If you thought London was just about rain, red busses, and lads in furry hats, think again! Coinbase CEO Brian Armstrong is bustling about, intent on transforming Britain into the kind of place your cryptocurrency dreams would move to, if only they had passports.

The UK, having previously wobbled like a tipsy uncle at a wedding over crypto regulations, now appears to have sobered up and decided to join the international shin-dig with a smile and a firm handshake.

Brian Armstrong Meets UK Bigwigs: Is Crypto Regulation About to Get the Buckingham Treatment?

Armstrong—looking as chipper as a chap can be when faced with British weather—has been schmoozing with policymakers in London. Picture high tea, but the scones have been replaced with blockchain whitepapers and the only jam is the regulatory kind.

Great to be in London today to meet with policymakers on how the UK can position itself competitively in the global race for crypto.

This is a pivotal moment – hopeful the UK seizes this opportunity to solidify its position as a global leader in crypto. Bullish on Britain!…

— Brian Armstrong (@brian_armstrong) June 16, 2025

The man’s on a mission—and rumour has it, he’s not just in it for the warm beer. Coinbase is seeking out markets that offer crypto more than just a polite “how do you do?”

This all follows the UK government’s enthusiastic volley of draft legislation, targeting a snazzy new era in crypto asset management by 2026. (Rumor has it, Big Ben is already being programmed with blockchain tech—don’t quote us.)

In the mix is the OECD and its Cryptoasset Reporting Framework. Think of it as the worst secret Santa ever—it’s all about transparency, audits, and making sure no one’s sneaking off with the mince pies (or, in this case, untaxed tokens).

Enter Tom Duff Gordon, Coinbase’s VP of International Policy: half TradFi, half Web3, and—if reports are to be believed—busier than a City pigeon in a sandwich shop. Tom’s spent his days guiding British regulators with the patience of a parent helping with particularly tricky homework.

Meanwhile, the folks at Ripple are waving from the sidelines, frantically urging lawmakers to get a move on before the intriguing “window of opportunity” shuts faster than the pub at closing time.

Britain’s FCA is simultaneously tinkering with stablecoin policies and crypto custody as if assembling a particularly baffling IKEA wardrobe. They’ve just wrapped up an industry consultation and are now after feedback on staking, lending, and, presumably, whether DeFi should come with a side of chips.

All this is, apparently, in pursuit of “innovation and consumer protection”—a delicate balancing act that’d make even the tightrope walkers at Piccadilly Circus break a sweat.

“Through our Plan for Change, we are making Britain the best place in the world to innovate — and the safest place for consumers. Robust rules around crypto will boost investor confidence, support the growth of Fintech and protect people across the UK,” Chancellor of the Exchequer Rachel Reeves stated in April.

Drafts, Surveys, and a Dash for Digital Gold: The UK’s Crypto Gamble!

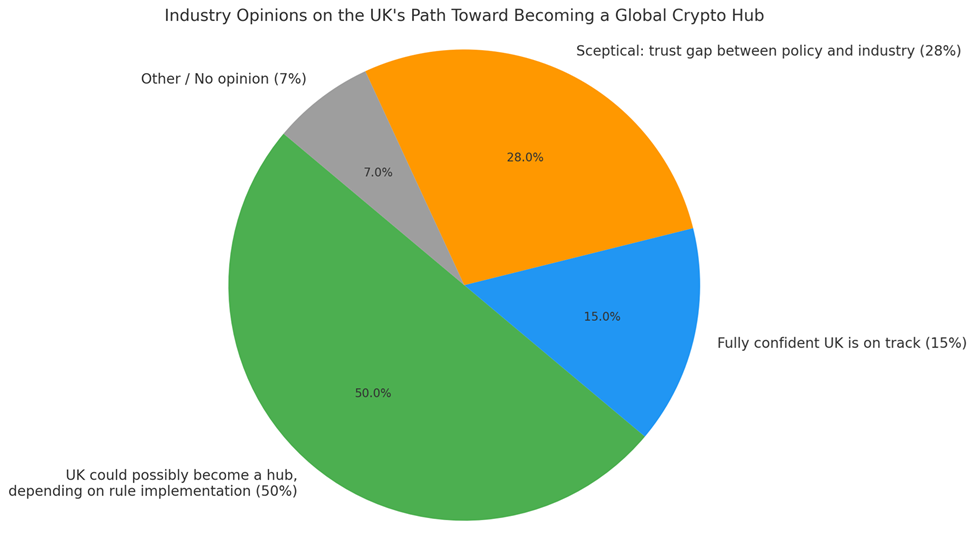

Of course, not all is cucumber sandwiches and coronation medals. A recent survey of 150 crypto and finance professionals shows that just 15% think the UK is scampering in the right direction. The rest are watching with the wary enthusiasm of cats at a dog show.

Still, 50% see a genuine chance for Britain to become the crypto world’s darling, though only 9% feel remotely prepared for the regulatory shenanigans stampeding their way.

All of this fuss is happening just when crypto is staging a global comeback. The UK’s approach is less “let’s copy the EU” and more “hold my tea, watch this”—eschewing stablecoin volume caps and flirting with foreign tokens like an aristocrat at a Parisian ball.

The FCA, in what some are calling the least British reversal since the Beatles moved to India, plans to lift the ban on retail crypto ETNs. Cue the confetti and Very Serious Twitter Posts.

INTEL: The UK’s Financial Conduct Authority (FCA) to lift the ban on cryptocurrency exchange-traded notes (ETNs) for retail investors

— Solid Intel (@solidintel_x) June 6, 2025

“This is huge – a big moment for the UK and crypto policy. Yet another country poised to lead on digital assets. Bravo FCA,” Coinbase CLO Paul Grewal commented in June.

Meanwhile, IG Group’s jump into retail crypto trading sets the feline among the financial pigeons—institutional and retail confidence appears to be on the up and up.

Still, Armstrong and friends sound a word of caution: if the UK dallies too long with its rules, startups could pack their bags and decamp to the EU, Singapore, or the US, where licensing is speedier, and no one mistakes “staking” for a barbecue activity. Ta ta for now! 🏏💼

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- 9 Most Underrated Jeff Goldblum Movies

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Castle Duels tier list – Best Legendary and Epic cards

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- Can the Switch 2 Use a Switch 1 Charger?

2025-06-17 11:19