Ah, the infamous bull trap—how it lures with its golden promise and then smashes the hearts of those poor retail traders who dared to dream of riches! As CryptoQuant’s esteemed Joao Wedson so wisely noted, it is a mere puppet show, a game where sentiment is played like a delicate harp, only to be struck by the harsh thunder of reversal when least expected. Classic, isn’t it? 😏

Wedson, in his infinite wisdom, stressed the vital importance of understanding market liquidity and the grand machinations of institutional players. If one is to navigate the treacherous seas of crypto trading, one must know how to avoid falling into the traps laid by the big, dark fish swimming in the murky waters of the market. Let’s face it, if you don’t understand these concepts, you might as well hand your wallet over to the sharks. 🦈

“If you don’t master market liquidity and how the big players operate, it’s unlikely you’ll achieve much success in trading,” said Wedson, as though the very fate of your trading success depends on whether you’ve read the right books on market liquidity. Spoiler alert: It does. 📚

Ah, and here’s where it gets deliciously cynical: Watch the sentiments on platforms like X. If you spot overly emotional posts, then, dear reader, the trap has been sprung. Traders who cling to solid data, like a knight with their sword of institutional analysis, are the ones who will survive this game. Others? Well, not so much. 😅

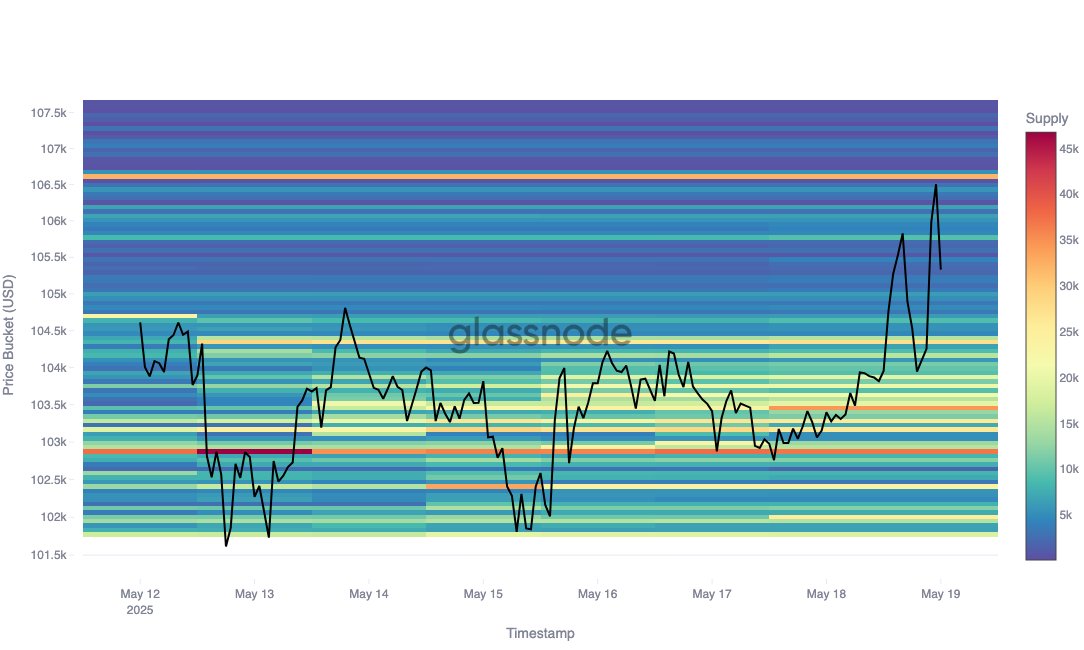

But wait, there’s more. Our friends at Glassnode, those brilliant minds who peek behind the blockchain curtain, have confirmed that BTC’s price surge has hit a rather intriguing stall just below $106.6K. Oh, and did I mention that about 31,000 BTC are clustered around that exact price, like treasure guarded by dragons? This, my dear reader, is a supply zone that simply refuses to budge. One can only wonder: Who are these strong hands, and why are they so resolute in not redistributing or averaging down? 🤔

“Making $106.6K an important level to watch in the short term,” they say. Well, of course, they do—because all roads in this market seem to lead to this fabled number. Is it a trap? A strategy? Or perhaps just a convenient moment for a certain brand of ‘smart money’ to sit back and chuckle while waiting for emotional traders to take the bait? Oh, the drama! 🍿

Read More

- Gold Rate Forecast

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- EUR CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Castle Duels tier list – Best Legendary and Epic cards

- Jerry Trainor Details How He Went “Nuclear” to Land Crazy Steve Role on ‘Drake & Josh’

- Pop Mart’s CEO Is China’s 10th Richest Person Thanks to Labubu

- Mini Heroes Magic Throne tier list

- Kendrick Lamar Earned The Most No. 1 Hits on The Billboard Hot 100 in 2024

2025-05-19 17:54