Oh, what a jolly good show it is! Bitcoin, that cheeky little rascal, is breaking records left and right, reaching heights that would make even the tallest giraffe blush! And guess what? It’s not just the usual suspects—those stuffy investment funds and lone wolf investors—who are getting in on the action. No, no! Traditional companies from every nook and cranny are diving headfirst into the Bitcoin pool! 🏊♂️

From the hallowed halls of education to the bustling world of healthcare, and even the brick-and-mortar of housing construction, businesses big and small are racing to hoard Bitcoin like it’s the last cookie in the jar! They’re seeing it as a shiny strategic asset, a delightful twist in the tale of how companies view cryptocurrencies. 🍪

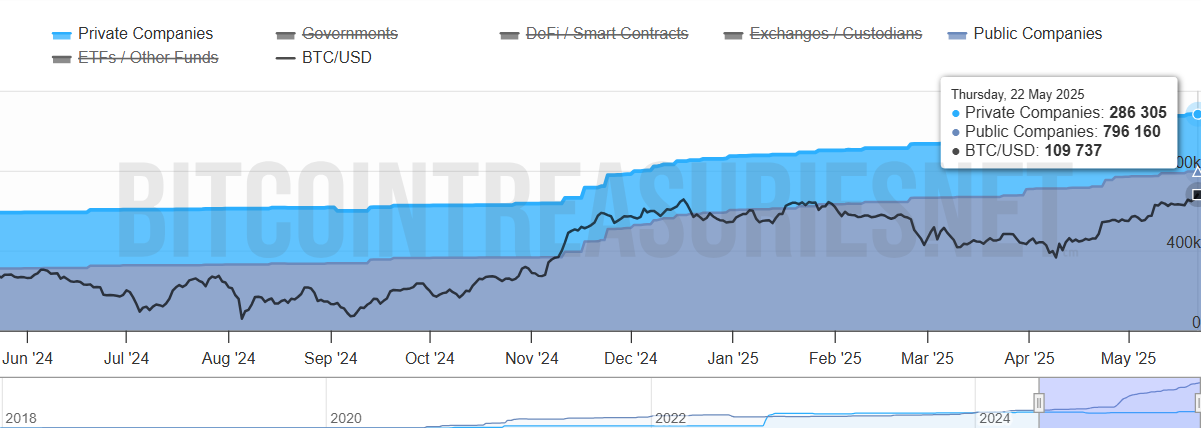

Bitcoin Accumulation Across Industries in May

Take a gander at Genius Group, a clever little education company that recently announced a whopping 40% increase in its Bitcoin stash! Talk about commitment! Meanwhile, Basel Medical Group, a healthcare whiz from Singapore, sent shockwaves through the market with a jaw-dropping $1 billion Bitcoin buy. Can you believe it? 💸

These shenanigans show that Bitcoin is no longer just a playground for tech geeks and investment wizards. It’s spreading its wings and fluttering into sectors that were once as far removed from crypto as a cat is from a dog! 🐱🐶

In Europe, H100 Group has become the first publicly traded company in Sweden to adopt a Bitcoin reserve strategy. They splashed out 5 million NOK to snag 4.39 BTC. And let’s not forget Blockchain Group, the trailblazers of Europe, who recently added 227 BTC to their treasure chest, bringing their total to a staggering 847 BTC! Talk about a treasure hunt! 🏴☠️

“Europe stacking sats at the corporate level,” quipped Nic, the CEO & Co-founder of Coin Bureau, on this delightful news.

These antics highlight the growing acceptance of Bitcoin as a strategic asset, especially as its value reaches dizzying new heights! 🎢

Manufacturing and Retail Companies Join the Movement

But wait, there’s more! Manufacturing and cybersecurity companies are also jumping on the Bitcoin bandwagon. BOXABL, a modular home manufacturer, has declared Bitcoin a reserve asset. It’s like the construction industry has suddenly discovered digital finance! Meanwhile, JZXN, a US electric car retailer, has given the green light to purchase 1,000 BTC within the next year. Vroom vroom! 🚗💨

The participation of companies from seemingly unrelated industries, like automotive and housing, shows that Bitcoin is becoming the new darling of corporate portfolio diversification. Who would have thought? 🤔

Several Web3-related companies also decided to build Bitcoin reserves in May after it reached a new ATH. SecureTech, a cybersecurity firm, announced its reserve strategy, while Roxom Global raised a whopping $17.9 million to fund its Bitcoin reserve and expand its media network. Ambitious, aren’t they? 💪

These efforts reflect a strong ambition to combine digital assets with innovative business models. What a time to be alive! 🎉

Bitcoin Becomes a Macro Asset with a Limited Supply

Recent reports suggest that retail investors were largely absent during this latest rally. However, the flood of company Bitcoin acquisition announcements indicates a wave of institutional FOMO (fear of missing out). Oh, the irony! 😂

Strategy is one of the companies leading this trend. As Bitcoin hit new highs, the value of its BTC holdings surged to a staggering $64 billion. But they haven’t stopped there! The company recently announced plans to raise another $2.1 billion to continue its Bitcoin-buying spree. Talk about a shopping spree! 🛒

Data from Bitcoin Treasuries shows that private and public companies now hold over 1 million BTC—more than 5.4% of the circulating supply. Meanwhile, Bitcoin’s supply remains fixed, and the number of companies accumulating it continues to grow each month. It’s like a game of musical chairs, but with Bitcoin! 🎶

“Bitcoin breaking through $110,000 reflects the new reality: it’s no longer a fringe asset—it’s a macro instrument, ETF inflows, sovereign interest, and structurally limited supply are driving institutional demand at scale. For funds sitting on cash in a low-yield world, Bitcoin is starting to look less like a risk and more like a benchmark,” said Mike Cahill, CEO of Douro Labs, in an interview. Wise words, indeed!

This trend proves that Bitcoin is gaining institutional trust in 2025. It’s no longer dismissed as a financial bubble. Instead, it’s being recognized as a strategic asset of the future. What a twist in the tale! 📖

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Castle Duels tier list – Best Legendary and Epic cards

- AOC 25G42E Gaming Monitor – Our Review

- Mini Heroes Magic Throne tier list

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Grimguard Tactics tier list – Ranking the main classes

- Fortress Saga tier list – Ranking every hero

- Outerplane tier list and reroll guide

- Call of Antia tier list of best heroes

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

2025-05-24 05:11