slam, but with slightly higher stakes.

Bitcoin [BTC], the top dog of the cryptocurrency universe (and the likely cause of many ruined dinners), is once again wagging the market around like a hyperactive labrador chasing a stick made of pure existential dread.

Apparently, this latest bout of enthusiasm is thanks to whale activity—yes, not those singing ocean mammals, but shadowy financial creatures who move more money in a day than most people see in several disappointing lifetimes.

Whales withdrew 110,000 BTC, or: How I Learned to Stop Worrying and Love Volatility

Ever since Bitcoin started “bleeding” (a technical term meaning “people everywhere shouting into monitors”), whales and other crypto titans leapt in, buying the dip like it was the last Black Friday deal on the planet.

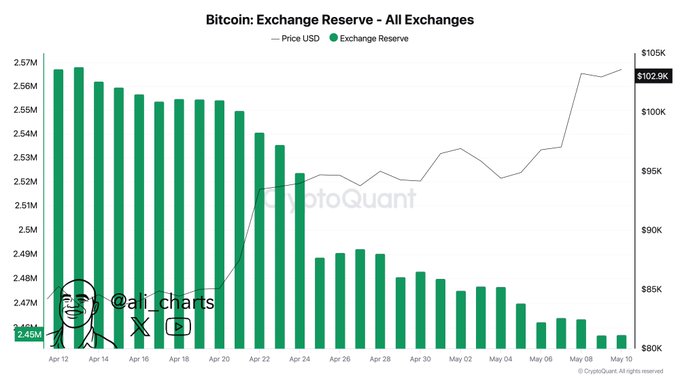

One crypto guru—who may or may not live entirely on Twitter—unearthed data: in the last month, these creatures spirited away over 110,000 BTC from exchanges. Presumably into cold storage, or perhaps just under a really big mattress.

The result: immense “accumulation”, a word that here means “someone else is buying and now you probably want to, too.” As a result, buying pressure cranked up, and BTC prices did what they always do—surged, slumped, and gave everyone a headache.

But wait (cue mysterious synth music)—the whales did not stop there. No, in the past 48 hours, they managed to scarf up an additional 20,000 BTC. Because moderation is for fiat currencies.

Such relentless binge-accumulation signals that whales either have enormous faith in Bitcoin’s future… or they just like playing extremely expensive practical jokes.

Retailers Least Participation, a.k.a. Where Did Everyone Go?

The average retail punter, meanwhile, has been a no-show, possibly fleeing for the comforting simplicity of scratch cards. Many sold in a panic—proving once again that “hodl” is easier said than done, especially when your retirement fund looks like a rollercoaster mid-loop.

Analysts suggest this is normal. Retail swarms in when the price is so high a new all-time high seems inevitable, but not when things are recovering, correcting, or generally behaving like an unruly toddler in a supermarket.

With BTC just a hop, skip, and a jump (about 5%) below its previous apotheosis, the lack of retail froth may actually be… calming. Or possibly just the calm before the FOMO storm. Stay tuned!

$500 Million Plonked Down on Bullish Bets—Trader Optimism or Mass Delusion?

Traders apparently had a meeting and decided to pile up on leverage, because what could possibly go wrong? At $102,819 (aka “Support” for those who enjoy market jargon), nearly half a billion dollars worth of longs have been built, with shorts straining at $104,871 (“Resistance”—or as some call it, “the wall against which dreams break”).

This proves that bulls are currently running the show, at least until the bears return from their nap or margin calls spike. Hopes are high (literally), as long as $102,819 support holds and the memes remain bullish.

As of the last check, BTC was hovering around $104,300—up 0.75% in 24 hours (enough to make you giddy if you own a small country’s worth of it). However, trading volume dipped 7%, suggesting that even degens need a coffee break now and then.

Bitcoin Price Action & Technical Analysis (Or: Why Charts Mean Everything Until They Don’t)

AMBCrypto’s technical divinations hint at bullish momentum carrying Bitcoin toward resistance at $106,800—a number with all the mystique of a Douglas Adams trilogy minus a shoe.

Should the price break through, we might well see a new all-time high, at which point everyone will forget last week’s panic and issue new price targets with all the certainty of a horoscope columnist.

But beware: the Relative Strength Index (RSI) currently sits at 74—well into “overbought” territory. In layman’s terms, this is right around where the market turns into a Monty Python scene and lobs a correction at the smug and the overexposed alike.

Will BTC break out or break down? The only certainty: whatever happens, someone will say, “I told you so.” 🛸

Read More

- DEEP PREDICTION. DEEP cryptocurrency

- CRK Boss Rush guide – Best cookies for each stage of the event

- Ludus promo codes (April 2025)

- Summoners Kingdom: Goddess tier list and a reroll guide

- Mini Heroes Magic Throne tier list

- Maiden Academy tier list

- CXT PREDICTION. CXT cryptocurrency

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

- ORDI PREDICTION. ORDI cryptocurrency

- Outerplane tier list and reroll guide

2025-05-12 00:31