Hark! On this past Monday, the noble Ethereum did suffer a most ignoble descent, as doth occur when fortune’s fickle winds bloweth ill upon both the crypto and stock markets. ‘Twas said a whale, bloated with coin, did make a grievous error, capitulating with losses most lamentable. 🎭

Verily, Ethereum (ETH) didst sink to a paltry $2,400, a far cry from the month’s zenith of $2,732. Such a fall didst obliterate $35 billion in market capitalization, a sum that would make even Croesus weep, tumbling from $325 billion on the fourteenth of May to a mere $289 billion. 💸

Alas, ETH retreated like a coward in battle after a large holder, perhaps addled by too much mead, didst surrender. According to the scribes at Lookonchain, this blubberous whale didst withdraw 7,000 ETH, valued at $16.8 million, at a considerable loss. Previously, this same witless address had withdrawn 13,479 ETH worth $48.82 million between the fifth of December and the thirteenth of January. The whale, still clinging to 6,479 ETH, hath realized a loss of $16.28 million. One might say, a fool and his money are soon parted! 😂

Yet, fear not, for Ethereum’s very essence doth hint at a potential resurgence. Nansen’s wise data revealeth that more investors, perhaps weary of thieving exchanges, are moving their ETH into self-custody wallets. Tokens on exchanges didst dwindle by 3.46% on Monday, leaving a mere 23.47 million. The total supply on exchanges hath also shrunk to a meager 19.45%. Huzzah! 🤩

These dwindling exchange balances are typically a sign of good fortune, indicating that investors are not plotting to sell their precious coins in the immediate future. ‘Tis a sign of faith, or perhaps just stubbornness. 🤔

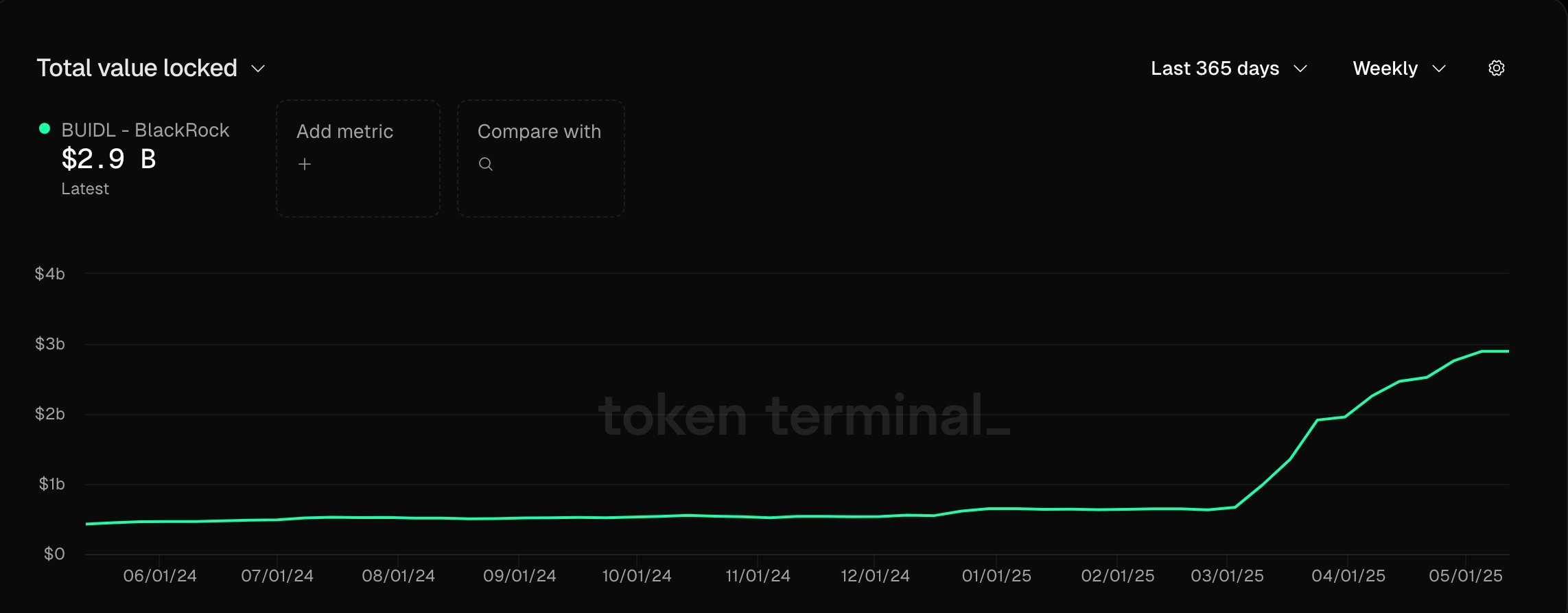

Another auspicious sign is the continued growth of assets on the Ethereum network, despite the market’s foul mood. Behold, BlackRock’s USD Institutional Digital Liquidity Fund, or BUIDL, hath ascended like a phoenix from the ashes. Its assets hath swelled to $2.9 billion, a mighty increase from the $640 million seen on the first of January. 🚀

Ethereum price technical analysis

The daily chart doth reveal that ETH bottomed at $1,380 in April before rallying to $2,732 last week. Since then, ’tis retreated as investors, ever greedy, took their profits. 😈

Despite this setback, ETH doth remain above the 50-day and 100-day Exponential Moving Averages, which are on the cusp of forming a mini golden cross. The current pullback occurred after the price reached the 50% Fibonacci retracement level, suggesting that ETH may now be entering the second act of an Elliott Wave pattern. 🧐

Should this optimistic vision hold true, Ethereum could bounce back with vigor, potentially retesting the 78.2% retracement level at $3,527 in the long run. However, should the price fall below the $2,000 support zone, this bullish scenario would be rendered naught but a fool’s dream. So, let us watch and wait, with bated breath and trembling fingers! 🤞

Read More

- Gold Rate Forecast

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Hero Tale best builds – One for melee, one for ranged characters

- EUR CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Mini Heroes Magic Throne tier list

- Why The Final Destination 4 Title Sequence Is Actually Brilliant Despite The Movie’s Flaws

- EUR NZD PREDICTION

- Kendrick Lamar Earned The Most No. 1 Hits on The Billboard Hot 100 in 2024

2025-05-19 17:16