Bitcoin’s Decline: Is Wynn’s Long Bets Behind The Crash? 🤔

In a world where institutional giants rampage and macro storms buffet retail sailors, Bitcoin stands tall, or so they say. Everyone’s bullish—except maybe the whales with their sea of leverage. Enter James Wynn, the Hyperliquid behemoth, waving his long bets like a mad prophet. But alas, instead of soaring to heaven, BTC seems to be stumbling, perhaps mocking Wynn’s daring bets. Could it be that traders, in a fit of cruel irony, press down the price just to watch Wynn’s liquidations drown him? Ah, the comedy of capitalism! 😂

James Wynn’s Bitcoin Saga: A Pandora’s Box of Market Mischief

Today, Bitcoin wobbles near $105,000—down 11% from its illustrious peak two weeks prior. Yet, the world’s headlines scream of hope—South Korea’s new prez dreams of ETFs, a Spanish coffee chain plans a billion-dollar Bitcoin splash, Russia makes secret crypto moves, and Trump Media piles in with $2 billion. So why does the market hesitate? Some point fingers at Wynn—the giant of hyperliquidity—whose outrageous long bets and emotional outbursts might be the real puppeteers behind the curtain. 🎭

James Wynn(@JamesWynnReal) just got liquidated for 240 $BTC ($25.16M).

He also manually closed part of his position to lower the liquidation price.

He still holds 770 $BTC ($80.5M), with a liquidation price of $104,035.

— Lookonchain (@lookonchain) June 4, 2025

Yes, folks, Wynn’s leveraged long was swept away for 240 BTC when Bitcoin flirted with his liquidation level. It’s almost poetic. Meanwhile, Wynn fumes, accusing market makers of plotting—no, conspiring—to hunt his liquidation like a kid after the last cookie.  Who controls the markets? Billions flow in, prices sink—so obvious, isn’t it? Or maybe Wynn just forgot to take his meds before tweeting. 🤡

Who controls the markets? Billions flow in, prices sink—so obvious, isn’t it? Or maybe Wynn just forgot to take his meds before tweeting. 🤡

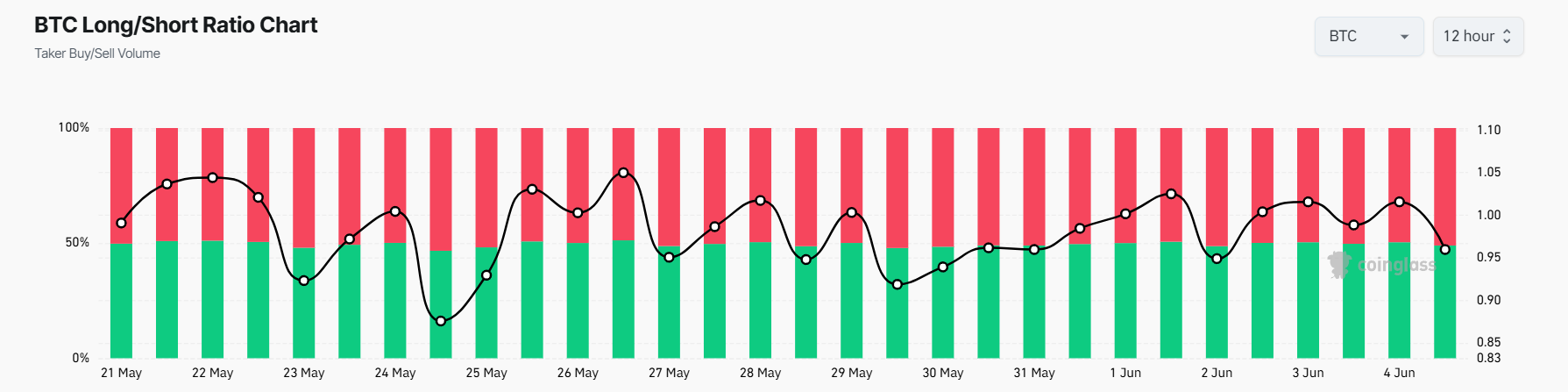

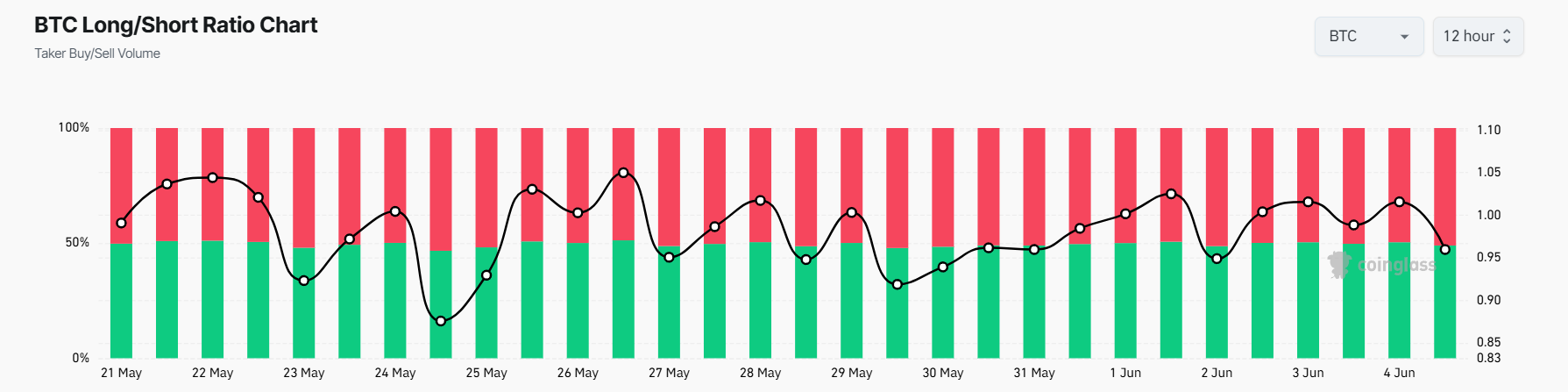

Today’s data shows shorts slightly ahead of longs—51.03% to 48.97%. Hmm. If Wynn’s liquidation was the grand trigger, wouldn’t we see a tidal wave of sell orders and a steep decline? Instead, what we observe is more like a slow descent—profit-taking, macro fears, and traders realizing perhaps it’s time to cash in on the dream.

So, what’s really moving markets?  Big institutions, traders, and algorithms are busy reducing their risks, not necessarily plotting Wynn’s downfall. It’s like blaming the weather for a bad hair day—well, maybe not the best analogy, but you get the point.

Big institutions, traders, and algorithms are busy reducing their risks, not necessarily plotting Wynn’s downfall. It’s like blaming the weather for a bad hair day—well, maybe not the best analogy, but you get the point.

Whale Psychology & the Meme of Manipulation — A Comedy of Errors

Wynn’s colossal positions turn the crypto circus into a volatility carnival. When a famous whale like Wynn tweets his liquidation price, some traders—probably bored—think, “Ha! Here’s my chance!” and jump ship. High leverage is a ticking time bomb—one forced sell sparks margin calls, and soon the market is a haunted house of cascading liquidations. But remember, it’s not all about one man’s drama; the macro universe holds its sway. The market doesn’t dance to Wynn’s tweets alone. 🕺💃

Picture Wynn warning, “If the whale hits the white line, I’m dead again. Pure market manipulation!” Oh, Wynn, your melodrama could fill a soap opera! Meanwhile, actual market activity—algorithmic sell-offs and liquidations—are more like choreographed ballet than a conspiracy. Still, he insists: “Hurry up, Binance!” because if they don’t create some secret dark pool, how will he survive the chaos? 🙄

“If the MM’s hit the white line I’m liquidated again. Pure and simple market manipulation. No ifs or buts. FACT!

Hurry up @cz_binance and create a dark liquidity dex pool. Because this is outrageous!!!!”

— James Wynn (@JamesWynnReal) June 4, 2025

In Wynn’s universe, every sell is a grand conspiracy—yet, in reality, it’s just the usual dance of algorithms, liquidations, and chance. His entire tale a mixture of bravado and paranoia, like a Dickens character shouting into the void.

The Verdict: Beyond the Whale’s Whims

Wynn’s leveraged bets and fiery tweets add flavor to Bitcoin’s rollercoaster. They may worsen the swings near his liquidation levels—true, but to believe his antics are the sole cause of the 11% dip is to ignore the broader symphony of market forces. Profit-taking, resistance levels, macroeconomic tremors—these are the real puppeteers, not Wynn’s dramatic flair. 🎭

Perhaps Wynn’s forced sales scatter dust on the market’s fragile veneer, but the engine of decline roars from elsewhere. The world spins, traders gamble, and markets move—regardless of one man’s frantic Twitter rants.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-06-04 23:38