As a seasoned researcher with a background in blockchain and cryptocurrencies, I must say that the recent surge of ApeCoin (APE) has piqued my interest. The 50% price increase in just 24 hours is quite impressive, especially considering its six-month high and the surpassing of the $1.1 billion market cap.

In the past 24 hours, I’ve noticed a significant 50% increase in the value of ApeCoin, which can be attributed to the unveiling of its cross-network bridge and various advancements within its ecosystem.

Yesterday, the governance token for the Ape ecosystem, ApeCoin (APE), climbed up to a six-month high of $1.53 from its previous value of $1.21. Additionally, the total market capitalization of APE surpassed $1.1 billion.

The surge in ApeCoin’s price can largely be explained by the debut of ApeChain, a fresh Layer-3 blockchain. This new platform facilitates effortless transfers between networks for APE, Wrapped Ethereum (WETH), USD Coin (USDC), Tether (USDT), and Dai (DAI), including ApeChain, Ethereum (ETH), and Arbitrum (ARB).

After its debut, the usefulness of APE has grown within the Yuga Labs ecosystem, which is responsible for well-known NFT collections such as the Bored Ape Yacht Club. By introducing a new bridge, APE tokens can now be utilized in yield farming activities, allowing token holders to automatically earn returns on APE, ETH, and stablecoins, thereby increasing the token’s functionality.

In ApeChain, the native token APE is pivotal for several key functions. It’s used to cover transaction charges, take part in decision-making within the ApeCoin Decentralized Autonomous Organization (DAO), and serve as a payment option in Yuga Labs’ video games and real-life transactions.

Furthermore, ApeCoin has implemented an upgrade to its smart contract system, incorporating the LayerZero Omnichain Fungible Token (OFT) standard. This change enables APE to serve as a governance token for the ApeCoin Decentralized Autonomous Organization (DAO), and also simplifies transaction fees across various blockchain networks.

Multiple analysts on topic X observed that the recent spike in APE occurred as more investors purchased the token, fueled by their anxiety of not missing out on substantial profits. Usually, when a meme coin surpasses the $1 billion market cap, investors anticipate a steep increase in its value due to growing faith in the token, as it becomes less susceptible to manipulation or sudden withdrawal (rug pull).

Many individuals appear to be caught up in the excitement, perhaps fearful of missing out (FOMO), as they eagerly observe this surge in the price of APE.

— LA𝕏MAN (@Theblockvlog) October 21, 2024

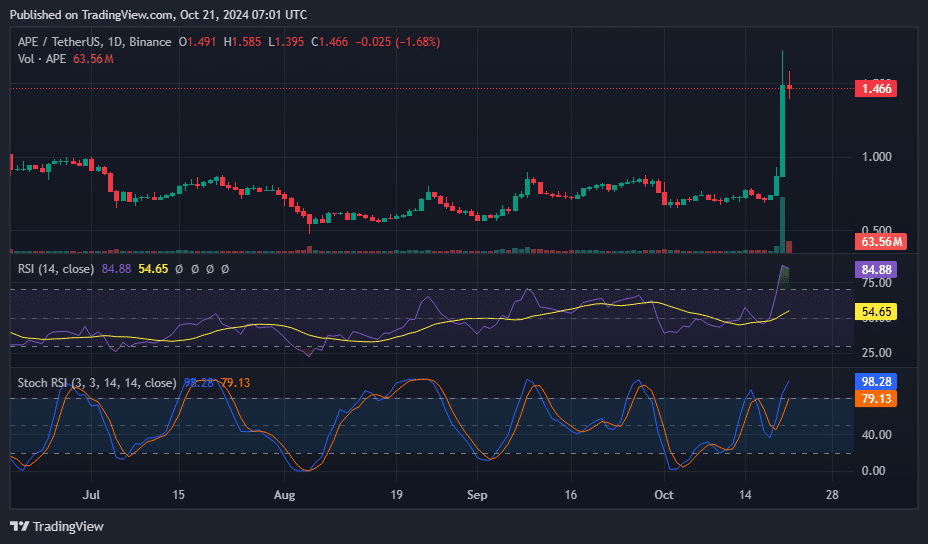

At the current moment, the Relative Strength Index (RSI) and Stochastic RSI for APE exceeded the overbought threshold. Typically, this suggests a potential correction might occur soon. Nevertheless, if meme coins maintain their popularity among traders, they could potentially drive up prices as we’ve witnessed with other competitors like POPCAT and WIF in the past.

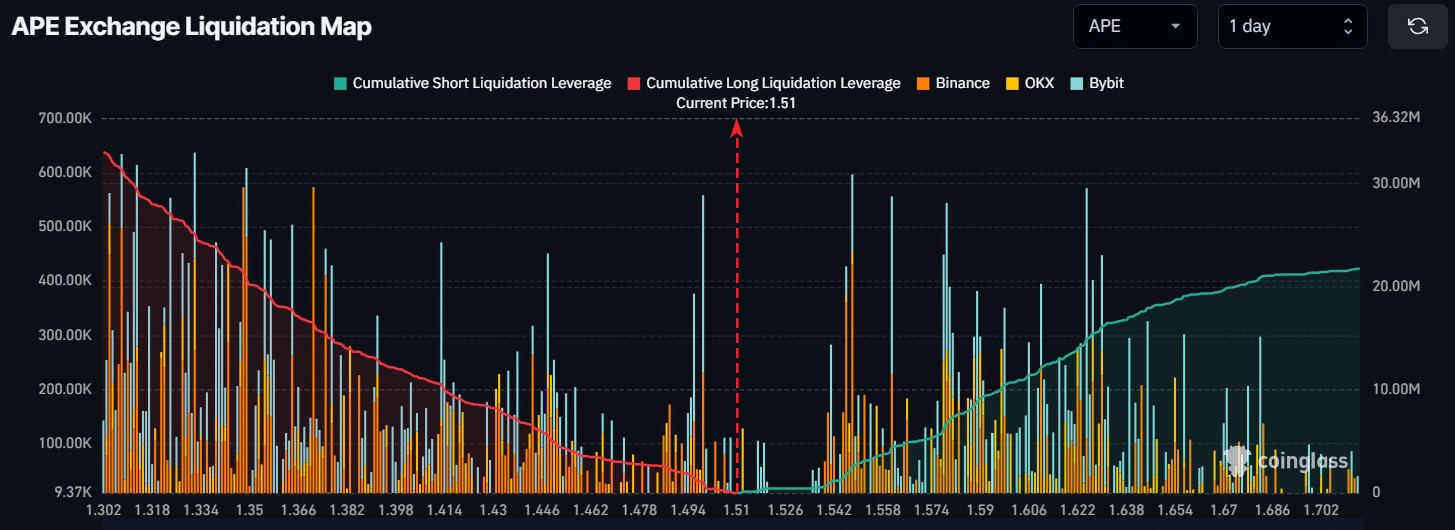

At present, the critical points for APE’s liquidation stand at approximately $1.548 (on an upward trend). Many intraday traders typically operate near this level, as suggested by CoinGlass data. If APE manages to reach $1.548, it may trigger the liquidation of around $2.59 million worth of short positions.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-10-21 10:40