- HYPE, that sly fox, leapt 14.72% in a single day, scurrying from $26.13 to $30.45—clinging to Bitcoin’s coattails like a bureaucrat to his overcoat.

- Hyperliquid, not to be outdone, strutted about as the chain with the fattest daily fees: $3.2 million! Annualized Fees? A plump $639 million—enough to make even the greediest official blush.

Hyperliquid [HYPE] has been strutting through the marketplace like a provincial governor after a fresh bribe, boasting a 14.72% gain in just 24 hours.

The soothsayers and market whisperers claim this parade may continue, for HYPE’s recent antics seem to mimic Bitcoin’s every move—like a minor clerk aping the mayor’s gait.

Digging deeper (with a shovel borrowed from the town gravedigger), we find that both trading and on-chain activity are tilting heavily in HYPE’s favor. The scales of fortune, it seems, are not so easily balanced.

HYPE and Bitcoin: A Curious Pas de Deux

After Bitcoin’s triumphant march to an all-time high, only a handful of tokens dared follow. HYPE, ever the ambitious understudy, was among them.

According to AMBCrypto’s crystal ball, HYPE’s latest leap was spurred by whale-sized wallets—those mysterious oligarchs of liquidity—wielding Hyperliquid for their grand futures trades.

The whales led the charge, as always. The most dramatic flourish? A $1.07 billion long position, now plumper by $28 million in Unrealized PNL. One can almost hear the champagne corks popping in the counting house.

Such ostentatious trades tend to embolden the common folk—retail investors who see HYPE as their ticket out of obscurity. Thus, the altcoin has risen from its humble $26.13 on May 20th to a rather more respectable $30.45.

Meanwhile, the mood in the marketplace is bullish—longs make up 51.17% of positions, just nudging out shorts at 48.83%. It’s a tug-of-war worthy of a Gogolian town square.

Trading Activity: All Smoke or Genuine Fire?

The trading floor is abuzz with gossip and coin clinking—a positive correlation that could yet propel HYPE higher. Artemis reports Hyperliquid raked in the highest Trading Fees in the last 24 hours: $3.2 million. Not bad for a day’s work (or mischief).

This frenzy reflects a swelling tide of interest across Hyperliquid’s ecosystem. Over the past month, Annualized Fees ballooned past $639 million—a 37.24% price jump that would make even Chichikov envious.

Staked HYPE has climbed to 423.4 million, shrinking the available supply just as demand begins to howl at the door like a hungry wolf.

This could spark a supply squeeze—a classic Gogolian farce where everyone wants bread but there’s only enough for the mayor’s cat.

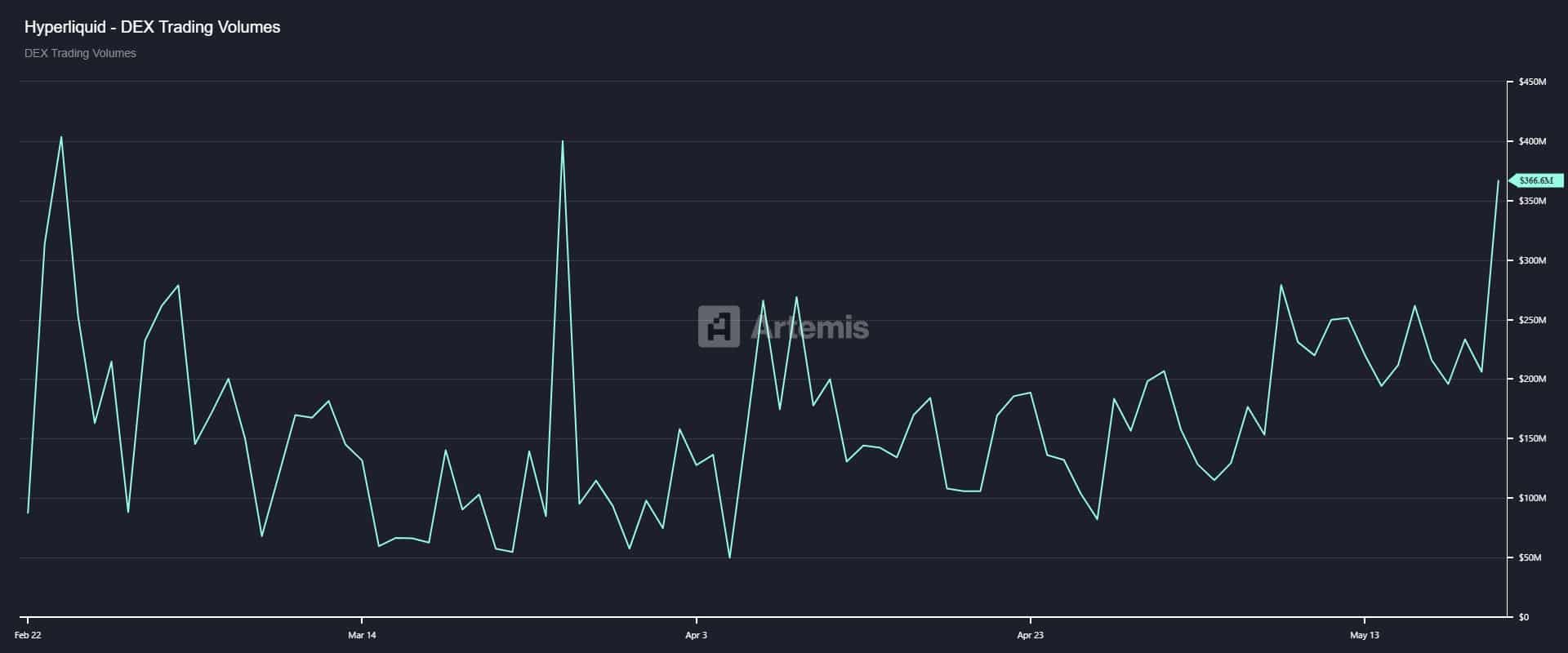

Across decentralized exchanges, HYPE’s trading activity has ballooned. In just 24 hours, volume hit a new milestone: $366.6 million. The clerks are surely sweating over their ledgers tonight.

This marks a feverish level of interest—the likes of which we haven’t seen since March 26th. Over 30 days, trading volume is up 97.46% from its humble beginnings. If only government salaries rose so quickly!

Would you like me to explain or break down this code?

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- 9 Most Underrated Jeff Goldblum Movies

- Castle Duels tier list – Best Legendary and Epic cards

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- Can the Switch 2 Use a Switch 1 Charger?

2025-05-22 17:18