Ah, the 200-week moving average (WMA)—often seen as the crypto’s equivalent of the wise old owl perched on a blockchain branch, whispering secrets to anyone willing to listen. It’s regarded as one of those reliable long-term indicators—kind of like your weird aunt’s intuition, but with fewer conspiracy theories and more data points. It usually acts like a gentle, slightly bossy floor for prices during those tumultuous market rollercoasters that only the brave, or perhaps the foolish, dare to ride.

Historical Significance of the 200WMA

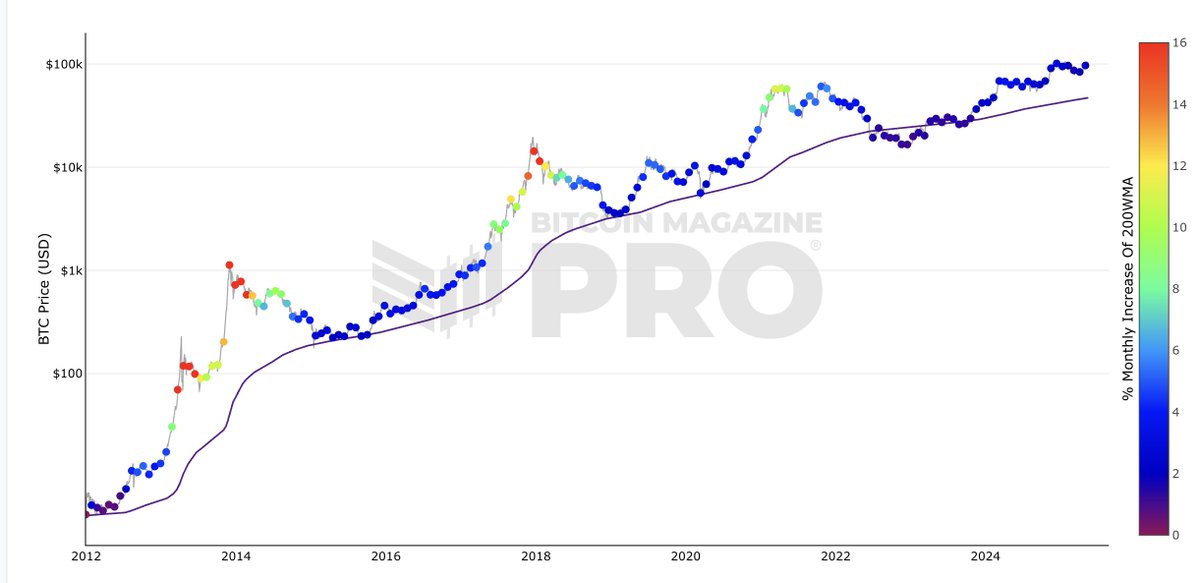

Bitcoin has only dipped below its venerable 200WMA during those lovely periods of market chaos—like early 2020 and late 2022—like an unpredictable toddler throwing a tantrum just when you think everything’s fine. Now, with the 200WMA quietly climbing above $47,000, it’s almost as if Bitcoin is putting on its grown-up shoes and preparing to behave. 🎩

According to the illustrious Adam Back (who, by the way, probably drinks coffee made from bitcoin-shaped beans), the upward journey of this 200WMA isn’t just a happy coincidence; it’s repeating the broader rally that has been happening over the past year—because, clearly, markets have the memory span of a goldfish on a caffeine rush.

While short-term fluctuations are as inevitable as a cat knocking over your coffee, Back’s witty chart seems to suggest that this long-term indicator isn’t just reacting to fleeting hype, but more like the seasoned observer of market shenanigans—kind of like the wise man at the party who knows when the music’s about to stop.

A Shift in Market Trends?

This does not mean that Bitcoin’s rollercoaster is over—oh no—there’s still plenty of room for ups and downs, zig-zags, and the occasional plot twist that keeps everyone on the edge of their seat. But the rising 200WMA makes it increasingly unlikely that Bitcoin will decide to take a nosedive below the critical $47,000 mark. Basically, it’s like trying to un-ring a bell that’s already been knocked off the table—pretty darn difficult.

As this indicator keeps its upward trajectory, Bitcoin might find itself strutting into a new era of higher prices—making the sub-$47,000 days look as outdated as dial-up internet. So buckle up, or perhaps gently secure your digital piggy bank, because the future’s looking a little brighter, and a lot more expensive.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Grimguard Tactics tier list – Ranking the main classes

- Mini Heroes Magic Throne tier list

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- CRK Boss Rush guide – Best cookies for each stage of the event

2025-05-18 18:12