What to know:

- Well, it seems our dear ETH took a little tumble, sliding down 0.15% to $2,758, as profit-takers decided to cash in after a failed attempt to break above $2,870. Oh, the drama!

- In a grand spectacle, over 140,000 ETH decided to pack their bags and leave exchanges on Tuesday, marking the biggest daily outflow in over a month. Talk about a mass exodus!

- Options skew and call volume are signaling that folks are getting a bit frisky, with a rising appetite for short-term upside. Who doesn’t love a good gamble?

- Spot ETH ETFs are on a roll, posting a whopping $240 million in inflows on Wednesday—outpacing our dear friend BTC. Looks like ETH is the belle of the ball!

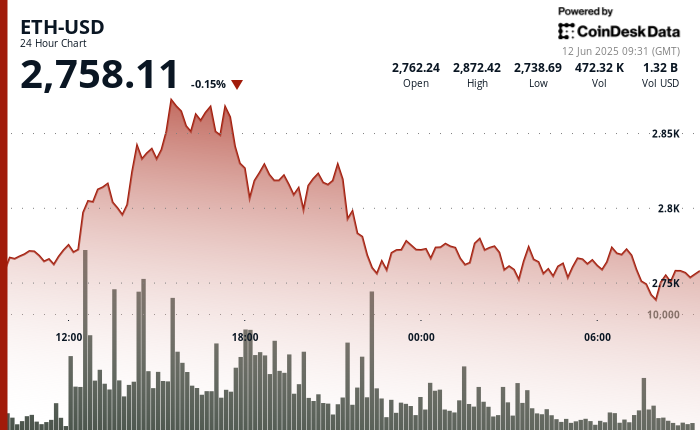

Now, our friend Ether (ETH) had a bit of a rough patch, struggling to keep up the momentum from Tuesday. It fell 0.15% to $2,758, as selling pressure crept in during the U.S. afternoon trading on June 11.

This little pullback followed a brief rally to $2,872.42, which, let’s be honest, was about as sustainable as a paper boat in a storm. The price action reversed sharply between 15:00 and 17:00 UTC, according to CoinDesk Research’s technical analysis model.

The late-session sell-off intensified in the early hours of Asia, with a dramatic 1.29% dip from $2,772 to $2,736 on heavy volume, before Ether managed to rebound slightly toward $2,758 at press time. Quite the rollercoaster ride, wouldn’t you say?

Despite this downturn, key metrics suggest that the bulls are still feeling rather bullish.

Glassnode reported that options skew flipped sharply negative over the past 48 hours—one-week skew dropping from –2.4% to –7.0%—indicating that demand for short-dated calls is on the rise. Put-call ratios remain heavily tilted toward upside exposure, with open interest and volume ratios holding near multi-week lows. Quite the conundrum!

On-chain flows are also reinforcing this bullish bias.

Analytics firm Sentora (formerly known as IntoTheBlock) flagged that over 140,000 ETH, worth approximately $393 million, was withdrawn from exchanges on June 11—marking the largest single-day outflow in more than a month. A sight to behold!

Simultaneously, ETH-based ETFs are extending their inflow streak with another $240.3 million added on Wednesday, surpassing the day’s Bitcoin ETF totals. Analyst Anthony Sassano noted that Ethereum has avoided a single net outflow day since mid-May, calling the trend “accelerating” and arguing that the asset remains structurally undervalued. Quite the optimistic fellow, isn’t he?

While price action shows short-term weakness, market positioning and capital flows suggest traders may be buying the dip in anticipation of another upside attempt. A classic case of “buy low, sell high,” if I ever saw one!

Technical Analysis Highlights

- ETH traded within a $139 range between $2,733 and $2,872 before closing at $2,758. A fine dance, if I do say so!

- Heavy selling emerged near $2,870–$2,880 during June 11’s late U.S. session. A real nail-biter!

- Support near $2,745–$2,755 was breached after multiple tests, triggering a quick decline. Volume spiked above 34,000 ETH during a rapid drop from $2,772 to $2,736 early June 12. Quite the spectacle!

- A temporary bounce toward $2,752 failed, and a new support zone may be forming near $2,735. The plot thickens!

Read More

2025-06-12 14:04