So, the generals of finance assemble around the campfire—Strategy’s campfire, if you will—tossing shovelfuls of dollars into Bitcoin’s open furnace, all because the fire is warm and seems, for now, not to burn them. The price climbs ever higher, like prisoners scaling a wall that might just collapse under its own weight. Even as they buy, the shadow of liquidation—forced sales, chaos—lurks in the corner, impatiently awaiting their next misstep. One can only wonder what Satoshi would say, watching his child lured by corporate siren songs. 😏

The pontiffs of Bitwise, Komodo Platform, and Sentora smile with the empty eyes of bureaucrats well-fed on optimism. According to their prophecies, the risks are mere gnats—small, overleveraged companies might vanish, but who’ll notice? The machine grinds on, rolling over the bones of those failed dreamers. MicroStrategy, now simply “Strategy”—perhaps because nothing says “clever rebrand” like nipping the “Micro” and thinking big—hugs its Bitcoin tight, setting the pace. No one sells yet, but history, grim and unblinking, reminds us it’s only a matter of time. 😏

The Growing Trend of Corporate Bitcoin Adoption

They are multiplying. A legion of suit-clad acolytes, reading charts where ancient men pored over scriptures. Sixty-one? No—make it one hundred and thirty. The number swells, not unlike state quotas reported in the harvests—you always know the truth is somewhere beneath the math, smoking a cigarette and refusing comment.

Strategy sits atop a pile of unrealized gains so large that even a Soviet commissar might blush with envy. The rest of the pack watches, their eyes glittering with hunger and anxiety, and shuffle more assets toward the same altar, praying to whatever gods govern blockchain.

“The Wilshire 5000—5000 public companies, comrades. Watch as the march accelerates, a whole army of treasurers filing in step, Bitcoin-bound. 2026 will be the year of the golden calf—sorry, the golden coin,” proclaims André Dragosch, offering a vision equal parts ambition and mania.

Why believe this? The reasons, reader, are piled higher than government paperwork before an inspection.

How Does Bitcoin’s Volatility Compare to Other Assets?

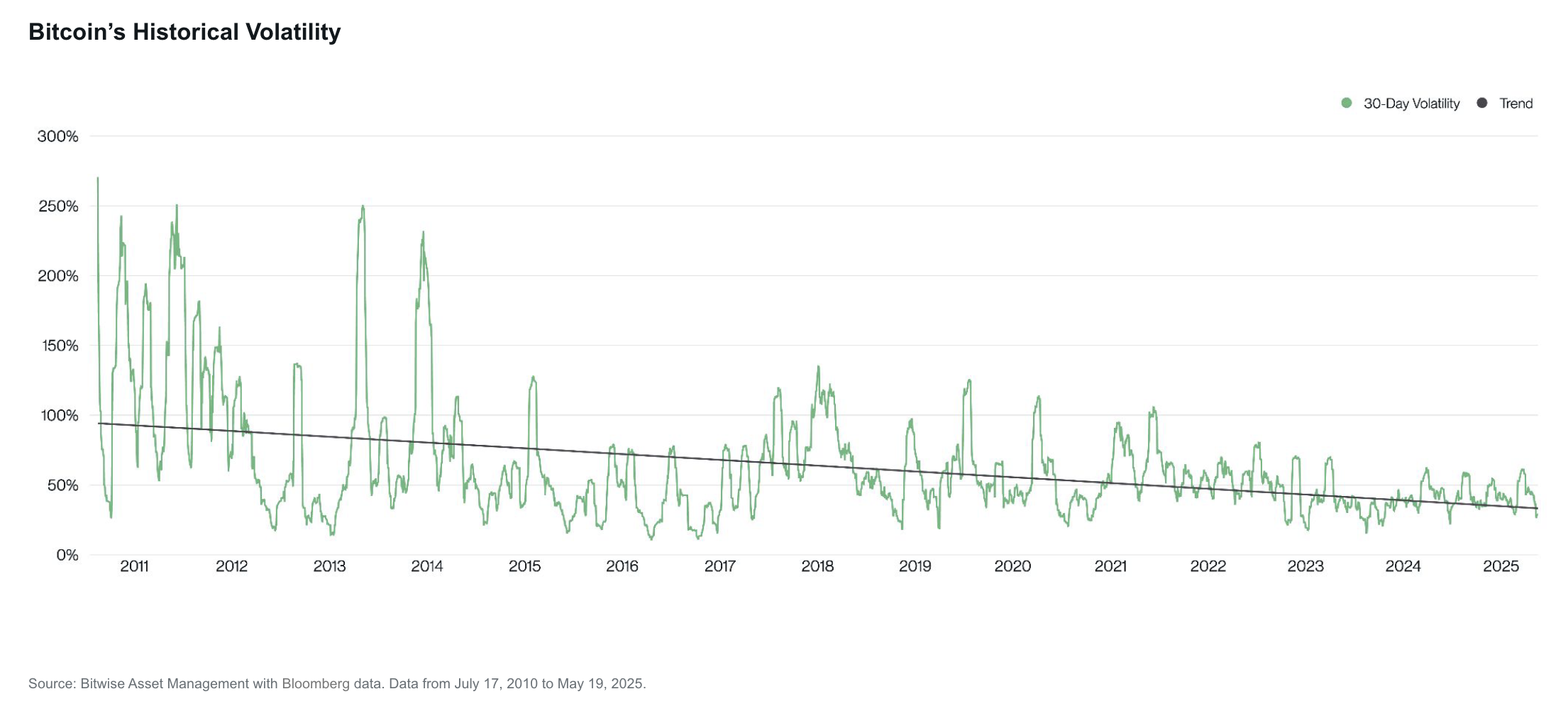

Volatility, yes, but geez—look at those returns! Bitcoin grandstands in front of stocks and gold, wild and unpredictable, the village idiot who accidentally burns down the mayor’s house and discovers gold in the garden underneath.

“You say, ‘Never invest in such a volatile beast!’” admits Ryan Rasmussen, even as the obedient flock load up on Tesla and Nvidia. With a wink, he reminds us those same tech darlings have been more volatile of late than Bitcoin itself. Wolves lecturing the sheep on howling, really.

Stability emerges, or at least the illusion of it, and so the herd stampedes in. Past performance is not a promise, but when has that ever stopped anyone?

“Volatility’s down. Soon, as the price ‘discovers’ itself, it’ll shrink further, boredom will set in, and adoption may slow. But as long as we can play dice, why not?” Kadan Stadelmann reflects, sounding equal parts scientist and gambler.

In these desperate times, as governments and markets teeter, Bitcoin dangles like a shiny key before starving debtors—and what a magnificent distraction it is.

Will Bitcoin Outcompete Traditional Safe Havens?

America and friends, beset by drama worthy of ancient epics: inflation that must be viewed sideways, deficits defying gravity, and wars that pop up like mushrooms after rain. In strolls Bitcoin—“digital gold,” the latest in fad diets for broken balance sheets. Strategy’s winnings only fuel the frenzy further.

“Shareholder pressure will build, like steam in a broken boiler. More companies will follow, debts will stack, and gold… well, prepare it for retirement,” says Dragosch, perhaps auditioning for the role of Bitcoin’s Nostradamus.

Soon, he predicts, the day will come when Bitcoin wipes its feet on the welcome mat of those other, stodgier safe havens—US Treasury bills, gold—hovering as a competitive asset, ready to upstage the elders.

“Bitcoin volatility on a long, slow slide downward. With every halving and every convert, its edges dull. Soon, it will be as boring as gold, but way cooler at parties,” he asserts.

And, blessed by the gods of technology, Bitcoin might even outshine gold’s mustard-stained reputation.

“It’s more than just shiny—Bitcoin is technically superior. In a world drowning in debt, it might just dethrone gold and take a bite out of US Treasury bonds for dessert,” raves Dragosch.

Pity, then, that not every company gets a seat at the grown-ups’ table.

Differentiating Corporate Bitcoin Strategies

According to Rasmussen, there are two corporate Bitcoin adopters: The rich and the reckless.

Some (Coinbase, Square) simply buy with spare change. Others, and one imagines their accountants lie awake at night, borrow or sell equity to gamble. For now, demand surges and Bitcoin’s price follows, faithful as a puppy—until the leash snaps.

Well-run businesses buying with real money? Yawn. No real risk to anyone. They’ll probably keep buying until further notice or until the lights go out.

The highwire act is for those funding their habit with other people’s money.

“Bitcoin-financing companies only live because public markets are dazzled enough to pay more than a dollar for a dollar’s Bitcoin exposure. It’s unsustainable—like betting the farm every harvest,” says Rasmussen, playing the role of reluctant prophet.

At the end, profits (or losses) are paid, debts remembered, and bankers reemerge from their dens, sniffing the ledger like wolves in springtime.

Mitigating Corporate Bitcoin Risk

The ancient maxim holds: The well-fed outlast the hungry. Just as gulags filled with those who couldn’t outpace the system, so too will the little companies vanish if they overreach.

“Strategy, Metaplanet, GameStop—the big fish can always wriggle out, find cash, refinance, repeat the cycle, while the minnows get fried,” says the experts, not bothering to pretend at sympathy.

Dragosch offers a word of weary warning: borrow what you can repay, or taste the bitter soup of forced liquidation.

“Overleverage breaks everything—copycat corporations soon find their Bitcoin dreams dashed on the rocks of debt. Next bear market, the bodies will pile,” he intones, perhaps checking “grim foreshadowing” off his to-do list.

But in the grand marketplace, those little deaths barely register—a hiccup in a drunken festival.

“A handful of small companies crashing barely makes a ripple. The market will blink, yawn, and go back to lunch,” shrugs Rasmussen. 🍽️

Worry sets in only when the goliaths feel an itch to sell.

Are Large Holdings a Systemic Risk?

As more companies hoard Bitcoin, decentralization is sung like a patriotic hymn… but with each chorus, Strategy’s pile grows until one wonders if the song wasn’t always ironic.

Strategy now commands almost 600,000 Bitcoins—enough to raise eyebrows, and alarms, in every shadowy backroom meeting across the land.

“More than 10% of all Bitcoin, corralled in ETFs and corporate wallets. Should these temples of custody tumble, the whole market gets to enjoy the fireworks,” says Juan Pellicer.

Tragedy, though, always comes wrapped in farce: Stadelmann wagers that a great sell-off will ripple, then stabilize; after all, when the rich drop their toys, someone will always scurry to pick them up.

“MicroStrategy will sell in secret at first, but word gets out, panic follows—the price drops and new scavengers dive for scraps, even as the world marvels at how only 21 million coins still manage to cause such fuss,” he muses, sardonic as a Cossack at a state parade.

Yet the greatest irony: the more Bitcoin is snatched up, the less decentralized it becomes. The revolution eats its children after all.

Centralization as a Trade-Off for Adoption

This much is certain: as corporate beasts amass their hoards, the myth of Bitcoin as the people’s coin sags badly under the weight. The DeFi believers gnash their teeth, watching their golden cow sprout corporate logos.

Dragosch, ever the optimist, says: “Don’t worry—he who owns the coins can’t change the rules. That’s what proof-of-work is for. Hash power matters, not greedy hands.”

“The beauty of it all: you can pile up coins, but you can’t rewrite the laws of Bitcoin—unlike those other crypto children who play by different rules,” Dragosch nods sagely, as if quoting The Gulag Archipelago for the blockchain age.

Pellicer, meanwhile, grins and shrugs: “Yeah, it ruins the decentralized dream, but it makes Bitcoin respectable for the bureaucrats and boardrooms. Perhaps this is the price of progress—regulatory clarity, liquidity, and an easier interface for those who’d rather not trust themselves with private keys.” 😅

“Adoption is a Faustian bargain—we traded the spirit for a bit of structure and comfort,” he implies, perhaps dreaming wistfully of a more rebellious age.

So yes: the corporate caravan rumbles on, Bitcoin in tow, as new risks gather in the twilight and the market—for now—pretends not to hear the wolves howling at the edge of the campfire. 🐺

Read More

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Hero Tale best builds – One for melee, one for ranged characters

- Gold Rate Forecast

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Castle Duels tier list – Best Legendary and Epic cards

- 9 Most Underrated Jeff Goldblum Movies

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- EUR CNY PREDICTION

2025-06-18 06:17