In the grand theater of finance, where fortunes are made and lost with the flick of a digital switch, a curious phenomenon has unfolded. The once-mighty inflows of stablecoins, those bastions of financial stability known as USDT and USDC, have plummeted with the grace of a lead balloon. What could this mean for our dear friend Bitcoin and its volatile companions? Let us ponder this together.

The Great Decline of Stablecoin Inflows

In a recent missive on the platform known as X, the astute observer Axel Adler Jr. has illuminated the latest trends in the Exchange Inflow of our two stablecoin protagonists, USDT and USDC. One might wonder, what is this “Exchange Inflow”? It is, dear reader, a measure of the total assets flowing into the wallets of centralized exchanges, a veritable river of digital currency.

Typically, when investors wish to part with their coins, they deposit them into these exchanges, signaling a desire to trade. A high Exchange Inflow often suggests a robust demand for swapping cryptocurrencies. However, for the ever-volatile Bitcoin, such a surge can be a harbinger of bearish tidings.

Yet, let us not forget the nature of stablecoins! Their value, steadfast as a rock, remains impervious to the whims of exchange deposits, clinging to the fiat currencies they emulate like a child to a mother’s apron strings.

Nevertheless, the inflows of these stablecoins are not without their repercussions. Investors often deposit them with the intent to exchange for the more tempestuous cryptocurrencies. Thus, a spike in stablecoin inflows can indeed breathe life into Bitcoin, igniting a bullish fervor.

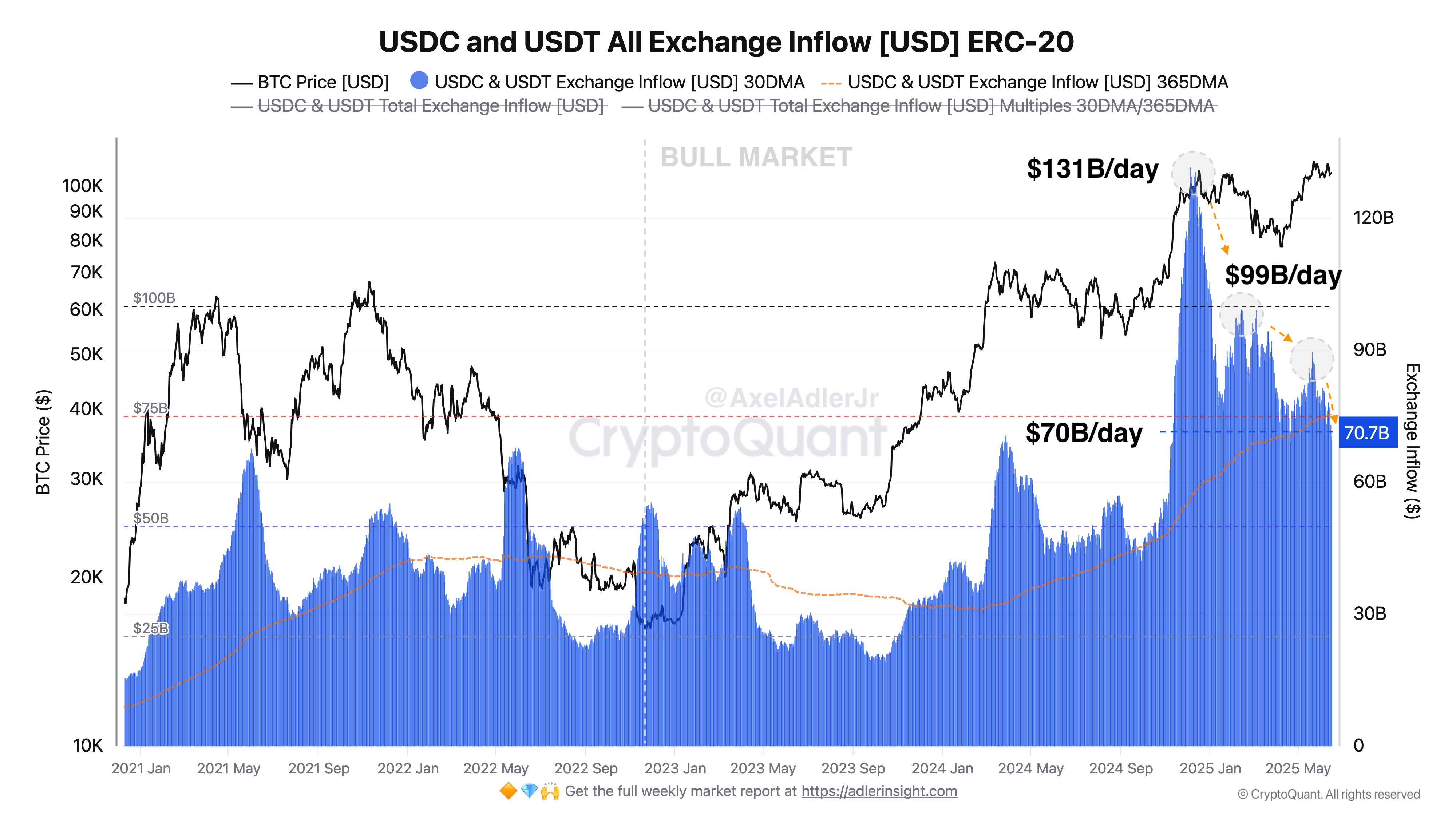

Now, behold a chart that chronicles the Exchange Inflow of our stablecoin heroes over the past few years:

As the chart reveals, the inflows of USDT and USDC soared to dizzying heights at the close of the previous year, a clear indication that investors were making substantial deposits. Coincidentally, Bitcoin experienced a meteoric rise to an all-time high, suggesting that these stablecoin inflows may have provided the necessary fuel for such a rally.

At the zenith of this inflow, the metric reached a staggering $131 billion per day. Alas, as the chart indicates, this figure has since descended to a mere $70 billion per day, a decline of $61 billion that would make even the most stoic investor weep.

While this drop is indeed significant, it is essential to view it within the broader context of the market cycle. Should this trend of declining stablecoin inflows persist, it may spell trouble for Bitcoin and its digital brethren. Yet, despite earlier setbacks, Bitcoin remains above the $100,000 mark, perhaps indicating that investors are merely entering a phase of consolidation, or perhaps they are just taking a well-deserved nap.

The Current State of Bitcoin

In a twist of fate, Bitcoin has managed to recover approximately 2.5% in the last 24 hours, climbing back to the $108,100 level. A small victory in the grand scheme of things, but a victory nonetheless! 🎉

Read More

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Hero Tale best builds – One for melee, one for ranged characters

- Gold Rate Forecast

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Castle Duels tier list – Best Legendary and Epic cards

- 9 Most Underrated Jeff Goldblum Movies

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- EUR CNY PREDICTION

2025-06-17 10:18