In the universe of cryptocurrency, where the only thing more unpredictable than a cat on keyboards is the price of Bitcoin, Twitter rumors and buzzwords swirl like a particularly aggressive blizzard. Right now, Bitcoin has hit a splendid milestone of BTC $105,088, causing a tiny ripple of excitement—probably among the ants in the server room. Despite this shiny new high, retail investors are behaving like a bunch of cats faced with a cucumber—completely unimpressed and utterly unmotivated.

Retail Bitcoin Demand Is About as Euphoric as a Monday Morning

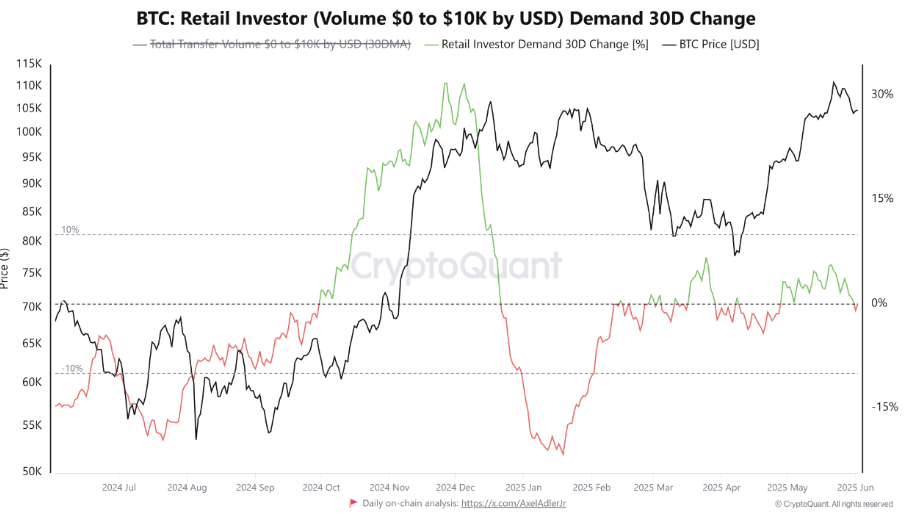

Crypto analysts at CryptoQuant, who seem to spend their time obsessively watching charts and sipping overpriced coffee, have deduced that the “small investor” demand has shrugged off the euphoric feeling—dropping around 2.45% recently. It’s almost as if everyone is waiting for the other shoe to drop or perhaps just bored out of their minds. Apparently, these folks might be splurging elsewhere—maybe ETFs, or Bitcoin-themed Tupperware parties—because on-chain movements of up to $10,000 are about as common as a unicorn at a dog show.

If nobody is buying with wild abandon, then where’s the buying frenzy? Well, according to the data (and the screen glare), not much is happening. Normally, a euphoric market’s structure would look like a rollercoaster with a lot of upward momentum, but it’s more like a flat line at a very high altitude—impressive, but hardly thrilling.

BTC Retail Investor Demand Change | Source: CryptoQuant

Even the ETF world, which is like the Kardashians of investing—always dramatic, sometimes pointless—has seen its fair share of mood swings. Between May 29 and June 2, Bitcoin ETFs had a full-blown crying session, exiting with a staggering $1.21 billion in outflows. That’s enough money to buy a small island or at least a really fancy coffee maker.

Meanwhile, some brave souls—like Paris-based Blockchain Group—are still loading up, bagging an extra 68 million dollars worth of Bitcoin. They now own enough Bitcoin to make Elon Musk jealous (roughly 1,471 BTC to be precise). At current prices of roughly $105,524, that’s a solid $155 million out of your wildest dreams, or perhaps your worst nightmares, depending on your investment psychology.

The Solaxy Saga: The Only Thing Cooler Than Bitcoin

Just when you thought you’d seen everything, along comes Solaxy—a project promising to solve all of Solana’s problems with a presale that’s raising, wait for it… $48 million. Think of it as the magic potion in a world otherwise filled with trolls and bugs. It claims to offer unparalleled scalability, lower fees, and a network so reliable that even your grandma’s Wi-Fi might be jealous.

This magic token, SOLX, is currently on sale at a saucy $0.001744 (less than the cost of a fancy latte) and is wrapping up its presale in just under two weeks. So, if you want to be part of the blockchain revolution instead of just watching it happen, now’s the time to jump in—before the whales, sharks, and a few very ambitious seagulls snap it all up.

With a claimed 116% staking yield and infrastructure designed to make even the most skeptical investors swoon, Solaxy is probably the next big thing—unless it isn’t, in which case, you’re just 12 days away from learning that painfully the hard way.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-06-04 17:56