Crypto Wizards or Just Very Confused? MetalphaPro Turns ETH Into a Loan Shark’s Dream

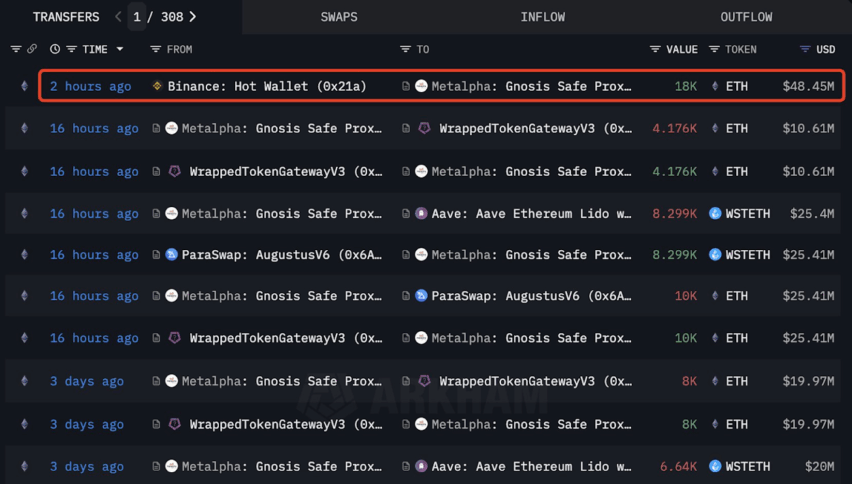

If you ever wondered what happens when a Nasdaq-listed crypto asset manager decides to play with fire, wonder no more. MetalphaPro, the corporate equivalent of that guy at the party who brings a calculator to the bar, just swooped up 18,000 ETH—equivalent to roughly $48.45 million—straight from Binance’s treasure chest about ten hours ago. Because, of course, what’s better than holding a bunch of digital gold? Lending it out, apparently. Because who doesn’t love earning interest on something that could literally vanish in a puff of code? 🔥

Now, MetalphaPro is sitting pretty with over 48,000 stETH—think of it as Ethereum’s less glamorous twin—valued at more than $133 million across DeFi playgrounds like Aave, Spark, and Treehouse Finance. Essentially, these platforms are just digital piggy banks with smarter locks; lock in your crypto, earn a bit of interest, and hope you don’t wake up to a surprise raid. As they lend out these tokens, the firm gets to play the part of the responsible adult—earning returns while keeping control of the digital pizza slices. 🍕

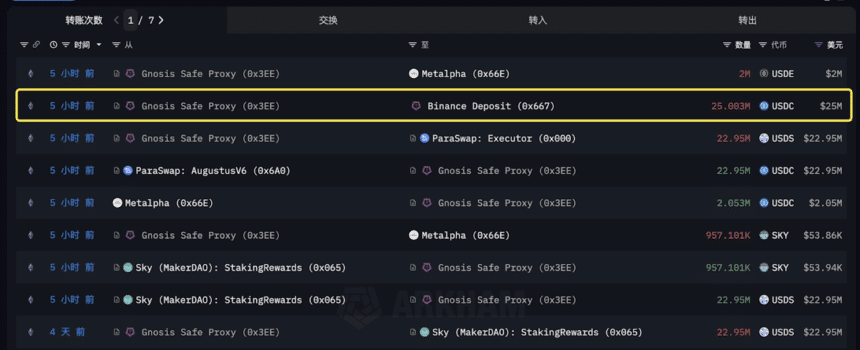

It’s basically a giant game of “what could possibly go wrong?” with MetalphaPro eager to make its crypto assets work harder than a checkout clerk on Black Friday. Last month, they funneled around $25 million USDC into Binance and later withdrew 7,000 ETH, which at the time was worth over $11 million. Because nothing screams financial genius quite like moving money around faster than a cat chasing a laser pointer.

Before all this merriment, MetalphaPro had already pulled out a staggering 29,000 ETH—roughly $48.73 million—at an average of about $1,680 each from Binance, because hoarding isn’t as fun as lending your way to riches. Meanwhile, corporations are “investing” billions into ETH—because what’s more fun than letting big money do the heavy lifting while you sleep? Sharplink, for instance, is eyeing a cool $1 billion worth of ETH—some say it’s a sure sign that crypto is the new corporate cuddly toy.

Read More

2025-06-10 19:36