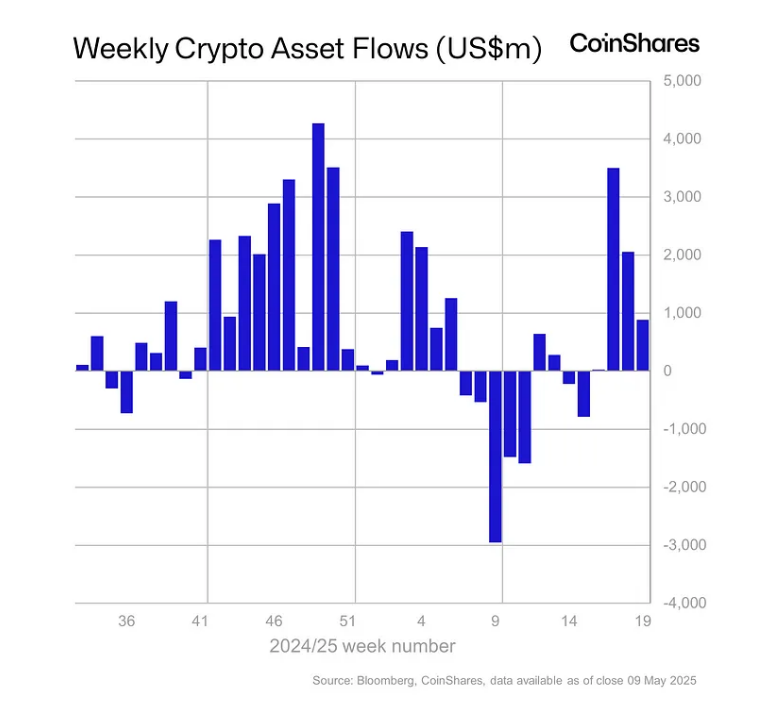

Last week, dear reader, brought on a display of affluence most unbecoming in its magnitude, as if all the gentlemen speculators in England had suddenly tossed aside their pocketbooks and, with an air of wild abandon, plunged their wealth into these notorious “crypto funds.” As reported by the estimable CoinShares (whose reliability, one trusts, does not quite match that of a gossipy aunt), no less than $880 million sashayed into such investments over seven turbulent days. Year-to-date inflows surge to $6.7 billion. It seems the gentlemen and ladies of fortune are swept up in the fever, what with Bitcoin having flirted with the grand sum of $105,000 (one blushes to repeat such figures) and Ethereum, ever the wallflower, catching timid glances above $2,600. The suitors gather at the ball, eager to claim their dance before the orchestra ceases to play.

Fortune’s Favoured Fad Persists

The facts, though rather in want of refinement, suggest another $882 million found its way into the coffers of these funds over the week—four consecutive weeks of impassioned, perhaps imprudent, devotion. The broader markets may not quiver in their bonnets, but money, like a relentless suitor, persists in knocking.

A lady—or indeed, a fund manager—might boast of $6.7 billion raked in so far this year, an amount sufficient to ensure many an uncomfortable silence at a dinner party, should anyone attempt to outdo it.

Bitcoin: The Darcy of Digital Assets

Of all the coins in the kingdom, Bitcoin is most ardently admired; it captured $867 million last week, with American ETFs playing the part of Lady Catherine’s estate—graciously towering above the rest. Since January 2024, these ETFs have played host to nearly $63 billion, passing even their previous best, like Mrs. Bennet’s nerves after a successful ball. Poor Ethereum, consigned to the side parlour, welcomed a mere $1.5 million. The message is clear: society, ever wary, still places its affections with the eldest son.

Sui, an upstart with all the impertinence of a second cousin’s debutante daughter, managed to steal $11.7 million in but a single week—outperforming even Solana and Ethereum during this small but lively gathering. Sui’s year stands at $84 million, barely ahead of Solana’s rather gentlemanly $76 million.

XRP, meanwhile, is content to collect $1.4 million in weekly affections, standing at $258 million for the year and presiding regally over $1.35 billion of assets—a fortune that surely would tempt even the most staid of clergymen. Other altcoins, not wishing to overburden themselves with the vulgarity of wealth, make only minor moves; the ton, it appears, is selective in its passions.

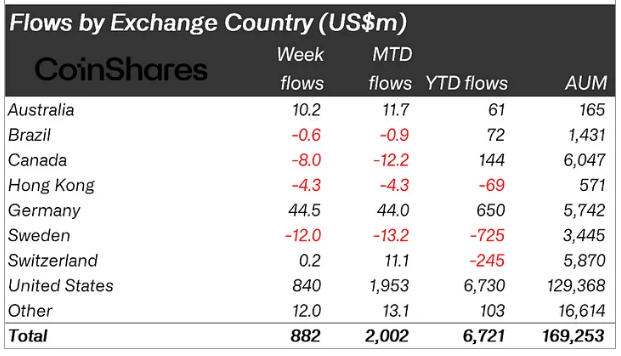

Across the globe, the United States, in typical style, dominates the proceedings—$840 million found itself at home on those shores. Germany looked on, somewhat abashed at its $44 million, while Australia barely managed an entrance with $10 million. Alas, poor Sweden nearly cleared the dance floor, with $12 million tripping out the door.

Hong Kong, ever mercurial, misplaced $8 million, while Canada’s $4.3 million slinked away quietly (perhaps in search of better refreshments). The American market, led by BlackRock and its iShares Bitcoin ETF, is still master of ceremonies, having welcomed over $1 billion last week. Nonetheless, for every grand arrival, there stood Grayscale and Bitwise with $257 million in outflows, delivering the sort of plot twist usually reserved for the third act of a country house novel.

Underlying all this commotion are the eternal verities: money, policy, and the wise (or desperate) attempts to hedge one’s fortunes against slow growth and high inflation. As M2 money supply grows ever more plump (one suspects it has been partaking of far too many tea cakes), some lords and ladies are seeking solace in crypto—if not happily ever after, at least happily for the time being.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Cat Fantasy tier list

- Overwatch Stadium Tier List: All Heroes Ranked

- EUR CNY PREDICTION

2025-05-13 17:01