So, XRP is hanging out at $2.35, with a market cap of $137 billion and a trading volume of $1.75 billion. It’s like the indecisive friend who can’t choose between pizza or sushi—today’s price danced between $2.30 and $2.37, showing us it’s not quite sure what it wants to be when it grows up.

XRP

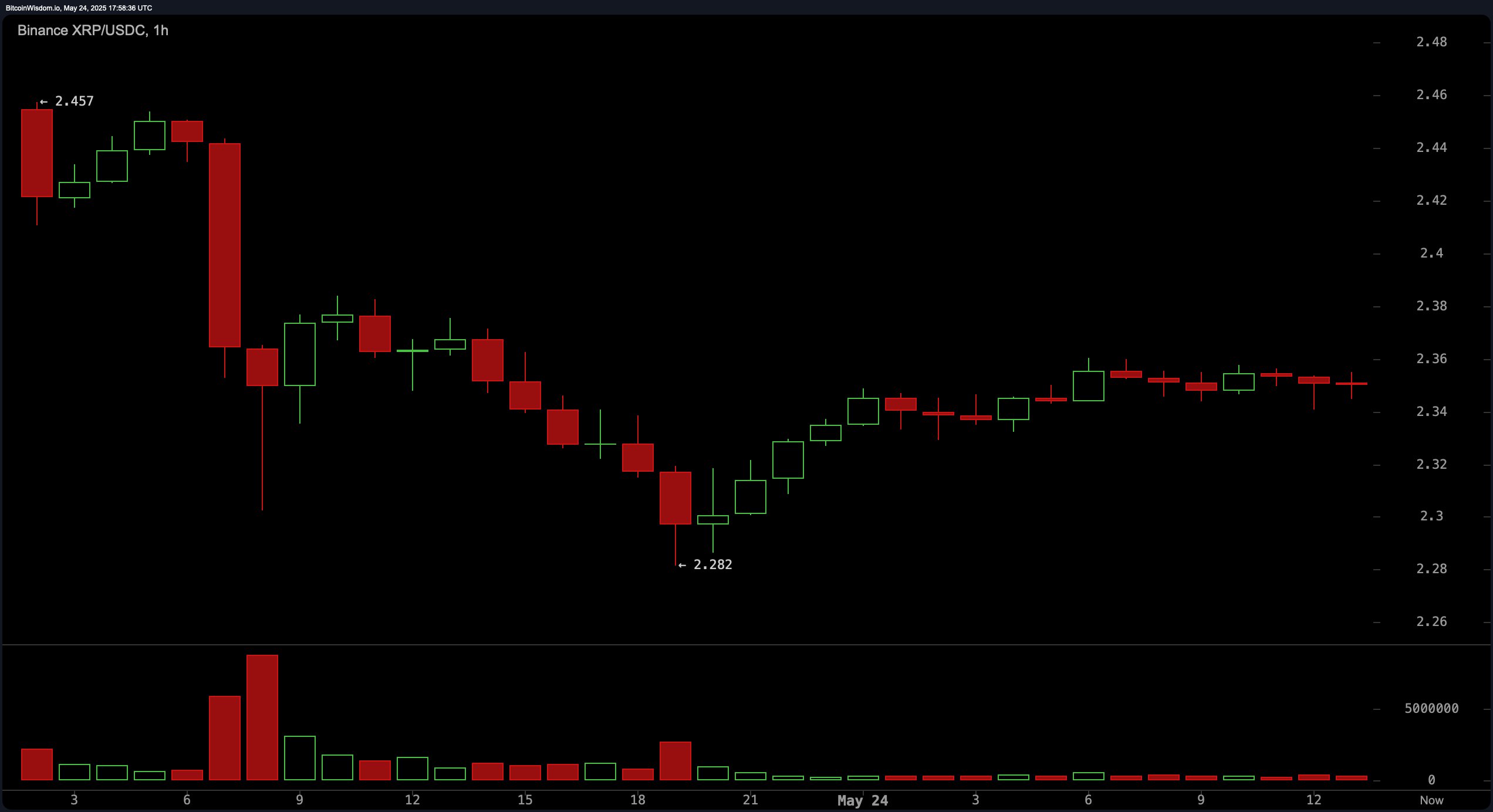

The one-hour (1H) chart reveals that XRP took a nosedive from $2.457 to $2.282, but hey, it’s recovering like a champ! It’s now stuck in a cozy little consolidation zone between $2.34 and $2.36, like a cat in a sunbeam. Traders are on the edge of their seats, waiting for a breakout above $2.36—preferably with a strong green candlestick and a side of increased volume. A stop-loss just below $2.30 might be a smart move, with targets set at $2.42 and $2.47–2.48, because who doesn’t love a good comeback story?

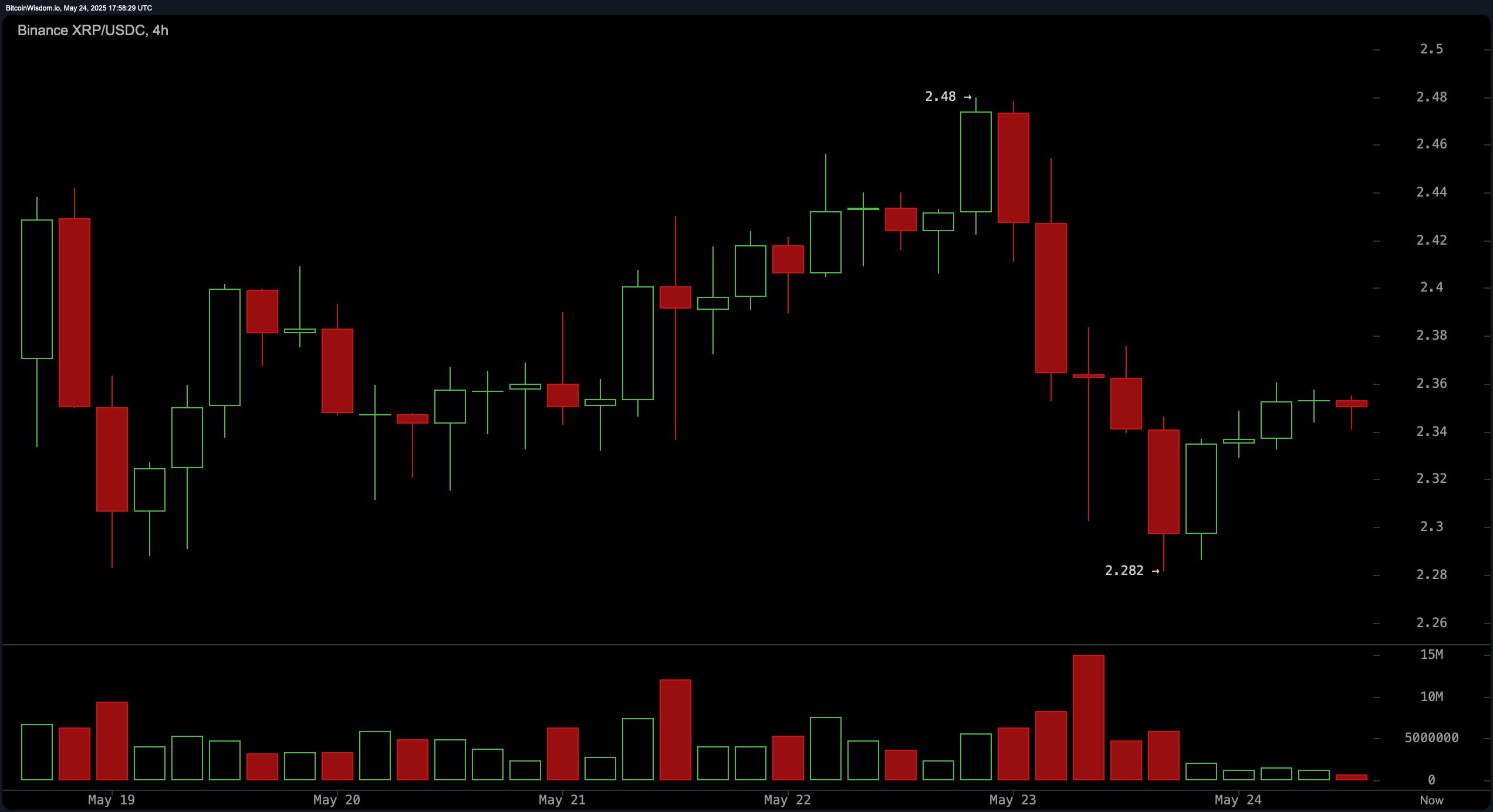

On the four-hour (4H) chart, XRP is trying to stabilize after hitting a recent low of $2.282 on May 23. It’s like that friend who keeps saying they’re “fine” but clearly needs a hug. The asset is consolidating between $2.33 and $2.36, while the overhead resistance at $2.48 is like a bouncer at a club—very hard to get past. If it breaks and retests the $2.37–2.38 area with confirming volume, we might just have a party on our hands! Profit-taking could happen around $2.47–2.48, which is like finding money in your old jeans.

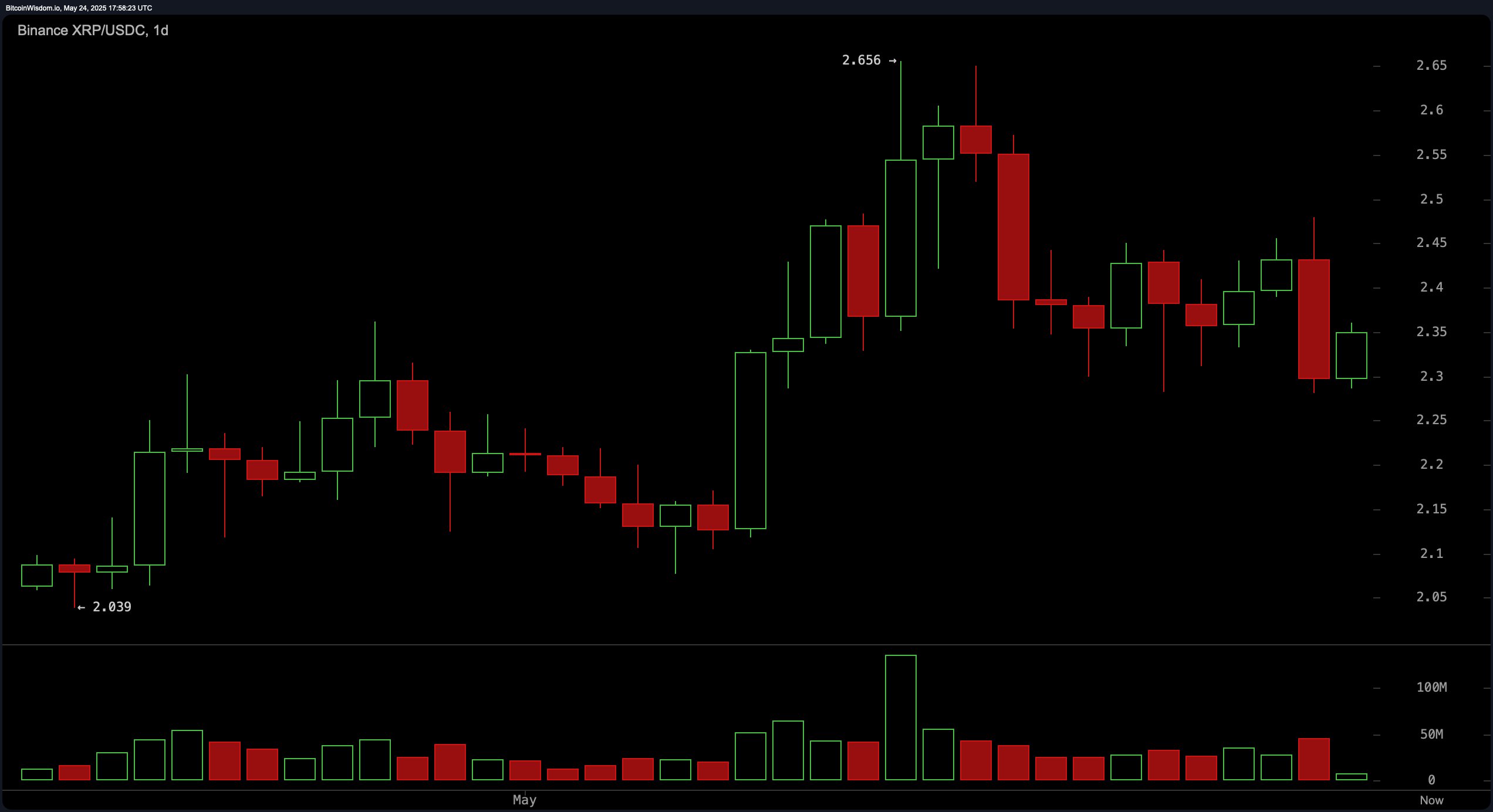

The daily (1D) XRP chart tells a tale of a strong rally that peaked at $2.656 before taking a little tumble. It’s like that rollercoaster ride that starts off fun but ends with you questioning your life choices. The support zone between $2.30 and $2.32 is being tested, and a critical buy zone is forming between $2.25 and $2.30, contingent on a reversal candle confirmation. Resistance is still glaring at us from $2.55–2.60, like an ex at a party.

Oscillators are giving us a neutral to slightly bearish vibe. The relative strength index (RSI) is at 51.02, which is like saying, “I’m not mad, just disappointed.” The Stochastic oscillator is at 20.02, teetering on the edge of oversold but still neutral. The average directional index (ADX) is weak at 15.56, suggesting we’re in a trendless wonderland. The Awesome oscillator is modest at 0.07627, while momentum at -0.20234 is like a lukewarm cup of coffee—meh. The MACD is showing a bearish signal at 0.03688, reinforcing that mixed bag of feelings.

The moving averages (MAs) are like the wise old sages of the market. Short-term indicators like the 10-period EMA at $2.37388 and the 10-period SMA at $2.37612 are waving red flags. But wait! The 30-period EMA at $2.32562 and SMA at $2.31615 are hinting at some bullish activity. Longer-term indicators are feeling optimistic, with the 50-period EMA at $2.29813 and SMA at $2.21741, and the 100-period EMA at $2.26846 and SMA at $2.29522 all pointing to positive vibes. If we can break through those immediate resistance zones with volume, we might just be on the road to recovery!

Bull Verdict:

If XRP can keep its head above the $2.30–$2.32 range and break above $2.37 with some volume, we’re still in the bullish game. With layered support from moving averages and signs of accumulation, we could be heading toward $2.47 and beyond. A confirmed reversal on the daily chart could send XRP back to retest the $2.55–$2.60 resistance range, and we’ll all be cheering!

Bear Verdict:

But if XRP can’t hold the $2.30 support, especially with increasing volume, we might be looking at a “pause before the plunge” situation. With short-term moving averages signaling weakness and the MACD suggesting bearish momentum, a breakdown below $2.25 could lead us to $2.15 or lower. Until we see some bullish confirmation, it’s time to put on our cautious hats!

Read More

2025-05-24 21:58