Crypto’s Final Hurrah? 5 Reasons to Watch Before the Big Fall—or Rise! 🤔

Ah, Thursday—what a grand spectacle it was. Bitcoin and its merry band of altcoins looked like they had just come back from a long vacation, blinking in the sunlight after a weekend binge. The rally, that temperamental beast, took a breath—probably to yawn and wake up for the next round of chaos.

Bitcoin (BTC) slipped below $107,000—just a number, really, but in crypto-land, it’s like losing your last sock in the laundry. Meanwhile, Ethereum (ETH), Cardano (ADA), Chainlink (LINK)—they all retreated like tired soldiers retreating from an overconfident enemy. Yet, beneath this chaos lie five reasons that, oh yes, an epic crypto bull run might just be hiding behind the next corner, laughing maniacally.

1. Bitcoin’s Rock-Solid Fundamentals (or so they say) 🏔️

First and foremost, Bitcoin’s tech and fundamentals are as sturdy as a Soviet brick wall. Demand? Rising faster than a bureaucrat’s promises. Spot Bitcoin ETFs—those fancy financial instruments that make Wall Street fancy—are pouring money in. Since January last year, inflows have hit a whopping $45.2 billion, with BlackRock’s IBIT alone holding over $72 billion. Imagine that—Wall Street salivating like a cat near a fish market.

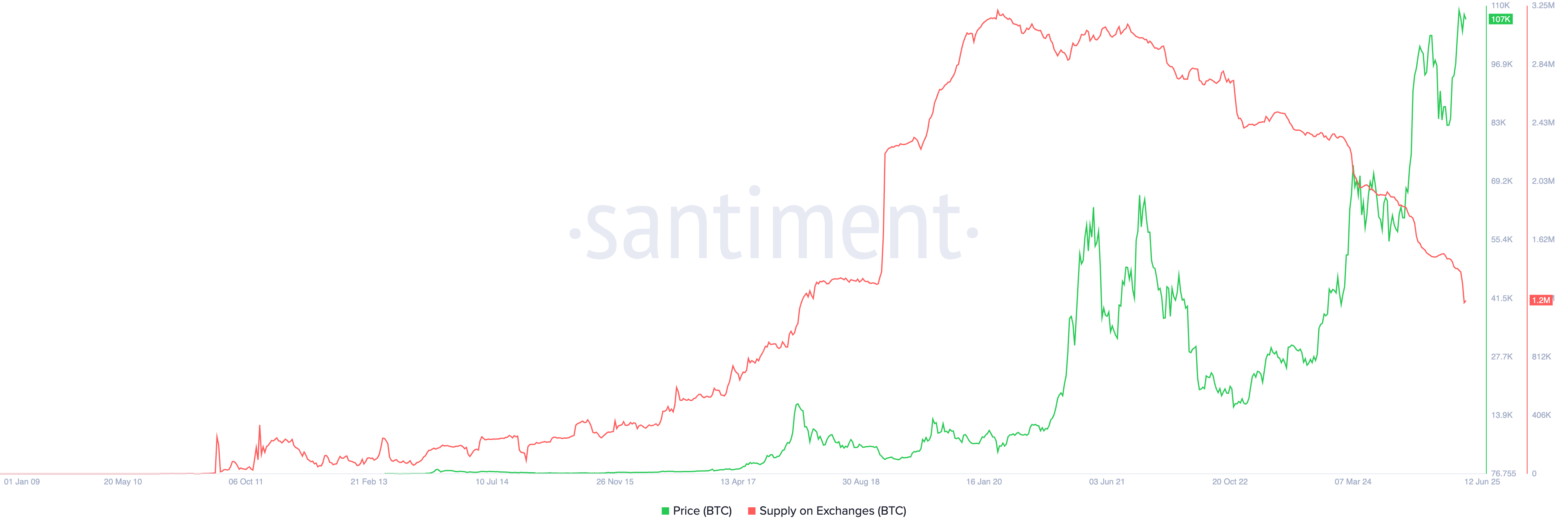

Companies like GameStop, Semler Scientific, Trump Media (yes, that Trump), and MetaPlanet are hoarding Bitcoin like paranoid hoarders guarding candy. As a result, Bitcoin on exchanges has shrunk from 3.2 million in 2020 to just 1.1 million—an elegant game of hide and seek, as Bitcoin becomes scarcer than a honest politician.

From a technical standpoint, Bitcoin has drawn a cup-and-handle pattern—like a fancy café dish—ready to serve up a price surge. Breakout above $111,900? That’s the shining beacon signaling more gains. And when that happens, the rest of the crypto circus may just follow suit with a wild, unpredictable ride.

2. Ethereum ETFs Are Booming—Seriously 💼

Meanwhile, Ethereum ETFs are like that overenthusiastic salesperson at the market—demand is surging. Five weeks of consecutive inflows adding over $1.2 billion? That’s more money than some countries see in a year. The total now hits $3.7 billion, proving investors are still drunk on ETH—or perhaps just hopeful.

Ethereum’s price patterns? Bullish flags and golden crosses—sounds like a fancy dance move, but it’s actually a good sign for those who like their gains with a side of optimism.

3. Altcoin ETFs Are Coming—Hold Onto Your Hats 🎩

Expect a stampede—altcoin ETFs are gaining approval odds faster than a teenager sneaking out past curfew. XRP ETF approval chance? 88%. Solana? A whopping 90%. Other contenders like Litecoin, Hedera Hashgraph, and Sui are also whispering sweet nothings to the regulators. Wall Street investors? They’re already lining up like kids for free candy, pushing prices to dizzying heights.

4. Federal Reserve Might Cut Rates—The Gambler’s Dream 🎲

The Fed’s interest rates? Like a gambler’s last chip—some say they’re about to fold and start cutting. Polymarket traders estimate two or three cuts this year, more in 2026. The trigger? A surprisingly tame inflation report—CPI rose only to 2.4%, lower than expected. It’s like the economy is whispering, “Don’t worry, be happy.”

And—hold your breath—Trump’s potential pick for Fed Chair, Scott Bessent, is expected to be more crypto-friendly and dovish than the hawk Powell. Imagine that—the government possibly becoming a fan of crypto. Who would have thought?

5. Trade Wars Cooling—Or Not? 🔥❄️

The last act in this circus is the tension between the US and China easing—kind of. China’s using rare earth metals effectively, giving them leverage in negotiations. But be warned, if tariffs come back, it’s a trade war redux, and crypto might just be collateral damage.

Meanwhile, the US Senate passed the GENIUS Act—yes, a truly fitting name—bringing clarity to stablecoins. Some companies are filling their treasuries with XRP and Solana—because who doesn’t want a little chaos on the side? And the M2 money supply? Still soaring, like a teenager’s ego after their first date. 🚀

Read More

2025-06-12 17:33