Somewhere between the cursed streets of Moscow and the even more bewildering crypto world, the markets—oh, the markets!—collapsed in a swoon most dramatic. Not from sorcery (unless one counts economic policy as black magic), but from that old phantom: inflation numbers. Ah, giddy traders, clutching their digital coins, took profits with the glee of cats chasing shadows, just as Bitcoin waltzed gaily past $100,000 for the first time in history. The ghost of Professor Woland himself might have grinned at the chaos.

With a flick of cold bureaucratic wrist, the statisticians revealed fresh inflation figures, as if delivering a mysterious potion in a dusty glass: behold, the lowest inflation rate seen since the halcyon days of 2021, now at 2.3%. “What does it mean?” cried the masses. Should we celebrate, or cower in the pantry with stale rubles and a bottle of questionable vodka? No sooner had they asked than the whole crypto market, transfixed by an existential dread, slipped 0.48% to $3.32 trillion, while our beloved Bitcoin shuffled sheepishly down to $103,228—a mere hiccup by crypto standards.

Only in this peculiar tale does lower inflation not gladden hearts. “Why not—low prices, more pelmeni for the people!” you’d think. Alas, the Federal Reserve, as obstinate as Berlioz before his fateful encounter with a foreigner, remains unmoved. President Trump huffs and puffs, tariffs swirling like mysterious winds, but the Fed sits quietly, waiting, its intentions as clear as a cat in the fog. Rate cuts? Not today, comrade. Lower interest rates, that gentle rain so cherished by the crypto markets, remain a distant rumor, as elusive as a straight answer from the devil at Patriarch’s Ponds.

Meanwhile, as traders made off with their profits, Bitcoin lounged above $100K, smoking an invisible cigarette, looking down on the chaos with something like amusement. The real show, however, comes from the legion of altcoins staging their own clandestine revolution.

Crypto markets remain strong (and mildly conspiratorial) 😼

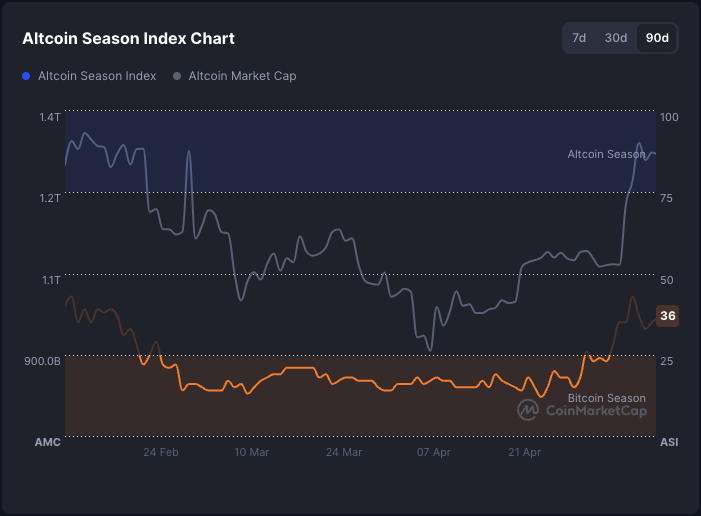

The altcoin index, like a black cat crossing your path (for better or worse), shot to its highest level since February. In the last ninety days, 36 cunning tokens outwitted Bitcoin on the trading floor. The altcoin market cap leaped from $1.1 trillion to $1.35 trillion—a feat even Margarita might envy.

This parade of bullish bravado suggests a certain irrepressible optimism, as if the markets themselves were devils in disguise, hatching fresh schemes. Yet, all eyes swivel nervously toward the Federal Reserve, wondering if it will act, or simply order another cup of tea. Will rate cuts come before September, or will the world wait to see whether a handshake with China matters more than a thousand blockchain transactions?

So there it stands: crypto down—but not defeated. Like Moscow in spring, there’s mischief in the air and fortunes to be made or lost, depending only on the whim of fate, federal officials, and perhaps a talking cat with a bag of tricks.

Read More

2025-05-13 18:44