So, here we are, folks. Pi Network is at this critical point, like a guy at a bar who’s had one too many and is about to spill his drink. Oversold conditions, declining volume—it’s like watching a slow-motion train wreck. But hey, if it can reclaim that $0.99 swing high, we might just have a party on our hands! 🎉

After a strong bullish expansion, Pi Network (PI) has decided to take a little vacation downwards. It’s like it’s saying, “I’m going to trend downward, but don’t worry, I’m still technically valid!” A swing high at $0.99 and a swing low at $0.66—what a range! It’s like a rollercoaster, but without the fun. 🎢

These two price levels are now framing a range where accumulation might happen before the next directional move. If support holds and volume returns, we could be looking at an upside. But let’s be real, it’s like waiting for a bus that’s always late.

Key technical points

- Dynamic Resistance Compression: Price keeps getting rejected by this descending trendline. It’s like trying to get into a club that’s at capacity—just not happening!

- 0.618 Fibonacci Confluence: This key support region aligns with the 0.618 retracement. It’s like the universe is trying to tell us something, but we’re just not listening.

- Volume Profile Support: Trading near the value area low around $0.70—historical demand zone. It’s like a sale at your favorite store; you just have to be there at the right time!

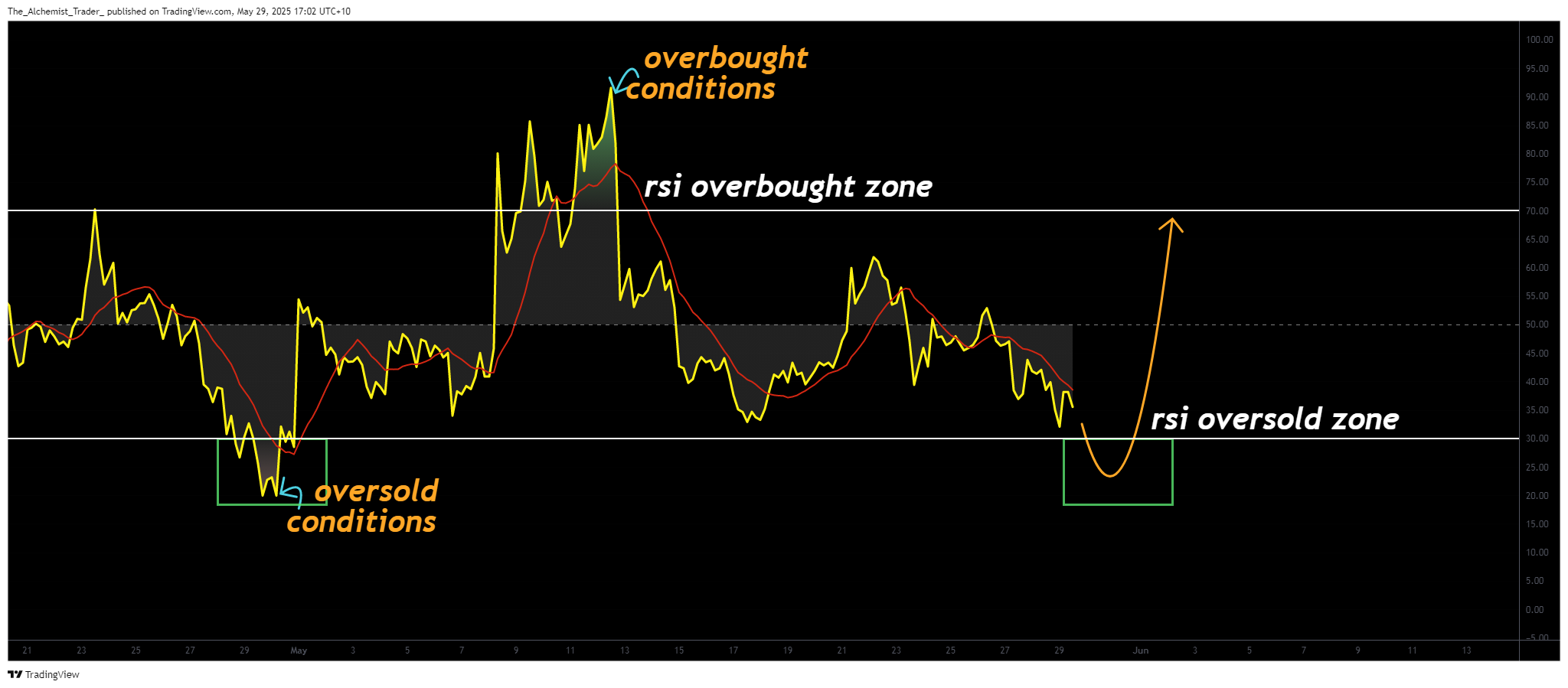

- RSI Approaching Oversold Levels: The RSI is nearing 30. Historically, when it dips into oversold territory, it’s like a rubber band ready to snap back. Let’s hope it doesn’t just snap! 🤞

- Point of Control Reclaim at $0.74: If it reclaims the POC, we might just see a move toward $0.85 and beyond. But until then, it’s like waiting for your friend to finish their story—just get to the point already!

This price compression is like being stuck in a traffic jam—wedged between dynamic resistance and high-timeframe support. Classic apex structure, folks! These setups often lead to high-volatility moves. It’s like waiting for the moment when the traffic finally clears. Will buyers overpower sellers? Who knows! 🤷♂️

The support zone around $0.69–$0.70 aligns with the 0.618 Fibonacci level. It’s like a popular diner where everyone goes for the pancakes. This area also overlaps with VWAP SR and the value area low. From a technical standpoint, it’s a high-probability trade location—ideal for forming a potential higher low or a failed auction. Just don’t get your hopes up too high!

The failed auction setup becomes more probable with the decreasing volume profile. When volume tapers off as price approaches support, it usually means sellers are getting tired. It’s like watching someone try to lift weights—they’re about to drop them! Once selling pressure subsides and buy-side volume enters, we could see a quick reversal. If Pi Network reclaims that $0.74 point of control, we might just be in for a ride toward $0.85 and $0.99. Buckle up! 🚀

The RSI is trending toward 30, painting a bullish setup. Historically, Pi Network has responded to oversold RSI conditions with sharp reversals. It’s like a bad breakup that suddenly turns into a romantic comedy. These moves often coincide with failed breakdowns and deviations around high-confluence support levels. A similar sequence seems to be unfolding. This alignment of RSI oversold conditions with strong support adds weight to the bullish reversal narrative. But let’s not get too carried away!

Volume remains the missing piece of the puzzle, but that’s expected. A decline in volume at support is typical before a breakout. The key signal will be a sudden increase in volume when reclaiming the point of control. This shift would suggest a reversal is underway, and buyers have regained control. When combined with RSI reversal and technical pattern breakout, it could be a powerful signal for continuation. Or it could just be another false alarm. Who knows? 😅

The broader volume range supports the case for a full rotation. The current structure spans from the value area low ($0.70) to the value area high ($0.85), with $0.74 acting as the point of control. In past cycles, Pi Network has shown clean rotations within such ranges. This implies a move from $0.70 back to $0.85, and eventually to $0.99, if momentum and volume support the trend. But let’s not hold our breath!

What’s important to highlight

If the current level breaks with conviction and a bearish retest confirms the breakdown, this would invalidate the bullish structure. But until that happens, the market leans toward a corrective pullback in a still-intact bullish macro structure. The longer price consolidates without breaking down, the more likely it becomes that a reversal is forming. Or maybe it’s just taking a nap. 😴

What to expect in the coming price action

As long as Pi Network holds above $0.69 support and volume enters the market, a reclaim of the $0.74 point of control would signal a bullish shift.

From there, expect rotation toward $0.85, followed by a potential rally to $0.99. This would complete a full value range rotation and mark a continuation of the larger bullish trend. With RSI nearing oversold and volume building quietly, Pi Network may be nearing its next impulsive move. Or it could just be another day in the life of crypto. Who knows? 🤔

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Grimguard Tactics tier list – Ranking the main classes

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Seven Deadly Sins Idle tier list and a reroll guide

- Cookie Run Kingdom Town Square Vault password

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

2025-05-29 19:39