In a world where the absurd often masquerades as the profound, Eric Trump, the scion of the illustrious Trump dynasty, has unveiled a curious partnership between World Liberty Financial (WLFI) and the TRUMP meme coin. Ah, the irony! A coin that embodies the very essence of meme culture now seeks legitimacy through the financial machinations of a family that has become synonymous with spectacle.

As the community, a motley crew of enthusiasts and skeptics alike, raises its collective eyebrow, one cannot help but recall the infamous follies of Sam Bankman-Fried and his ill-fated FTX empire. The echoes of past misdeeds linger, casting a shadow over this new venture.

Eric Trump’s Grand Announcement: A Stake in the Meme Coin

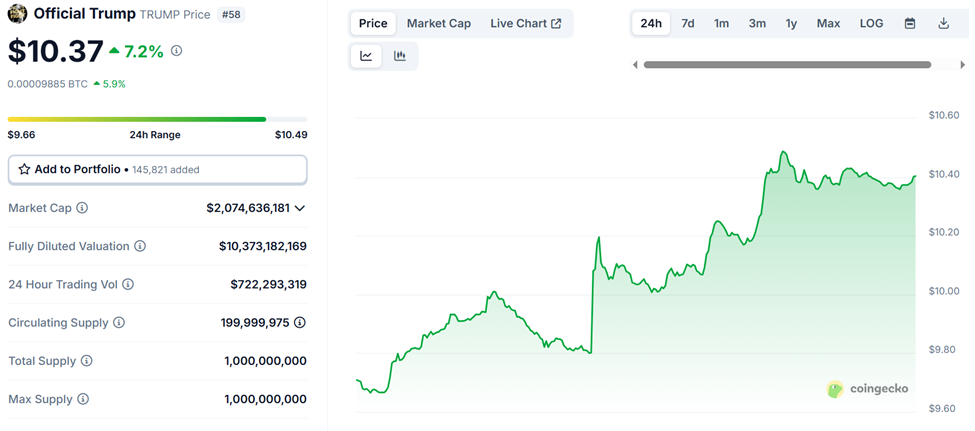

Lo and behold! The TRUMP meme coin has experienced a meteoric rise of 7% in the last 24 hours, trading at a princely sum of $10.37. This surge, one might say, is a testament to the power of familial branding, following Eric Trump’s proclamation of a partnership with WLFI.

The financial firm, a curious entity partially owned by the Trump family, has grand designs to acquire a “substantial position” in the TRUMP coin for its Long-Term Treasury. Ah, the sweet scent of ambition!

“I am proud to announce the TRUMP Meme Coin has aligned with World Liberty Financial… We’re proud to announce that World Liberty Financial plans to acquire a substantial position in TRUMP for their Long-Term Treasury,” Eric Trump proclaimed on X (Twitter), as if the world were waiting with bated breath.

WLFI, in a display of corporate camaraderie, echoed this sentiment on their official Twitter account, proclaiming a shared mission of amplifying American strength through innovation. How noble! Or is it merely a clever ruse?

The Trump meme and WLFI may be different lanes, but they share the same highway. Same values, same mission—amplifying American strength through innovation.

— WLFI (@worldlibertyfi) June 6, 2025

Investor enthusiasm erupted like a poorly timed firework, with supporters heralding this move as a strategic fusion of patriotism and crypto innovation. Yet, amidst the cheers, a whisper of skepticism wafted through the air, laden with ethical concerns.

The Backlash: An Ethical Quagmire Surrounding the TRUMP Coin

Critics, ever vigilant, wasted no time in questioning the ethics and transparency of this deal. One crypto trader, Clemente, dismissed the collaboration as a “joke,” while others hinted at potential scandals lurking in the shadows.

Meanwhile, the specter of manipulation and insider trading loomed large, as a WLFI advisor, in a twist worthy of a Shakespearean tragedy, shorted TRUMP with a staggering $1 million before flipping long. Oh, the drama!

ogle(@cryptogle), the advisor of @worldlibertyfi, closed his short position on $TRUMP at a loss of $188K.

Then he flipped to long $TRUMP 4 hours ago, with a liquidation price of $8.

— Lookonchain (@lookonchain) June 7, 2025

Specifically, this advisor, Ogle, opened a 10x leveraged short position on TRUMP, only to close it at a loss and then, in a fit of audacity, went long again with a 4x leveraged position worth $3 million. What a tangled web we weave!

“What kind of operation you guys got running over there?” one user quipped, capturing the absurdity of the situation.

Should the TRUMP coin price plummet below $8, Ogle faces liquidation—a fate that seems almost poetic in its irony.

Some users have drawn parallels between WLFI’s financial practices and the notorious Alameda Research, the trading arm of the now-defunct FTX exchange. The whispers of insider trading and profit-seeking behind a facade of patriotism grow louder.

According to an April 2025 New York Times investigation, a staggering 60% of WLFI is owned by a Trump-affiliated entity, while 75% of its revenue is derived from TRUMP coin sales. The ethical implications are as murky as a foggy St. Petersburg morning.

Regulatory uncertainty adds yet another layer of complexity to this already convoluted narrative. The SEC has deemed TRUMP a non-security, while the CFTC insists it falls under commodity jurisdiction. A delightful mess, indeed!

SEC Commissioner Hester Peirce has stated that the TRUMP token is outside the SEC’s regulatory scope, indicating that investors should not expect guidance on the meme coin.

In February, the SEC announced that most meme coins are not classified as securities under U.S. federal…

— LondonCryptoClub (@LDNCryptoClub) June 1, 2025

In January, Trump’s crypto czar, David Sachs, declared TRUMP coin a collectible, dismissing any claims of conflict of interest. How convenient!

“This means you should sell TRUMP just like when Eric Trump told you to buy $ETH and it dumped 50% over the next month,” one user sarcastically remarked, referencing past dubious trading advice.

A Forbes report from May 2025 estimates WLFI has generated a staggering $550 million in sales during Trump’s second term, potentially netting the family a cool $400 million. Reports from The Verge also reveal strategic shorts of the TRUMP coin by contest winners and insiders, adding to the intrigue.

In this grand theater of finance, one must ponder: is this a legitimate long-term treasury play or merely another well-dressed pump? The answer, dear reader, may be as elusive as truth itself.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-06-07 16:57